The Nasdaq and S&P 500 Surge Amid Market Tensions

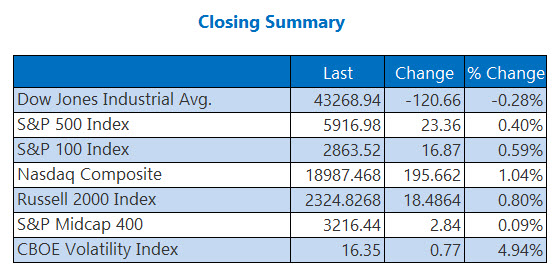

The Nasdaq and S&P 500 experienced significant gains on Tuesday, climbing ahead of an eagerly awaited earnings report from Nvidia (NVDA). In contrast, the Dow Jones Industrial Average fell 120 points for the fourth consecutive session, reflecting concerns over renewed global tensions between Russia and Ukraine. In a flight to safety, Treasury prices increased while yields dropped, and the Cboe Volatility Index (VIX) rose for the third time in four days.

Continue reading for more on today’s market trends, including:

5 Key Market Insights for the Day

- Moscow indicated its readiness for a nuclear response after Ukraine’s use of U.S.-made long-range missiles to strike Russian territory. (CNBC)

- Merck (MRK) announced positive results for its new cancer treatment, Keytruda. (MarketWatch)

- Investors should prepare for potential short-term challenges.

- Lowe’s has provided a pessimistic outlook for the future.

- An analyst suggests it’s time to consider buying BioNTech stock.

Commodity Prices Fluctuate Amid Ongoing Conflict

Oil prices displayed volatility as markets respond to recent developments in the Russia-Ukraine conflict. For the day, December-dated West Texas Intermediate (WTI) crude increased by 23 cents, or 0.3%, closing at $69.39 a barrel.

In contrast, gold prices reached their highest level in a week. Following Ukraine’s strikes, investors flocked towards safe-haven assets while anticipating updates from the Federal Reserve on interest rates. As of the latest update, gold futures rose by 0.7%, trading at $2,633.50 an ounce.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.