“`html

Olin Corporation Faces Mounting Challenges Amid Weak Market Conditions

Olin Corporation operates as a vertically-integrated producer and distributor of chemical solutions. The company, serving regions such as Latin America, Europe, Asia-Pacific, and North America, manufactures a diverse range of products including chlorine, caustic soda, methyl chloride, hydrochloric acid, potassium hydroxide, and various bleach products.

In Brazil, Olin holds a significant position as one of the largest marketers of caustic soda. It also offers epoxy chemicals like liquid and solid resins, allyl chloride, glycerin, and several other additives. Diversifying its portfolio, Olin produces sporting ammunition for hunters, recreational shooters, law enforcement, and industrial uses.

Despite its broad range, soft global economic conditions are taking a toll on Olin’s chemical business. Demand in its Epoxy segment is particularly weak in key markets such as China and Europe. To complicate matters, the company’s significant debt level restricts its financial flexibility.

Industry Performance Overview

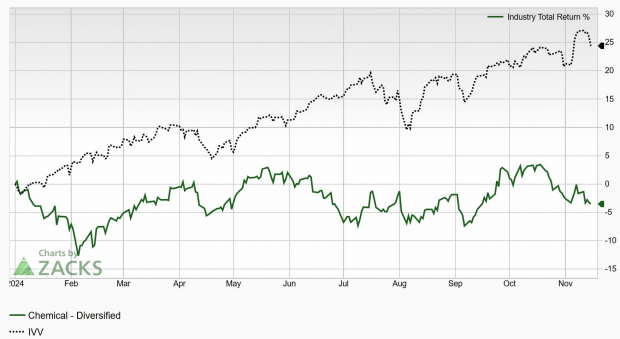

With a Zacks Rank #5 (Strong Sell), Olin OLN is a part of the Zacks Chemical – Diversified industry group, currently positioned in the bottom 19% among about 250 Zacks Ranked Industries. As we look ahead, it is anticipated that this industry will continue to lag behind the broader market in the next 3 to 6 months, reflecting trends seen throughout the year:

Image Source: Zacks Investment Research

Stocks situated in weaker industry segments can sometimes be appealing short-sell candidates. Although it is possible for individual stocks to perform well even in a lagging industry, being part of such a group generally poses additional challenges for potential rallies.

Along with many other diversified chemical companies, Olin’s shares are underperforming, as the general market reaches new highs. The stock has repeatedly hit lower lows, presenting a notable opportunity for short sellers as the year progresses into the fourth quarter.

Recent Earnings Dramatically Fall Short

Olin has underperformed on earnings in two of the last three quarters. Recently, the company announced a third-quarter loss of -$0.21/share, significantly missing the Zacks Consensus Estimate of $0.03/share by -800%.

The chemical distributor has experienced a negative trailing four-quarter earnings surprise of -187.6%. When a company consistently misses earnings estimates, it often leads to further underperformance—and Olin exemplifies this trend.

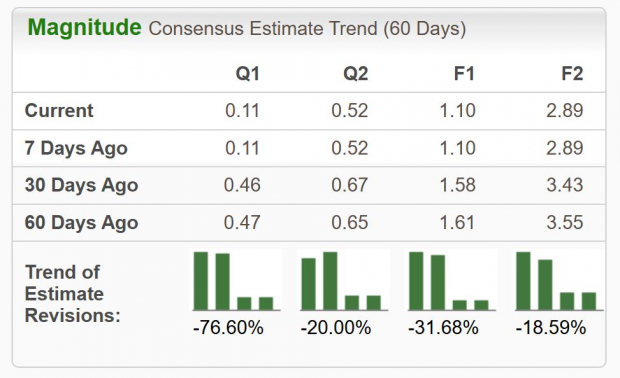

Just recently, analysts have drastically reduced expectations for the current quarter, slashing estimates by -76.6% over the last 60 days. The Q4 Zacks Consensus EPS estimate now stands at $0.11/share, suggesting a decline of -63.3% from the same period last year.

Image Source: Zacks Investment Research

Decreasing earnings estimates raise significant red flags, as this trend signals unfavorable conditions that tend to attract bearish sentiments.

Stock Performance Analysis

As illustrated in the following chart, OLN stock is on a consistent downward trajectory. Notably, it has recorded a series of lower lows, falling short of major indices. Additionally, shares are trading below a declining 200-day moving average (red line), a further indicator of weakness.

Image Source: StockCharts

OLN stock has also faced a “death cross,” in which its 50-day moving average (blue line) crosses below the 200-day moving average. For any new long positions to be justified, the stock would need to show significant upward movement along with improved earnings estimates. To date, shares have declined more than 20% this year alone.

Conclusion and Investment Considerations

In light of the deteriorating fundamentals and technical indicators, it seems unlikely that OLN will reach new highs in the immediate future. Being part of one of the poorest-performing industry groups only adds to the challenges it faces. Moreover, the history of earnings misses coupled with a downward revision in estimated earnings creates substantial barriers against potential recovery.

For potential investors, it may be wise to avoid this stock for now, or consider it as part of a short or hedging strategy. Investors with a bullish outlook should likely stay clear of OLN until definitive signs of improvement emerge.

7 Best Stocks for the Next 30 Days

Just released: Experts have identified 7 elite stocks from a pool of 220 Zacks Rank #1 Strong Buys. They predict these stocks as “Most Likely for Early Price Pops.”

Since 1988, this exclusive list has outperformed the market more than twofold, delivering an average annual gain of +23.7%. Therefore, be sure to pay attention to these seven selections.

Olin Corporation (OLN): Free Stock Analysis Report

To read this article on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`