“`html

Nvidia: The AI Powerhouse Sets Stage for Anticipated Earnings Report

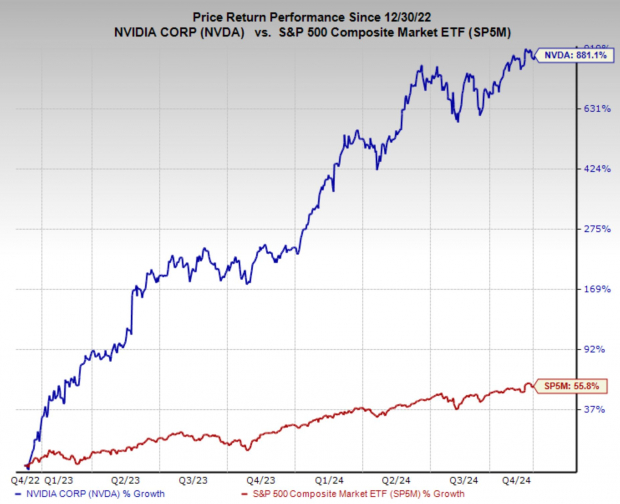

Nvidia (NVDA) is not just the largest publicly traded company globally; it’s also leading the charge in the AI revolution. Its stock has skyrocketed nearly 200% year-to-date and an astonishing 900% gain since early 2023, creating high expectations for its upcoming earnings report.

Investors and analysts are closely monitoring Nvidia as demand for its advanced Blackwell GPUs grows. Nvidia will report its quarterly earnings this Wednesday, November 20, after the market closes.

Image Source: Zacks Investment Research

Key Drivers Behind Nvidia’s Earnings Success

- AI Revolution Boost: Nvidia plays a crucial role in the generative AI boom. Its GPUs are vital for training large language models and supporting AI applications, including data processing and automatic systems. Major tech companies like Microsoft MSFT, Alphabet GOOGL, and Amazon AMZN are significantly investing in data centers and cloud AI infrastructure, creating huge demand for Nvidia’s high-margin products.

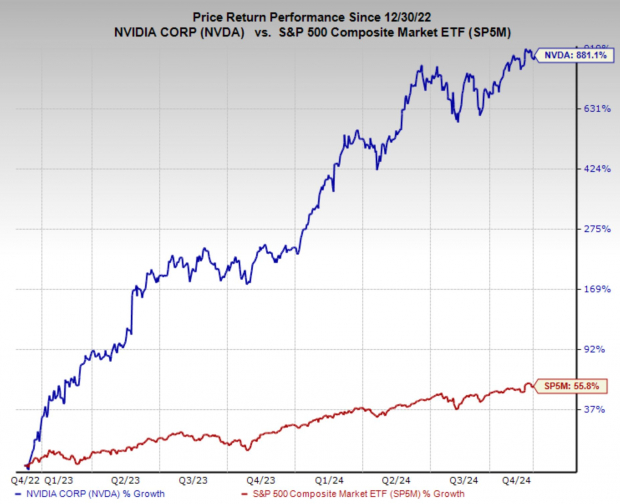

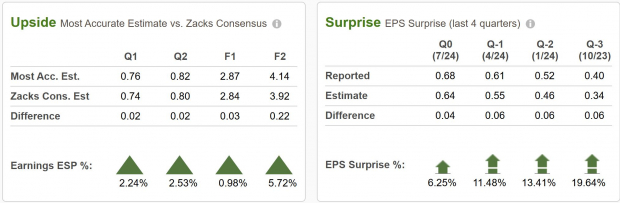

- Positive Earnings Forecasts: Analysts have been raising their earnings estimates for Nvidia over the past quarter, contributing to its Zacks Rank #1 (Strong Buy). The consensus earnings-per-share (EPS) estimate for the current quarter has risen from $2.81 to $2.84 in the last 60 days, with expectations for even stronger growth in the coming year. Earnings are projected to grow by an impressive 36% annually over the next three to five years.

Image Source: Zacks Investment Research

- Expected Surprise Prediction (ESP): Nvidia’s ESP stands at 2.24%, historically suggesting a good chance of beating earnings expectations. The company has a solid track record, with four consecutive earnings beats and surprises reaching as high as 19.64% in recent quarters.

Image Source: Zacks Investment Research

Market Perceptions and Influencers on NVDA Stock

The upcoming earnings report will assess not only Nvidia’s ability to beat expectations but also if it can validate its current valuation. Nvidia’s stock is presently trading at 36x next year’s earnings estimates, a rate that, while high, seems reasonable given the company’s growth outlook. This valuation greatly relies on Nvidia’s consistency in maintaining its rapid earnings growth, driven by its expertise in AI and cloud computing.

Historically, Nvidia’s valuation appears modest compared to the extreme P/E ratios during the dot-com bubble or the initial phases of the AI hype cycle. However, this moderation does not lessen the pressure on the company to deliver solid outcomes.

Questions that may arise during the report include:

- Blackwell Sales Outlook: Will Nvidia meet the ever-growing need for its GPUs despite supply limitations?

- Competitive Environment: Nvidia’s leading position relies heavily on partnerships with Microsoft, Amazon, and Alphabet. While these partnerships aid in growth, they also pose risks as these companies may explore their own chip development.

- Future Guidance and Earnings Growth: Analysts anticipate earnings growth of 85% or higher year-over-year this quarter. Nvidia’s capability to provide confident guidance for 2024 will be crucial in retaining investor trust at its current valuation.

Nvidia Stock: Nearing Record Heights

Nvidia’s rapid ascent is a result of ongoing earnings surprises and its critical role in the AI sector. The stock is currently hovering just below its all-time high, indicating strong demand and sustained market interest.

However, this strong performance brings some risks, as the stock’s current rally may lead to a decline if earnings do not meet the high expectations set by investors.

This week, the price also fell below a trendline that had formed since early September. Whether this trend shift presents a warning or is merely a strategy to test investor resolve remains uncertain.

Image Source: TradingView

Earnings reports can be unpredictable, and Nvidia’s upcoming release is no different. Here are some strategies for investors to navigate this event:

“`

Nvidia: A Critical Look Ahead of Earnings Reports

For Long-Term Holders: Investors who own Nvidia might find it wise to hold onto their shares despite the upcoming earnings report. The company’s leading position in AI and its strong history of performance suggest potential rewards. However, reducing some exposure could help ease portfolio risks, especially considering the stock’s high valuation.

For Prospective Buyers: New investors may want to wait for the earnings report to gain clarity before diving in. If the company experiences a significant pullback, it could present a more appealing buying opportunity.

What Could Go Wrong?

Even though Nvidia is in a strong position, certain risks could impact its upward trajectory:

- Guidance Miss: A slight miss on earnings guidance might lead to sharp declines in stock prices, as expectations are already very high.

- Valuation Concerns: With a forward price-to-earnings (P/E) ratio of 36, any signs of slowing growth or shrinking margins could trigger profit-taking among investors.

- Broader Market Conditions: Increasing interest rates or geopolitical issues could pressure growth stocks like Nvidia disproportionately.

Should Investors Buy Nvidia Stock?

Nvidia is considered one of the most exciting prospects in today’s stock market. The company’s leadership in AI hardware, coupled with strong earnings and ongoing trends in AI and cloud computing, supports a solid investment case. However, caution is advised due to the stock’s relatively high valuation and unpredictable earnings. For current shareholders, the potential for long-term growth may outweigh immediate risks, though taking some profits might be a sensible move. New investors could benefit from a wait-and-see approach, as post-earnings fluctuations might yield better purchase opportunities.

As Nvidia prepares to announce its earnings, one thing remains clear: all attention is on this AI powerhouse to deliver another strong performance.

7 Best Stocks for the Next 30 Days

Just released: Experts have identified 7 standout stocks from a list of 220 Zacks Rank #1 Strong Buys, labeling them as “Most Likely for Early Price Pops.”

Historically, this list has outperformed the market more than twice since 1988, averaging a gain of +23.7% annually. It’s worth closely monitoring these top 7 stocks.

Want the latest recommendations from Zacks Investment Research? Download “5 Stocks Set to Double” for free.

Available Stock Analysis Reports:

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read the full article on Zacks.com, click here.

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.