Understanding Semiconductor Stocks: Why They Still Offer Investment Potential

Semiconductors: Backbone of Modern Technology

For the last two decades, semiconductor companies have been vital to the U.S. economy. These chips power nearly all modern devices, ranging from smartphones to advanced computer systems. Continuous innovation within this industry has spurred breakthroughs across various sectors, including electronics, automotive, and healthcare.

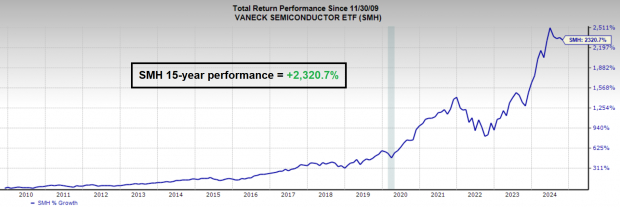

The demand for chips has surged dramatically over the last 15 years. This growth has been driven by trends such as the Internet of Things (IoT), artificial intelligence (AI), and the advent of 5G networks. The VanEck Semiconductor ETF (SMH), which tracks a variety of publicly traded semiconductor stocks, has skyrocketed by 2,320.7% in the past 15 years.

Image Source: Zacks Investment Research

Five Compelling Reasons to Invest in Semiconductor Stocks

Despite impressive growth, some investors may feel like they have missed out. Here are five reasons semiconductor stocks still hold potential:

1. Robust Demand for Data Centers & AI

According to SEMI (@SEMIconex), “The global semiconductor industry saw strong growth in Q3 2024 – indicating the first positive quarter-on-quarter increases across all key metrics in two years.”

2. Strong Growth Forecasts for Nvidia

Financial experts predict that Nvidia (NVDA), the leading player in the semiconductor market, will maintain impressive earnings growth. Zacks Consensus Estimates forecast an 85% year-over-year increase in NVDA’s quarterly earnings per share (EPS), with extraordinary growth projected for 2025 and 2026.

Image Source: Zacks Investment Research

3. Seasonal Trends Favor November

While semiconductor stocks have seen a dip this month, historically, November is a strong month for them. The SMH ETF has performed positively in 10 out of the last 12 Novembers, with only minor losses recorded.

4. Market Skepticism Presents Opportunities

Typically, market stocks rise amid concerns, known as climbing the “Wall of Worry.” Recently, Super Micro Computer (SMCI) faced challenges that influenced the market outlook after delaying financial filings. However, after securing a new auditor, SMCI shares surged. In light of this, companies like Dell (DELL) are poised to fill any market gap.

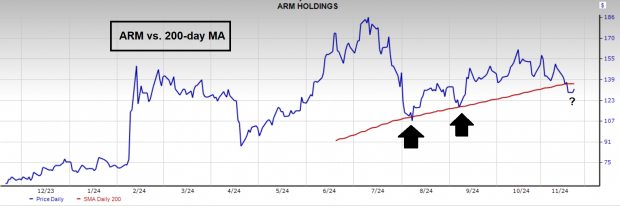

5. Technical Indicators are Favorable

Even though semiconductor stocks have recently stabilized, several leaders like Arm Holdings (ARM) are returning to important support levels. ARM shares are testing their 200-day moving average, where they previously attracted buyers.

Image Source: Zacks Investment Research

While AI continues as the main driver of growth, emerging technologies such as autonomous driving are also expected to contribute to steady expansion in the semiconductor sector.

Conclusion

Semiconductors remain essential to the U.S. economy. Despite a recent slowdown in chip stocks, projections for future growth are strong. Multiple factors point to potential price increases ahead.

Top 7 Stocks to Watch in the Coming Month

Experts have just released a list of seven top stocks chosen from the Zacks Rank #1 Strong Buys. These stocks are identified as “Most Likely for Early Price Pops.”

Since 1988, this curated list has outperformed the market, averaging gains of +23.7% annually. These seven stocks are worth your attention.

Interested in the latest stock recommendations from Zacks Investment Research? Today, you can download the report on 5 Stocks Set to Double for free.

Dell Technologies Inc. (DELL): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

ARM Holdings PLC Sponsored ADR (ARM): Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI): Free Stock Analysis Report

VanEck Semiconductor ETF (SMH): ETF Research Reports

For more details, visit Zacks.com.

Zacks Investment Research

The views expressed in this article are those of the author and do not represent the opinions of Nasdaq, Inc.