The Walt Disney Company DIS reported impressive earnings for the fourth quarter of fiscal 2024, delivering adjusted earnings of $1.14 per share. This figure surpassed the Zacks Consensus Estimate by 4.59% and represented a solid 39% rise year-over-year. Revenues increased by 6.3% to $22.5 billion, slightly below expectations, reflecting the company’s sustained growth across its various business segments. (Read More: Disney Q4 Earnings Surpass Estimates, Revenues Increase Y/Y)

Disney Thrives Amidst Challenges: Fourth Quarter Highlights

Streaming Growth Fuels Turnaround

Disney’s direct-to-consumer segment showcased significant progress, shifting from last year’s loss to achieve an operating profit of $253 million. The platform Disney+ reported a subscriber increase to 122.7 million, with 4.4 million new subscribers joining in the latest quarter. This rise, along with a 14% boost in ad revenues, highlights the effectiveness of Disney’s digital transformation strategy.

Entertainment Segment Posts Remarkable Gains

Disney’s Entertainment division excelled, with operating income climbing to $1.1 billion, an increase of $800 million from the previous year. The success was driven by major releases like Pixar’s Inside Out 2 and Marvel’s Deadpool & Wolverine, which collectively generated $316 million in operating income from Content Sales/Licensing.

Mixed Performance in Parks and Experiences

The Parks, Experiences, and Products division experienced a 1% revenue growth, reaching $8.24 billion. However, operating income fell by 5.7% to $1.65 billion. While domestic operations saw a 4.8% gain in operating income, international segments struggled, facing a noticeable 32.2% decline due to reduced attendance and lower guest spending.

Outlook and Strategic Developments

Disney projects positive growth, anticipating high-single digit adjusted EPS growth for fiscal 2025, supported by a planned $3 billion stock buyback and double-digit growth in the Entertainment segment’s operating income. The streaming division expects a notable $875 million rise in operating income, despite an anticipated slight dip in Disney+ Core subscribers in Q1 2025. The Sports segment aims for 13% growth, while the Experiences category targets an increase of 6-8%, primarily in the latter half of the year. Looking ahead, management is optimistic about achieving double-digit adjusted EPS growth for fiscal years 2026 and 2027, backed by strategic investments and operational efficiencies in all areas.

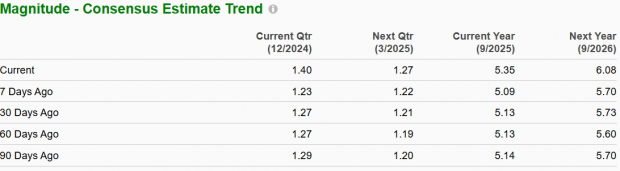

The Zacks Consensus Estimate currently predicts $95.03 billion in revenues for fiscal 2025, reflecting a 4.01% year-over-year increase. Furthermore, the earnings forecast for fiscal 2025 has risen by 4.3% to $5.35 per share over the last month, indicating a 7.65% growth compared to the previous year.

Image Source: Zacks Investment Research

Disney’s shares have risen 25.8% year-to-date, outpacing the broader Zacks Consumer Discretionary sector’s growth of 10.8%.

Year-to-Date Performance Overview

Image Source: Zacks Investment Research

Competing in a Crowded Streaming Market

Disney faces a challenging outlook due to anticipated modest growth in Disney+ Core subscribers for the first quarter of fiscal 2025. Increased competition from Netflix NFLX, Amazon AMZN-owned Amazon Prime Video, and Apple AAPL-owned Apple TV+ is evident, alongside general subscriber fatigue in the streaming market. Initial growth in Disney+ subscriptions is giving way to more significant hurdles, particularly as rivals like Amazon and Netflix continue to thrive.

Additionally, a decline of 6.4% in revenue from Linear Networks, falling to $2.46 billion in Q4 of fiscal 2024, raises concerns for Disney’s traditional movie-going experience, which faces ongoing changes in consumer preferences.

Financially, Disney’s high borrowings of $45.81 billion combined with a modest cash position of $6 billion create potential challenges.

Disney is currently trading at a premium, with a three-year trailing 12-month price-to-sales ratio of 2.25X compared to the Zacks Media Conglomerates industry’s 1.11X, indicating a stretched valuation.

Valuation Insights: DIS vs. Industry

Image Source: Zacks Investment Research

Investment Outlook

Disney’s ability to report strong streaming profits, create compelling content, and manage its domestic parks suggests current investors may wish to maintain their positions. The company’s strategic direction and strong content pipeline could support future growth.

Conversely, new investors may want to be cautious and wait for a more opportune entry point. Challenges in international park operations, potential impacts on consumer spending, transformation costs in the streaming segment, and a projected decline in Disney+ Core subscribers indicate a need for careful consideration.

Conclusion

Disney’s fourth-quarter results reflect its successful strategic execution, especially within streaming and content production. While existing investors may find value in holding shares for future potential, those considering an investment should look for more favorable entry points as the company navigates through immediate challenges and continues its transformation efforts. The planned $3 billion stock repurchase and expected double-digit adjusted EPS growth through fiscal 2027 highlight management’s confidence in Disney’s future. Currently, Disney holds a Zacks Rank #3 (Hold). You can find a full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts have identified 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys, deemed “Most Likely for Early Price Pops.”

Since 1988, this complete list has outperformed the market more than twice, with an average gain of +23.7% annually. Don’t miss out on these selected 7; they deserve your attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.