Analysts Predict Growth for First Trust Mid Cap Core AlphaDEX Fund ETF

Recent analysis of the First Trust Mid Cap Core AlphaDEX Fund ETF (Symbol: FNX) suggests potential for significant gains based on the performance of its underlying assets.

The average analyst target for FNX stands at $132.70 per unit. In contrast, the ETF currently trades around $120.81, indicating analysts foresee an upside of 9.84%. This optimistic outlook is supported by three notable holdings within FNX—Avidity Biosciences Inc (Symbol: RNA), AeroVironment, Inc. (Symbol: AVAV), and Life Time Group Holdings Inc (Symbol: LTH). Each of these stocks shows considerable potential for growth in the next year.

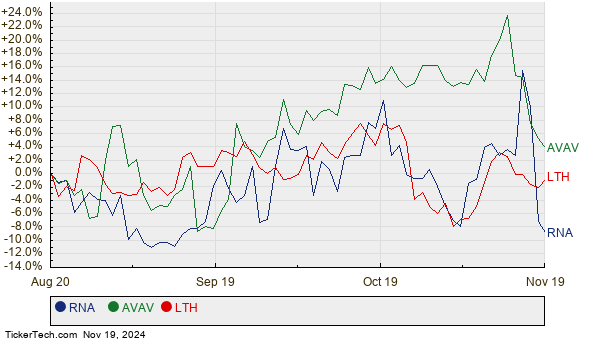

Avidity Biosciences, trading at $41.35 per share, has an average target price suggesting a 66.87% increase, reaching $69.00 per share. Similarly, AeroVironment’s recent price of $197.07 reflects a forecasted upside of 13.83%, with an expected target of $224.33. Likewise, Life Time Group’s current trading price of $24.02 comes with a projected target of $27.17, indicating a 13.10% increase. Below, you can observe their stock performances over the past twelve months:

Here’s a summary table of the analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust Mid Cap Core AlphaDEX Fund ETF | FNX | $120.81 | $132.70 | 9.84% |

| Avidity Biosciences Inc | RNA | $41.35 | $69.00 | 66.87% |

| AeroVironment, Inc. | AVAV | $197.07 | $224.33 | 13.83% |

| Life Time Group Holdings Inc | LTH | $24.02 | $27.17 | 13.10% |

As investors evaluate these predictions, they may wonder if the targets set by analysts are realistic or overly ambitious. It’s essential to consider whether analysts are accurately reflecting recent developments in the companies and their industries. While high price targets can signal optimism, they may also lead to adjustments if they fail to align with market trends. These considerations warrant thorough research for potential investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Top Stocks Held By Ken Griffin

Funds Holding DBDC

OEPWU Historical Stock Prices

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.