“`html

Wall Street Stays Bullish Ahead of Key Earnings Reports

As Wall Street begins a week packed with earnings announcements from giants like Nvidia, Walmart, and Target, the Nasdaq holds steady at its 21-day moving average.

Check out the Zacks Earnings Calendar to keep up with market news.

The stock market appears to be in the hands of bullish investors who are encouraged by earnings growth prospects, as well as the potential for reduced corporate taxes and less regulation should Trump secure a second term.

Currently, CNN’s Fear and Greed Index, a measure of market sentiment, is at Neutral (50), having dipped from Greed last week. This indicates that the market is not overly inflated as we approach the end of November and the close of 2024.

For investors eager to continue purchasing stocks, it might be wise to target some high-potential, low-priced options.

In this analysis, we consider affordable stocks trading at $10 or less that could be valuable additions to an investment portfolio as December approaches.

Analysts on Wall Street have positive outlooks on these stocks, which also benefit from improving earnings projections, earning them strong Zacks Ranks.

Penny Stocks Explained

A typical benchmark for “penny stocks” used to be $1, but the SEC has now classified them as securities trading below $5. Many investors steer clear of these due to their speculative nature.

Furthermore, penny stocks often have low trading volumes and broad bid/ask spreads, which can lead to significant volatility. Despite this, some penny stocks achieve remarkable gains, keeping them on the radar for investors.

Stocks Priced Under $10

Next, let’s shift our focus to stocks trading between $5 and $10. These stocks typically carry less risk than penny stocks, as many investors may be more familiar with these companies and ticker symbols. However, they still possess a speculative edge compared to more stable, higher-priced stocks.

It’s possible to discover promising stocks below $10 if investors are discerning. Today, we’ve refined a vast array of speculative stocks down to a select group that holds potential for portfolio enhancement.

Screening Criteria

• Price capped at $10

• Trading volume at least 1,000,000

• Zacks Rank of 2 or better

(Only includes stocks with no Holds, Sells, or Strong Sells.)

• Average Broker Rating no worse than 3.5

(Average Broker Rating of a Hold or better.)

• Minimum of 2 analysts providing ratings

(Must have coverage from at least two analysts.)

• % Change in F1 Earnings Estimate Revisions – last 12 weeks must be 0 or greater

(Preferably upward revisions with no downward adjustments.)

Here is one stock from nearly 90 highly-ranked names trading under $10 that passed our screening today:

Should Investors Consider Surging Applied Digital Stock?

Applied Digital Corporation APLD is focused on creating next-generation digital infrastructures, which support high-performance computing, cloud services, and data center hosting. Their goal is to develop a versatile platform capable of operating multiple HPC data centers.

Recently, Applied Digital exceeded our Q1 FY25 earnings forecasts in early October. The firm revealed plans to finalize a lease with a U.S.-based hyperscaler for its ongoing 100 MW facility currently under construction. This impressive 369,000+ square-foot facility is built for HPC applications, including artificial intelligence. Additionally, two more buildings are being designed to expand the total capacity to 400 MW.

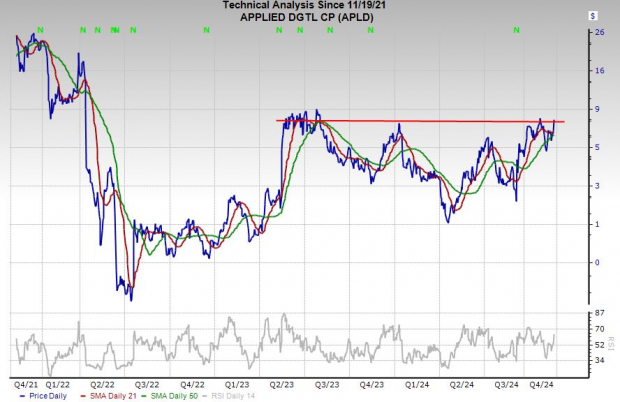

Image Source: Zacks Investment Research

Thanks to its recent upward earnings revisions, Applied Digital has received a Zacks Rank #2 (Buy). Projections indicate a revenue growth of 64% in FY25 for APLD.

“`

Nvidia’s Stake Boosts Confidence in Applied Digital’s Future

Wall Street Optimistic About APLD Stock

Wall Street analysts have become more optimistic following reports that AI leader Nvidia NVDA has invested in Applied Digital. As of September 30, Nvidia owned about a 3% stake in Applied Digital (APLD).

Investment Fuels Balance Sheet Improvements

Applied Digital has strengthened its financial position thanks to strategic investments made by a variety of institutional and accredited investors, alongside Nvidia and its related companies.

Stock Performance and Market Position

Over the past year, APLD shares have surged by 105%. However, they remain approximately 65% lower than their value in November 2021. On Tuesday, Applied Digital’s stock made significant gains, approaching its highest level in the past year.

Analyst Recommendations Favor APLD

APLD is currently trading 38% below the average price target set by Zacks. Impressively, six out of seven analysts from Zacks recommend it as a “Strong Buy.” With a share price under $10, many see Applied Digital as a value investment driven by its focus on artificial intelligence.

For more insights on promising stocks and companies, start your search today using Zacks’ Research Wizard with a free trial.

Your Guide to Today’s Best Stock Picks

This is a perfect time to gain access to our best-performing stock selections. Since 2000, our strategies have consistently surpassed the market, achieving remarkable returns: Small-Cap Growth at +44.9%, Filtered Zacks Rank5 at +48.4%, and Big Money Zacks at +55.2%.

Explore potential investments quickly and effectively using Zacks’ Research Wizard, with no obligations or credit card information required.

Download a free stock analysis report for NVIDIA Corporation (NVDA).

Download a free stock analysis report for Applied Digital Corporation (APLD).

To read this article on Zacks.com click here.

Visit Zacks Investment Research for more information.

The views expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.