Cirrus Logic Faces Stock Decline Amid Investor Concerns

Stock Performance Over the Last Month

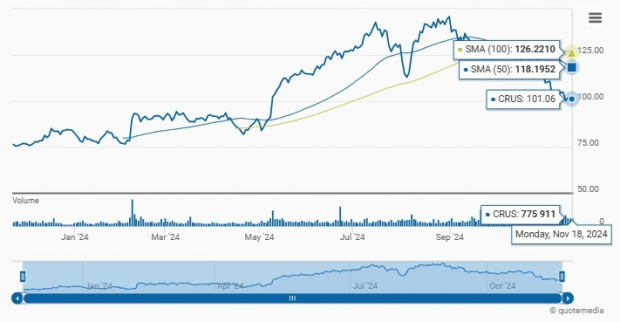

Image Source: Zacks Investment Research

Cirrus Logic, Inc. (CRUS) has seen its stock drop by 19.3% in the past month. This drop is significant compared to the overall sector, where the Zacks Computer and Technology sector saw a decrease of 7.8% and the S&P 500 Index posted a modest gain of 0.6%. Following its second-quarter fiscal 2025 earnings report on Nov. 4, CRUS stock fell further by 8.7%.

The decline in stock price is largely due to disappointing guidance for the current quarter. Management expects revenues between $480 million and $540 million, signaling a potential year-over-year drop of 17.6% at the midpoint. One factor contributing to this is the loss of a week in comparison to last year’s September quarter, which typically saw higher production volumes due to seasonal demand.

Currently trading at $101.06, CRUS is 31.5% below its 52-week high of $147.46, reached on August 29, 2024.

Is this decline a chance for investors to buy into CRUS? Let’s analyze the company’s prospects to help you make informed decisions.

Dependence on Apple Poses Risks

Cirrus Logic heavily depends on Apple (AAPL) for its revenue growth, with approximately 87% of its income in fiscal 2024 coming from audio chips in iPhones. Any downturn in iPhone sales could significantly impact the company’s overall revenue.

This dependence on the smartphone industry raises concerns about CRUS’ stability. Factors such as seasonal trends and supply chain disruptions can affect smartphone sales, which in turn can influence Cirrus Logic’s performance.

Rising Costs Could Squeeze Margins

In its latest quarter, Cirrus Logic reported a 10.8% increase in non-GAAP operating expenses, totaling $126.8 million. This rise is due to increased variable compensation, higher employee costs, and product development expenditures.

Looking ahead, the company anticipates GAAP R&D and SG&A expenses between $148 million and $154 million, including $22 million for stock-based compensation. Non-GAAP operating expenditures are expected to be between $124 million and $130 million, slightly higher than the previous year’s $125.6 million.

While investing in product development is essential for long-term success, rising expenses could pressurize margins, especially if new product revenues don’t meet expectations. Furthermore, CRUS faces strong competition from semiconductor companies such as AKM Semiconductor, Analog Devices (ADI), and Texas Instruments (TXN), which could impact profitability.

Analyst Sentiment Signals Caution

In the last two months, analysts have lowered their earnings estimates for CRUS. Current quarter and next quarter estimates have fallen by 5% and 6.4%, now standing at $2.08 and $1.03 per share respectively. Projections for the current year have decreased by 0.8%, while next year’s expectations have dropped 3%.

Image Source: Zacks Investment Research

Additionally, current technical indicators suggest a potential for further losses. CRUS has been trading below both its 50-day and 100-day moving averages, signaling waning investor confidence. This trend indicates that the stock could experience more volatility in the near future.

Trading Trends Under Review

Image Source: Zacks Investment Research

Promising Developments Amid Challenges

Despite current challenges, Cirrus Logic has some positive developments. The company is gaining traction in the laptop market, with recent design wins for next-generation flagship smartphones. In the second fiscal quarter, they successfully began shipping new audio amplifier products and introduced a 22-nanometer smart codec for new smartphone models.

Cirrus Logic is also making strides in the laptop space and has achieved its first high-volume design win for its PC codec. Additionally, the firm is rolling out its first power product across multiple devices for leading customers.

The company aims to extend its reach beyond audio and into high-performance mixed-signal solutions, particularly within the smartphone market. Their camera controller products, launched in 2020, are performing well and benefiting from recent smartphone launches that favor their product mix. Furthermore, Cirrus Logic is investing in power sensing and battery technologies, important as the industry focuses on efficiency.

Strong Financial Position: A Buffer for Shareholders?

Cirrus Logic boasts a solid balance sheet and is considered cash-rich. As of September 28, 2024, the company reported cash and equivalents of $478.3 million, with no long-term debt. In the previous quarter, they generated $8.2 million in net cash from operations, a notable improvement over the $22.7 million used during the same period last year. Free cash flow stood at $5.5 million in the most recent quarter.

This healthy free cash flow allows the company to invest in growth, acquisitions, or return value to shareholders through buybacks. In the last reported quarter, CRUS repurchased 356,432 shares for $50 million, and it currently has $224.1 million available for additional buybacks. Such repurchases can enhance shareholder value and support earnings growth, underlining the company’s capability to maintain buyback activities in the near term.

“`

Cirrus Logic (CRUS) Stock: Is it a Smart Investment Right Now?

CRUS stock is trading at a discount, currently carrying a forward 12-month Price/Earnings ratio of 15.32. This is notably lower than the industry average of 30.24.

Image Source: Zacks Investment Research

The Potential of CRUS Shares in Today’s Market

Cirrus Logic’s strategy centers on its smartphone audio segment while also aiming to enhance capabilities in high-performance mixed-signal functionality. Additionally, the company is working to enter emerging markets such as laptops and power sensing, which are vital for its long-term growth trajectory. A strong balance sheet combined with its appealing valuation also provides some tailwinds.

Despite these positive elements, the company’s rising operating expenses amid fierce competition and its significant dependence on a single customer for revenue growth introduces caution. Recent guidance indicates modest revenue growth for the current quarter, leading to downward revisions in earnings estimates. The effort to expand into new markets is promising but may take time, potentially impacting profitability in the short term.

Given these factors, investing in CRUS at this moment might not be the best idea. The stock carries a Zacks Rank of #3 (Hold), suggesting that caution is warranted. For further insights, you can check the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Currently, CRUS holds a Growth Score of F and a Momentum Score of D, making it less appealing for investors seeking growth or momentum.

Explore 7 Top Stock Picks for the Coming Month

Recently uncovered: Experts have identified 7 standout stocks from a pool of 220 Zacks Rank #1 Strong Buys, labeling them “Most Likely for Early Price Pops.”

Since 1988, past selections have outperformed the market more than twice over, boasting an average annual gain of +23.7%. These handpicked stocks deserve your immediate attention.

Don’t miss out; see them now >>

Interested in the latest recommendations from Zacks Investment Research? Download our report on 5 Stocks Set to Double at no cost. Click here to access this free report.

Analog Devices, Inc. (ADI): Free Stock Analysis Report

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS): Free Stock Analysis Report

For the original article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`