AMC Faces Critical Challenges as Stock Signals Worry

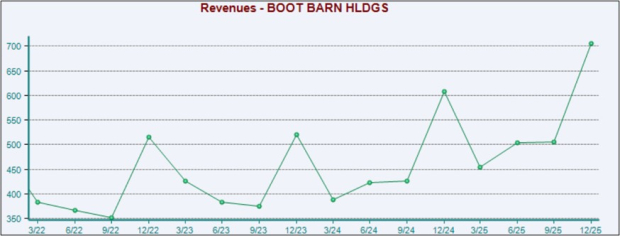

Chart created using Benzinga Pro

AMC Entertainment Holdings Inc. AMC is experiencing a pivotal moment as its stock approaches a Death Cross—a technical indicator that occurs when the 50-day moving average falls below the 200-day moving average. This pattern often suggests bearish trends, raising concerns for a company that carries $4 billion in debt.

Heavy Debt Drags Down Recovery

Despite a strong recovery in the domestic box office, which saw its best third-quarter results since 2020, AMC has struggled to take advantage of this upturn. As the largest theater chain with 900 locations and 10,000 screens, AMC’s significant debt remains a considerable hurdle.

While competitors such as Cinemark Holdings Inc CNK find ways to thrive, AMC must manage substantial interest payments that hinder its financial comeback.

Even with a lineup of blockbuster hits and upgrades to premium seating experiences like Dolby Cinema and IMAX, AMC reported a loss of $21 million in the third quarter, heavily impacted by its debt-related costs.

Read Also: AMC CEO Is ‘Confident And Optimistic’ About Cinema Chain’s Future As Q3 Earnings Show Revenue Beat, Record Food & Beverage Results

Investing in Premium Experiences

AMC aims to attract audiences back to theaters by investing in upscale experiences. CEO Adam Aron has outlined a “Go Plan,” which includes spending over $1 billion on enhanced screens, luxurious seating, and unique snack offerings.

While these efforts could boost revenues, analysts are cautious. Roth Capital analyst Eric Handler warns, “They’ve still got to be judicious with their cash flow.”

Investor sentiment appears lukewarm. AMC’s strategy of issuing additional shares to fund operations has diluted shareholder value, making the stock less appealing than even the most overpriced snacks in the theaters.

Stock Performance Raises Eyebrows

The approaching Death Cross signifies deeper concerns. AMC’s stock has fallen more than 39% over the past year and almost 29% year-to-date, reflecting a decline in investor confidence. A recent 1.63% gain feels more like a brief pause rather than a turnaround.

Can AMC Change Its Narrative?

Despite these troubling signs, there remains hope for a turnaround. The upcoming film schedules for 2025 and 2026 include highly anticipated franchise films that could boost ticket sales at AMC theaters.

However, the pressing question is whether AMC can manage its debt effectively, avoid further stock dilution, and stay solvent long enough to benefit from the industry’s recovery.

As AMC nears this critical technical juncture, the market’s response suggests uncertainty about whether the company can bounce back or if it will face continued challenges.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs