Okta Faces Challenges Amid Strong Portfolio Growth

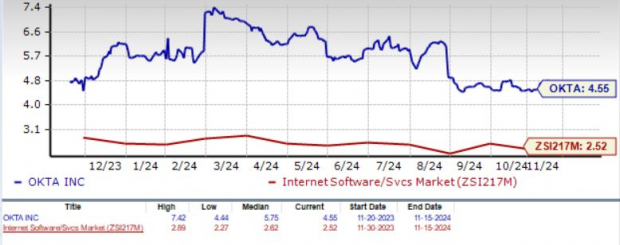

Okta (OKTA) shares are currently facing a stretched valuation, indicated by a Value Score of F. The forward 12-month Price/Sales (P/S) ratio stands at 4.55X, which is considerably higher than the Zacks Internet Software Services industry’s average of 2.68X.

In contrast, Okta is undervalued when compared to its closest competitors, including Microsoft (MSFT), Palo Alto Networks (PANW), and CrowdStrike (CRWD), which are trading at P/S ratios of 10.56X, 13.21X, and 17.99X, respectively.

The company’s shares have struggled due to a challenging macroeconomic environment, affecting both its Customer Identity and Workforce Identity segments.

Comparing Price/Sales Ratios

Image Source: Zacks Investment Research

Despite the challenges, Okta continues to showcase a strong portfolio with growing demand for products like Okta Identity Governance and Okta Privileged Access. An increasing client base, largely driven by the adoption of its Identity Threat Protection solution, remains a key factor for growth-oriented investors.

Fiscal 2025 Outlook is Optimistic

Okta’s innovative solutions are expected to contribute positively to its future. For fiscal 2025, Okta anticipates revenues between $2.555 billion and $2.565 billion, up from previous guidance of $2.53-$2.54 billion, suggesting a growth rate of 13% over fiscal 2024.

The Zacks Consensus Estimate for fiscal 2025 revenues stands at $2.56 billion, reflecting year-over-year growth of 13.2%.

Furthermore, Okta forecasts non-GAAP earnings in the range of $2.58 to $2.63 per share, an increase from earlier estimates of $2.35 to $2.40 per share. The consensus for earnings is now $2.61 per share, indicating a substantial rise of 63.13% compared to fiscal 2024.

For fiscal 2025, the company expects a free cash flow margin of approximately 23%.

Earnings Estimates Show Stability

For the upcoming third quarter of fiscal 2025, the Zacks Consensus Estimate for Okta’s earnings remains steady at 57 cents, indicating a growth of 29.55% compared to the same quarter last year.

In the past four quarters, Okta has consistently beat the Zacks Consensus Estimate, with an average surprise of 27.15%.

Okta’s Price and Consensus

Okta, Inc. price-consensus-chart | Okta, Inc. Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

The consensus mark for revenues in the third quarter is expected to be around $649.42 million, which reflects an 11.2% increase from the same quarter last year.

Can Okta’s Portfolio Drive a Recovery in 2H25?

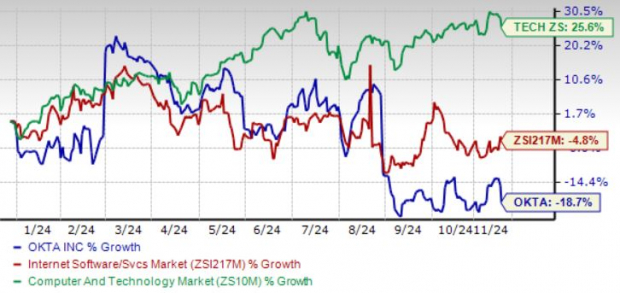

Year to date, Okta shares have dropped 18.7%, underperforming the broader Zacks Computer & Technology sector (up 25.6%) and the industry (down 4.8%).

Performance Comparison: OKTA vs. Sector and Industry

Image Source: Zacks Investment Research

Nevertheless, Okta’s innovative approach is expected to drive client acquisition and overall revenue growth. The introduction of Okta AI aims to provide both Workforce Identity Cloud and Customer Identity Cloud with enhanced AI capabilities, improving user experience and security against cyber threats.

Looking ahead, OKTA’s revenues are projected to grow at a compound annual growth rate (CAGR) of 25% from fiscal 2022 to fiscal 2025. In fiscal 2024, the company’s customer base grew by 7.7% compared to fiscal 2023.

As of the end of the second quarter of fiscal 2025, Okta reported a 5% year-over-year increase in total customers, now reaching 19,300, with a 10% increase in customers generating over $100,000 in Annual Contract Value (ACV) to 4,620.

Among the fastest-growing segments are customers with over $1 million in ACV, with Okta serving more than 40% of the Global 2000 companies.

In September, Okta enhanced both Auth0 and the Okta Customer Identity Cloud capabilities, providing developers with improved security and customization options.

These enhancements include an increase of Auth0 Free Plan users to 25,000 monthly active users, a passwordless feature, and more robust security options for paid plans.

Overall, Okta’s strong market position gives it an edge against significant competitors like Microsoft, IBM, and CyberArk in the cybersecurity sector.

Conclusion

While Okta is viewed as a risky investment in the near term due to its stretched valuation and modest growth prospects, its robust product lineup and client base present potential long-term rewards for current investors.

Okta holds a Zacks Rank of #3 (Hold), suggesting that investors may consider looking for a more favorable entry point before adding this stock to their portfolios.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we provided our members with 30-day access to all our stock picks for the nominal fee of just $1. There is no obligation to spend any more money.

Thousands have taken advantage of this opportunity; others choose not to, perhaps thinking there’s a catch. Our goal is to familiarize you with our portfolio services, which had 228 positions deliver double- and triple-digit gains in 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download “5 Stocks Set to Double” for free. Click for details.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW): Free Stock Analysis Report

Okta, Inc. (OKTA): Free Stock Analysis Report

CrowdStrike (CRWD): Free Stock Analysis Report

For more information, click here to read this article on Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.