NIO Inc., a leading electric vehicle (EV) manufacturer based in China, is set to announce its third-quarter 2024 financial results this Wednesday, prior to market opening. Analysts at Zacks have projected a loss of 32 cents per share on total revenues of $2.7 billion for the quarter.

Discover the latest EPS estimates and surprises on Zacks Earnings Calendar.

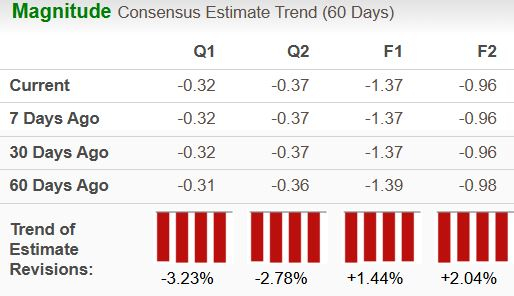

In the last 60 days, the loss estimate for this quarter has widened by a penny. Despite this adjustment, the projected loss indicates a 13.5% improvement compared to the same period last year. Revenue expectations show slight growth, with a year-over-year increase of 3.4% expected.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

For 2024 as a whole, NIO’s revenue is anticipated to reach $9.84 billion, which would represent a 26.3% increase from 2023. Analysts expect a loss of $1.37 per share for the year, showing improvement from a loss of $1.75 in the previous year. Over the last four quarters, NIO has beaten EPS estimates three times and fell short once, averaging an earnings surprise of 8.92%.

NIO Inc. Revenue and EPS Trends

NIO Inc. price-eps-surprise | NIO Inc. Quote

What to Expect from NIO’s Q3 Earnings

At this time, our analysis does not definitively indicate an earnings beat for NIO. A combination of a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) improves the chances for a positive surprise, but currently none of these conditions fully align. NIO has an Earnings ESP of 0.00% and a Zacks Rank of #2.

You can check out the complete list of today’s Zacks #1 Rank stocks here.

Factors Influencing NIO’s Q3 Performance

During the quarter ending September 30, NIO successfully delivered 61,855 vehicles. This figure represents an 11.6% year-over-year increase from last year’s numbers and exceeds deliveries made in the previous quarter, which stood at 57,373 units. These deliveries mark a significant quarterly record for NIO, aligning with its earlier estimates of 61,000 to 63,000 vehicles.

NIO’s entry into the affordable segment with its new ONVO brand, launched on September 19, signals a strategic expansion. The first product from ONVO, the L60, has started deliveries, with 832 units sold in the third quarter. Priced lower than Tesla’s TSLA Model Y in China, the L60 aims to compete directly for market share.

Expectations for revenue growth are bolstered by increased vehicle deliveries; however, competition-induced pricing pressures may somewhat mitigate these gains. Vehicle margins are trending upwards, with first-quarter 2024 margins at 9.2%, a 4.1% improvement year-over-year, and second-quarter margins at 12.2%. NIO anticipates reaching a vehicle margin of approximately 15% by year-end.

Nevertheless, challenges remain. NIO has faced declining operational efficiency lately, with SG&A expenses rising 31.5% over the past year. Increasing personnel costs and heightened sales and marketing efforts have weighed down profit margins. Significant investments in battery swap stations and expansions have also strained cash flows.

NIO Stock Performance and Valuation

This year, NIO shares have declined by 50.5%, underperforming both its industry peers and broader market indexes such as the S&P 500.

YTD Price Performance Comparison

Image Source: Zacks Investment Research

Currently, NIO trades at a forward sales multiple of 0.49, significantly lower than the industry average of 2.04, reflecting its challenging position within the market.

Image Source: Zacks Investment Research

Assessing NIO’s Investment Outlook

NIO remains a notable contender in the EV sector, driven by a diverse product range and innovative strategies. Its models, including the enhanced ET7, ES6, ES8, ET5T, and EC7, reflect NIO’s commitment to catering to various market segments. Plans for December include delivering 10,000 units, with aspirations to scale to 20,000 units per month by 2025, suggesting potential for increased delivery growth.

NIO’s Battery as a Service (BaaS) approach, which leverages its proprietary battery swap technology, offers a distinct competitive advantage. The company’s ambition to establish over 1,000 new battery swap stations in 2024, along with plans to extend the “Power Up Counties” initiative to 2,300 locations by 2025, highlight NIO’s focus on enhancing its infrastructure and reinforcing its market position in China.

In late September, NIO disclosed plans for a fresh investment of RMB 3.3 billion from strategic investors in NIO China, complemented by a RMB 10 billion commitment from NIO for new shares. This capital infusion is crucial for NIO as it pursues its growth trajectory, aiming for improved financial health and technological capabilities.

With its innovative technology and diverse product strategy, NIO appears well-positioned to capitalize on future growth, making it an intriguing investment option.

Unlock insights for just $1 with Zacks

No gimmicks.

Years ago, we surprised our members with a 30-day access offer to our full portfolio for only $1, with no additional obligations.

Thousands have taken advantage; others hesitated out of skepticism. However, the reason is clear: we want you to discover our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which reported 228 priced positions with double- and triple-digit gains in 2023 alone.

Get the latest recommendations from Zacks Investment Research and download our free report on 5 Stocks Set to Double.

Tesla, Inc. (TSLA) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report

Li Auto Inc. Sponsored ADR (LI) : Free Stock Analysis Report

XPeng Inc. Sponsored ADR (XPEV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.