“`html

The Wall Street Landscape Shifts Post-Trump Election: AI Stocks on the Rise

Following Donald Trump’s re-election, the initial excitement of Wall Street’s post-election rally has faded. Investors are now weighing the benefits and drawbacks of Trump’s economic policies. Key issues include tariffs, corporate tax cuts, deregulation, and their effects on inflation.

The technology sector is particularly wary of Trump’s tariffs on advanced chipsets. There’s also speculation about the future of the $52.5 billion Chips and Science Act and potential antitrust regulations that could affect major tech companies. Despite uncertainties, it’s clear the demand for artificial intelligence (AI) remains strong, as this technology becomes increasingly vital.

The Unwavering Demand for AI

Since the start of 2023, U.S. stocks have enjoyed a notable rally, mainly fueled by advancements in technology. The global surge in generative AI adoption has played a pivotal role in this growth.

Bloomberg Intelligence forecasts that spending on generative AI will skyrocket from $67 billion in 2023 to $1.3 trillion by 2032. Meanwhile, UBS projects that four major U.S. tech companies, part of the “magnificent 7,” will invest approximately $267 billion in AI applications by 2025, marking a year-over-year increase of 33.5%.

Top 5 AI Giants for Potential Gains

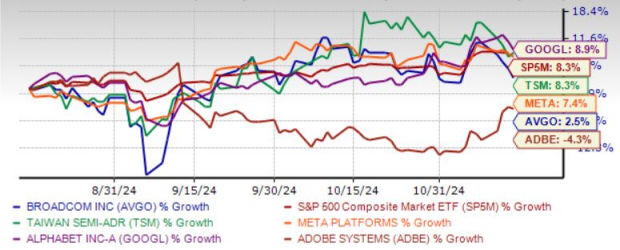

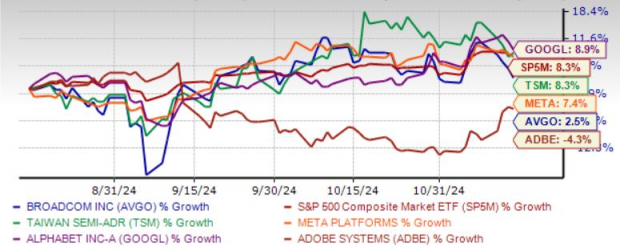

Currently, we recommend five leading generative AI companies with favorable Zacks Ranks that show promise for double-digit gains in the near term. These are Alphabet Inc. (GOOGL), Meta Platforms Inc. (META), Taiwan Semiconductor Manufacturing Co. Ltd. (TSM), Adobe Inc. (ADBE), and Broadcom Inc. (AVGO).

The following chart illustrates the price performance of these companies over the past three months.

Image Source: Zacks Investment Research

Alphabet Inc.

Ranked #2 by Zacks, Alphabet is experiencing robust growth in its cloud and search services. Google Cloud is seeing accelerated growth thanks to advancements in AI infrastructure and the development of its enterprise AI platform, Vertex. The strength of Alphabet’s AI portfolio is drawing in new customers and enhancing existing partnerships.

Alphabet’s expanding capabilities in generative AI could drive future expansion. The company maintains a dominant position in the search engine market, and its latest updates to search algorithms continue to attract more traffic.

With growing interest in Large Language Models, GOOGL is leveraging its powerful model, Gemini, to enhance user experience across various platforms including Google Bard and the Search Generative Experience.

Significant Price Upside for GOOGL

Brokerage firms project an average short-term price target for GOOGL that signals a 17.6% increase from the last closing price of $175.58, ranging between $185 and $240. This indicates a possible upside of 36.7% with no downside risks.

Meta Platforms Inc.

Ranked #2 by Zacks, Meta Platforms is about to receive shipments of NVIDIA’s new flagship AI chip, Blackwell. This new chip is poised to enhance META’s AI-related initiatives.

The AI-driven platform at Meta is improving advertising efficiency, yielding higher returns for advertisers. The company plans a significant capital investment of $38-$40 billion in AI for 2024, with projections for this spending to exceed $50 billion in 2025.

Recently, META introduced its Llama 3 AI model, which shows promise in generating substantial revenue. According to management, for every $1 invested by an API provider, $7 can be expected in returns over four years, highly competitive in the market against established players like OpenAI.

