Analysts Predict Growth for Vanguard ESG U.S. Stock ETF

ETF Channel’s recent analysis reveals strong potential for the Vanguard ESG U.S. Stock ETF (Symbol: ESGV) based on impressive analyst target prices for its underlying holdings.

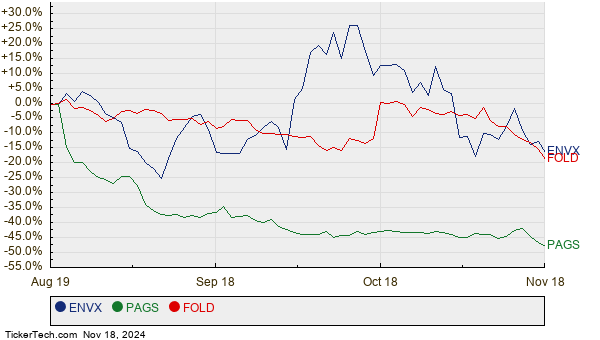

The implied analyst target price for ESGV stands at $114.30 per unit, with the ETF currently trading at approximately $104.04. This indicates an expected upside of 9.86% in the coming year. Notably, several underlying stocks show considerable growth potential. For instance, Enovix Corp (Symbol: ENVX) has a target price of $20.92, representing a significant 146.65% upside from its current price of $8.48 per share. Similarly, PagSeguro Digital Ltd (Symbol: PAGS) demonstrates a potential increase of 98.30%, with an average target of $15.15 from its recent price of $7.64. Amicus Therapeutics Inc (Symbol: FOLD) is projected to rise by 83.37%, with a target price of $17.75 compared to its current price of $9.68. Below is a chart showcasing the stock performance of ENVX, PAGS, and FOLD over the past year:

Here’s a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard ESG U.S. Stock ETF | ESGV | $104.04 | $114.30 | 9.86% |

| Enovix Corp | ENVX | $8.48 | $20.92 | 146.65% |

| PagSeguro Digital Ltd | PAGS | $7.64 | $15.15 | 98.30% |

| Amicus Therapeutics Inc | FOLD | $9.68 | $17.75 | 83.37% |

Are analysts optimistic, or do they hold realistic expectations for these stocks over the next twelve months? Understanding whether these price targets are warranted or if they are simply remnants of past performance is crucial for investors. While a high target can reflect optimism, it can also lead to future downgrades if based on outdated information. Investors are encouraged to conduct thorough research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• GEDU Videos

• Institutional Holders of BPYU

• BNA Historical Stock Prices

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.