Analysts See Potential Growth for SPDR MSCI USA StrategicFactors ETF and Its Holdings

ETF Channel analyzed the SPDR MSCI USA StrategicFactors ETF (Symbol: QUS) and its underlying assets, comparing their current trading prices with the 12-month target prices set by analysts. The findings suggest an implied target price of $174.93 per unit for the ETF.

Current Trading Status and Upside Potential

As of now, QUS is trading at approximately $158.50 per unit, indicating a potential upside of 10.36% based on analyst expectations for its underlying holdings. Notable companies within QUS that exhibit significant upside include Teradyne, Inc. (Symbol: TER), Bentley Systems Inc (Symbol: BSY), and CDW Corp (Symbol: CDW). For instance, while TER is priced at $102.58 per share, analysts have set an average target of $136.19, reflecting a 32.76% increase. BSY shows an upside of 30.50%, moving from a recent price of $46.59 to an expected target of $60.80 per share. Similarly, CDW is expected to rise to a target price of $227.64 from its current price of $177.63, translating to an upside of 28.15%.

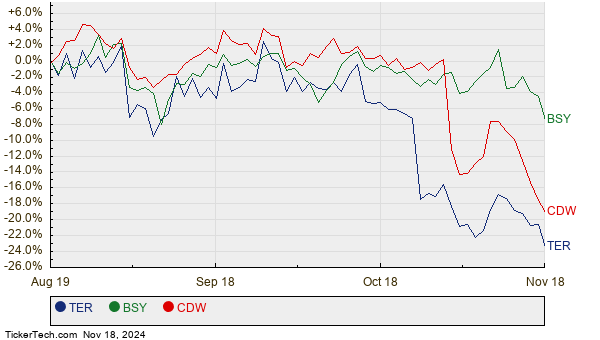

Below is a twelve-month price history chart showing the stock performance of TER, BSY, and CDW:

Analyst Target Price Overview

Here’s a table summarizing the current analyst price targets discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR MSCI USA StrategicFactors ETF | QUS | $158.50 | $174.93 | 10.36% |

| Teradyne, Inc. | TER | $102.58 | $136.19 | 32.76% |

| Bentley Systems Inc | BSY | $46.59 | $60.80 | 30.50% |

| CDW Corp | CDW | $177.63 | $227.64 | 28.15% |

Are Analysts on Target?

Questions arise regarding the justifications behind these analyst targets. Are they too optimistic, or do they reflect a grounded understanding of recent company performance and industry trends? While high price targets may signal optimism, they can also suggest potential downgrades if economic conditions change. Investors are encouraged to conduct further research to form their own conclusions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Mortgage REITs Hedge Funds Are Selling

• ES market cap history

• TFSL Historical Stock Prices

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.