Strong Price Upside for META

Brokerage forecasts suggest the average short-term price target for META indicates a potential increase of 12.2% from its last closing price of $577.16, with a target range between $475 and $811. This suggests a maximum upside of 40.5%, although there is a potential downside of 17.7%.

Taiwan Semiconductor Manufacturing Co. Ltd.

Ranked #1 by Zacks, Taiwan Semiconductor is the leading manufacturer of AI-based chipsets, particularly for major developers like NVIDIA, recognized as a global leader in generative AI chip technology.

The company offers a broad array of wafer fabrication processes, enabling it to meet diverse customer needs, and is currently seeing strong demand for its advanced chip technologies like 3nm and 5nm. There’s a notable shift towards its multi-project wafer processing services, which help clients cut costs while maintaining high-quality standards.

Taiwan Semiconductor is focusing on ramping up production of its 3nm technology and has begun development of the cutting-edge 2nm process, further strengthening its growth potential.

Favorable Price Upside for TSM

Brokerage analysts predict an average short-term price target for TSM represents a 19.2% increase from its last closing price of $188.50, with an expected target range of $200-$250. This implies a maximum potential upside of 32.6%, without indications of downside risk.

Adobe Inc.

Ranked #2 by Zacks, Adobe has integrated AI across its popular products, including Photoshop and Premiere. In 2023, Adobe launched Adobe Firefly, a generative AI tool. Additionally, features in Adobe Acrobat and Reader utilize AI to help users summarize documents, thereby enhancing productivity.

“`

Adobe and Broadcom: Uncovering Growth Potential Amid Changing Markets

Adobe Expands Into Digital Marketing with AI Innovations

Using its new AI-driven cloud-based platform, Adobe Inc. (ADBE) is diversifying its offerings by providing digital marketing services. These services include data mining, which helps businesses track page views, purchases, and interactions on social media. Through Adobe Marketing Cloud, companies can create personalized web experiences across multiple devices, manage multichannel campaigns, and optimize their media monetization strategies.

The company recently introduced Adobe Express, a user-friendly application designed for quick editing effects. Powered by generative AI, this tool is especially beneficial for creating short-form video content, such as Instagram Reels. Furthermore, Adobe has launched an AI-enhanced version of the Express app for both iOS and Android platforms.

Brokerage firms have set an average short-term price target for ADBE that suggests a potential increase of 14.4% from the last closing price of $529.87. The target price ranges from $440 to $703, indicating a possible upside of 32.7% and a downside risk of 17%.

Broadcom Capitalizes on Networking Demand

Broadcom Inc. (AVGO) continues to thrive due to rising demand for its networking products. In the second quarter of 2024, the company experienced strong orders for custom AI accelerators, AI networking solutions, Ethernet switching, optical lasers, thin dies, PCI Express switches, and Network Interface Cards from hyperscale customers. AVGO’s products are increasingly essential for managing heavier AI workloads and enhancing speedy networking within data centers.

Broadcom’s acquisition of VMware has greatly improved its infrastructure software offerings. VMware has attracted high-profile clients, including Alphabet and Meta Platforms. Additionally, AVGO’s partnerships with companies like Arista Networks, Dell Technologies, Juniper, and Supermicro serve as significant growth drivers. AI revenue is projected to reach $12 billion for fiscal 2024.

Strong Price Potential for Broadcom Stock

The average short-term price target for AVGO shares indicates a 12.5% potential increase from the last closing price of $170.38. Currently, the target price ranges between $150 and $240, suggesting a maximum upside of 40.9% and a downside risk of 12%.

Expert Picks Signal Promising Prospects

Among thousands of stocks, five Zacks experts have selected their top picks that could soar by 100% or more in the coming months. The Director of Research, Sheraz Mian, has identified one stock as particularly promising.

This company focuses on millennial and Gen Z consumers, generating nearly $1 billion in revenue last quarter. A recent market pullback presents an ideal entry point for investors. While not all expert picks guarantee success, this selection has the potential to exceed the performance of previous Zacks recommendations like Nano-X Imaging, which surged 129.6% in just over nine months.

Want to stay updated on the latest recommendations from Zacks Investment Research? Download the report noting “5 Stocks Set to Double” for free today.

Adobe Inc. (ADBE): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

For the full article, visit Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.