In a recent analysis by ETF Channel, insights were shared regarding the performance expectations of the iShares Dow Jones U.S. ETF (Symbol: IYY), particularly in relation to its underlying assets. After reviewing the trading prices for the ETF’s holdings against the average analyst 12-month forward target prices, it was found that the weighted average implied analyst target price for IYY stands at $158.04 per unit.

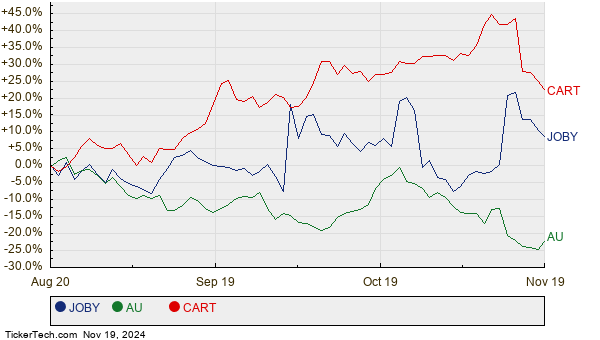

Currently trading around $143.78 per unit, IYY suggests that analysts foresee a price increase of 9.92%. This projection is supported by the promising outlook of some of its underlying holdings, notably Joby Aviation Inc (Symbol: JOBY), AngloGold Ashanti plc (Symbol: AU), and Maplebear Inc (Symbol: CART). Despite JOBY’s recent price of $5.61 per share, analysts set an average target 31.76% higher at $7.39. Similarly, AU, currently priced at $24.82, has an upside potential of 27.92% with a target of $31.75. Lastly, CART, trading at $40.91, is expected to reach an average target price of $48.38, indicating an 18.26% upside. You can see the twelve-month price history of JOBY, AU, and CART below:

Below is a summary table of the current analyst target prices for these companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Dow Jones U.S. ETF | IYY | $143.78 | $158.04 | 9.92% |

| Joby Aviation Inc | JOBY | $5.61 | $7.39 | 31.76% |

| AngloGold Ashanti plc | AU | $24.82 | $31.75 | 27.92% |

| Maplebear Inc | CART | $40.91 | $48.38 | 18.26% |

These analysts’ targets raise important questions: Are their projections realistic, or are they overly optimistic? Further examination of recent developments in these companies and sectors is needed to determine whether the analysts’ outlook will hold true or face adjustments. A high target price can suggest confidence in future growth but may also lead to revisions if market conditions change.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Top Ten Hedge Funds Holding CCMG

• Institutional Holders of LOWV

• Top Ten Hedge Funds Holding WAYN

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.