Exploring Oversold Stocks in the Industrials Sector: A Potential Buying Opportunity

Investors may find an attractive chance to purchase undervalued companies in the industrials sector. Recent trends indicate several stocks are considered oversold, suggesting they could be due for a rebound.

The Relative Strength Index (RSI) helps investors analyze a stock’s price movements. It measures how a stock performs on days it gains ground compared to days it declines. An RSI below 30 typically signals that the stock is oversold, according to Benzinga Pro.

Below are some notable oversold stocks in the industrials sector, identified with RSI values at or near 30.

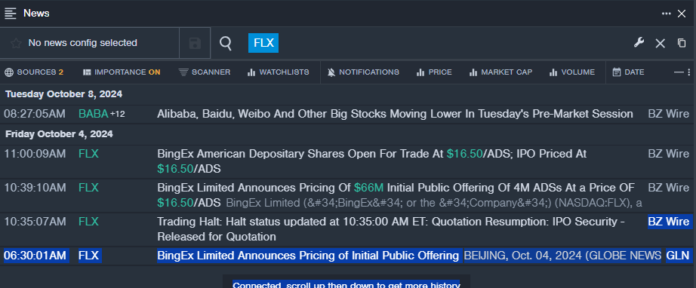

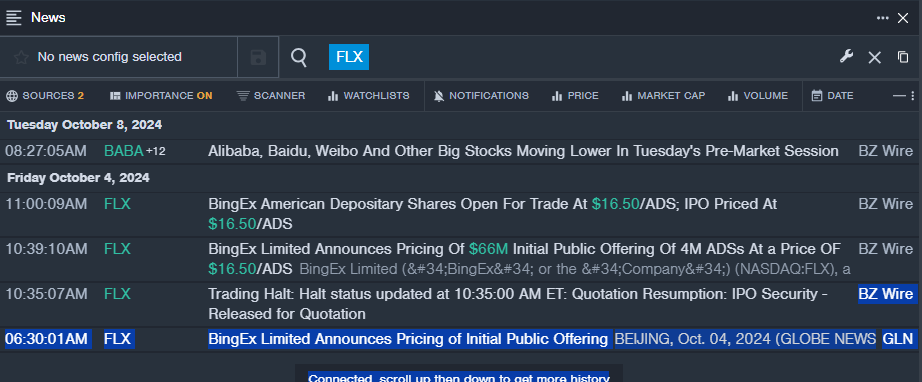

BingEx Ltd FLX

- On Oct. 4, BingEx priced its initial public offering at $66 million, selling 4 million American Depositary Shares (ADS) at $16.50 each. Despite this, the stock has dropped approximately 40% over the last month, with a 52-week low of $8.04.

- RSI Value: 27.38

- FLX Price Action: Shares fell 1.5%, closing at $8.71 on Tuesday.

- Latest updates on FLX were highlighted by Benzinga Pro’s real-time newsfeed.

Brinks Co BCO

- Brink’s reported weaker-than-expected quarterly results on Nov. 6, resulting in a 14% decline in its stock over the past month. The company has a 52-week low of $76.93.

- RSI Value: 25.00

- BCO Price Action: Shares saw a slight recovery, gaining 0.5% to close at $91.76 on Tuesday.

- Benzinga Pro’s charting tool has aided in recognizing BCO’s current trends.

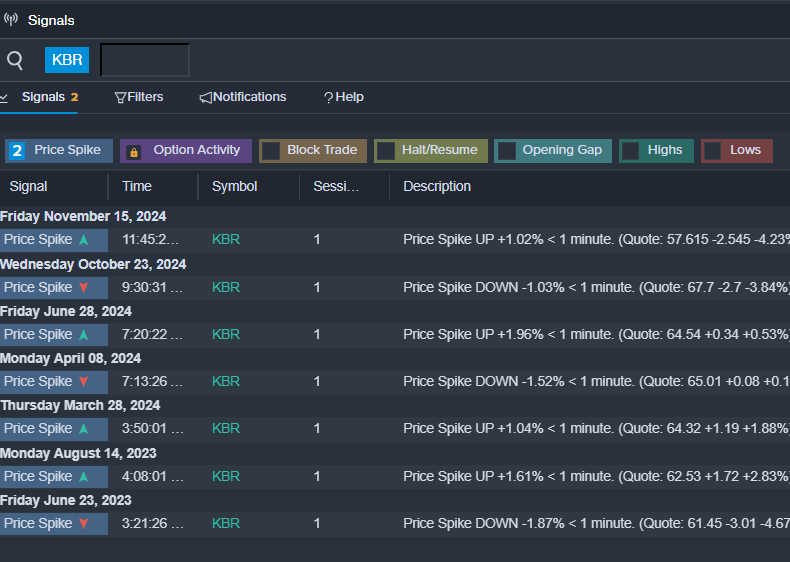

KBR Inc KBR

- KBR announced quarterly earnings on Oct. 23 that met expectations. The President and CEO, Stuart Bradie, noted impressive results. However, KBR’s stock fell about 17% over the last five days, with a 52-week low of $50.45.

- RSI Value: 27.09

- KBR Price Action: Shares increased slightly, gaining 0.2% to close at $58.29 on Tuesday.

- Benzinga Pro’s signals alerted investors to a possible breakout for KBR shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs