Analysts Project 10% Upside for iShares Climate ETF Based on Key Holdings

ETF Channel has analyzed the underlying assets in the iShares Climate Conscious & Transition MSCI USA ETF (Symbol: USCL) to assess its potential growth. Currently trading around $70.39 per unit, the ETF has a projected analyst target price of $77.43, suggesting an upside of 10.00% over the next 12 months.

Noteworthy Holdings with Significant Upside

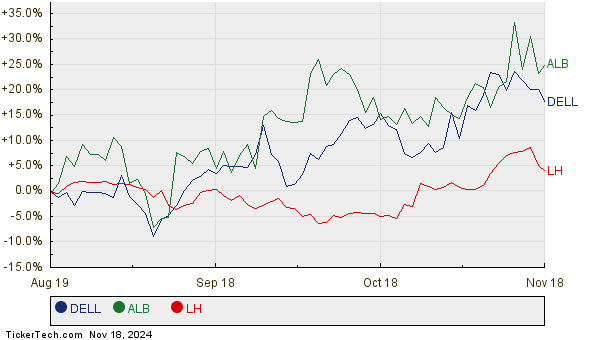

This ETF includes holdings that are expected to perform well according to analyst projections. Dell Technologies Inc (Symbol: DELL), Albemarle Corp. (Symbol: ALB), and Labcorp Holdings Inc (Symbol: LH) stand out for their potential growth. Dell’s current price of $131.64 could increase by 12.99% to reach an average target of $148.74. Albemarle shares, priced at $103.53, have a target of $115.83, reflecting an expected upside of 11.88%. Additionally, Labcorp’s recent price of $235.21 comes with a target of $262.44, indicating an upside of 11.58%.

To illustrate these performances, the chart below compares the stock histories of DELL, ALB, and LH for the past twelve months:

Summary of Analyst Target Prices

The table below summarizes the recent prices and analyst target prices for the ETF and its key holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Climate Conscious & Transition MSCI USA ETF | USCL | $70.39 | $77.43 | 10.00% |

| Dell Technologies Inc | DELL | $131.64 | $148.74 | 12.99% |

| Albemarle Corp. | ALB | $103.53 | $115.83 | 11.88% |

| Labcorp Holdings Inc | LH | $235.21 | $262.44 | 11.58% |

Conclusion: Analyst Outlook or Historical Bias?

Investors must consider whether analyst targets reflect a solid understanding of future performance or if they are based on outdated information. While high target prices can indicate confidence in a company’s growth, they may also lead to downgrades if expectations aren’t met. These factors necessitate further investigation before making investment decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Institutional Holders of AMDA

Top Ten Hedge Funds Holding QGBR

FRT Split History

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.