Raymond James Boosts Hewlett Packard Enterprise Outlook to Strong Buy

On November 18, 2024, Raymond James made headlines by upgrading their recommendation for Hewlett Packard Enterprise (XTRA:2HP) from Outperform to Strong Buy.

Analyst Forecasts Show Slight Downside Ahead

As of October 22, 2024, analysts predict an average one-year price target for Hewlett Packard Enterprise at 19.61 €/share. Projections vary, with the lowest target set at 16.52 € and the highest at 22.90 €. This average price suggests a potential decline of 2.82% from the company’s latest closing price of 20.18 € / share.

Revenue Growth Projections

Hewlett Packard Enterprise is expected to generate annual revenues of 30,469 million dollars, reflecting a growth rate of 4.99%. Additionally, the projected annual non-GAAP EPS stands at 2.17.

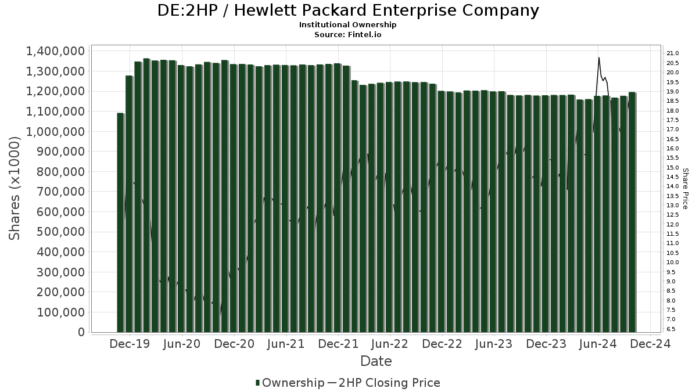

Institutional Investment Trends

Currently, 1,829 funds or institutions report holdings in Hewlett Packard Enterprise, an increase of 73 funds or 4.16% compared to last quarter. The average portfolio weight dedicated to 2HP is now at 0.20%, up by 0.98%. Total shares owned by institutions have risen by 4.70% over the past three months, with current holdings at 1,264,342K shares.

BlackRock is a key player, holding 120,652K shares, which equates to a 9.29% stake in the company. Meanwhile, Bank of America reported a decline in its holdings from 49,386K shares to 45,260K shares, reflecting a 9.12% decrease and an overall reduction of 79.10% in its portfolio allocation for 2HP over the last quarter.

The VTSMX – Vanguard Total Stock Market Index Fund Investor Shares increased its holdings by 0.39%, now owning 41,059K shares (3.16% ownership). In contrast, the DODGX – Dodge & Cox Stock Fund saw a 11.32% decline in its shares, currently at 37,601K shares (2.90% ownership).

VFINX – Vanguard 500 Index Fund Investor Shares also reported growth, increasing its shares from 32,762K to 33,359K, representing a 1.79% rise and a portfolio allocation increase of 15.09% over the last quarter.

Fintel serves as a rich resource for individual investors, traders, financial advisors, and smaller hedge funds, providing extensive data on investment research.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.