Super Micro Computer’s Stock Rallies Following Auditor Appointment

Key Developments and Stock Performance

Shares of Super Micro Computer Inc SMCI surged 31.24% on Tuesday, closing at $28.27 per share. This dramatic increase followed the company’s announcement that it had appointed BDO USA as its Independent Auditor, along with filing a compliance plan with Nasdaq.

The news has helped avert the risk of being delisted from Nasdaq. However, prior to this announcement, company insiders purchased considerable amounts of SMCI shares. Even with the rise in stock prices, most analysts have lowered their ratings on the stock.

Recent Troubles and Analyst Reactions

Super Micro Computer has faced significant challenges in 2024, including a failure to file its Form 10-K with the SEC, the annual financial report for the fiscal year ending June 30. Compounding these issues, a report from short-seller Hindenburg on August 27 accused the company of accounting manipulation and self-dealing, alongside sanctions evasion.

Adding to the turmoil, Ernst & Young resigned as the company’s auditor on October 30, further delaying the filing of its Form 10-Q for the first quarter of fiscal 2025, which ended September 30.

Stock Performance Overview

The stock is currently up nearly 64% from its 52-week low of $17.25 but remains down 77% from its 52-week high of $122.90. Year-to-date, the stock has declined by nearly 1%.

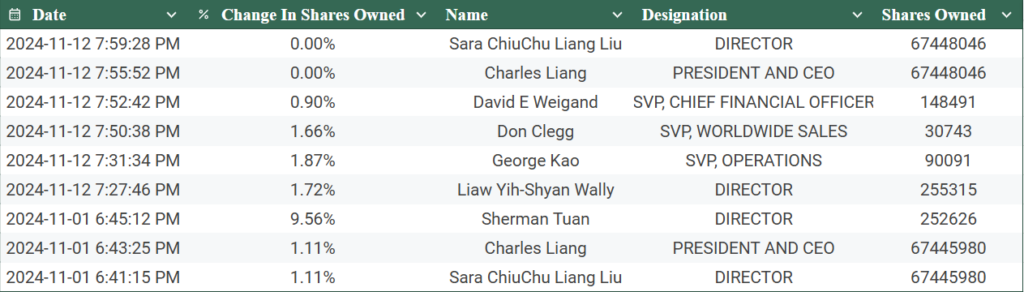

Currently, the stock’s relative strength index stands at 45.26, indicating it is neither overbought nor oversold. Insider trading records show that company executives bought shares between November 1 and November 12, just before the announcement of the new auditor.

Analyst Insights

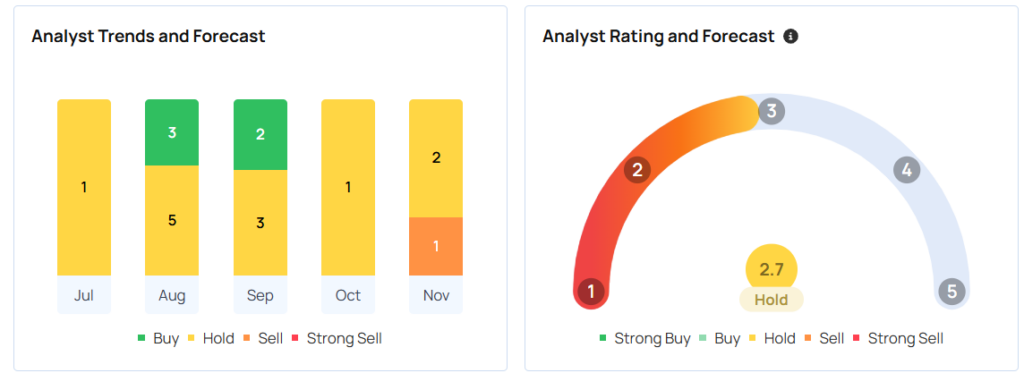

Brokerages have lowered their ratings and price targets for SMCI. Bank of America shifted its rating to ‘neutral’ and reduced its target price to $70.00, while Rosenblatt Securities maintained a ‘buy’ rating with a target price of $130.00 as of August. Barclays also revised its target to $42.00 with an ‘equal weight’ rating in October. More recently, JPMorgan Chase & Co. shifted from a ‘neutral’ to ‘underweight’ rating, establishing a target price of $23.00 in November.

Benzinga Pro reports that the average price target among Goldman Sachs, JP Morgan, and Wedbush stands at $27.67, suggesting an implied downside of -2.65% for Super Micro Computer. The consensus rating is approximately 2.7 out of 5, indicating a recommendation to hold the stock.

Next Steps

For more insights, read about how Super Micro’s future could be influenced by Nvidia’s earnings and Nasdaq deadlines.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs