Zimmer Biomet Achieves CE Mark for Innovative Knee System

Zimmer Biomet Holdings, Inc. ZBH has recently been granted a CE Mark for its Persona Revision Knee System. This certification broadens the Persona Knee System’s offerings, showcasing the company’s dedication to personalized orthopedic solutions.

After a successful introduction of the Persona Revision Knee in the U.S. and various international markets, the CE Mark aims to equip surgeons worldwide with enhanced tools for knee arthroplasty revisions.

Stock Reaction to the CE Mark Announcement

In response to the announcement, ZBH’s stock rose by 0.4% to $113.02 on Monday. The company is experiencing synergies from its focus on the Persona revision line, leading to valuable opportunities in the revision category. Zimmer Biomet plans to migrate its legacy knee systems towards a complete Persona portfolio, making the CE Mark an important milestone for its mission. Consequently, we expect optimistic market sentiment regarding ZBH stock following this news.

As of now, ZBH holds a market capitalization of $22.09 billion and has consistently surpassed earnings expectations over the past four quarters, with an average surprise of 1.76%.

Understanding ZBH’s Persona Revision System

The Persona Revision Knee from Zimmer Biomet provides a personalized fit and improved functionality for patients undergoing knee revisions. Its anatomical design and user-friendly instruments simplify the procedure while enhancing precision. This flexibility enables surgeons to make adjustments during surgery, ensuring optimal alignment for every patient.

The system incorporates proprietary Trabecular Metal Technology, which supports long-term bone in-growth and enhances implant fixation. Notably, the Persona Revision Knee is the leading product in the U.S. knee revision market.

Positive Outlook for the Industry

According to a Future Market Insights report, the revision knee replacement market is projected to grow to $2.00 billion by 2032, expanding at a compound annual growth rate (CAGR) of 4.1% during 2022-2032. A notable driver of market growth is the rising prevalence of age-related diseases like obesity, arthritis, and diabetes. Furthermore, advancements in technology—such as minimally invasive surgery and improved implant materials—are expected to increase global demand.

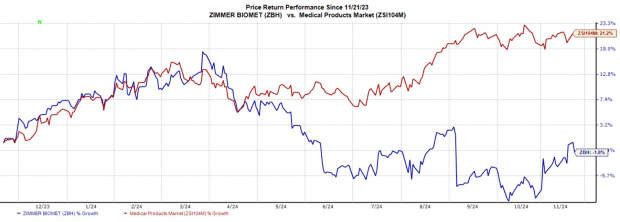

Image Source: Zacks Investment Research

Other Recent Initiatives by ZBH

Last month, the company revealed plans for the commercial launch of the Z1 Femoral Hip System (Z1 System) for total hip arthroplasty during the 2024 annual American Association of Hip and Knee Surgeons (AAHKS) meeting. This new system features a triple-taper design that integrates seamlessly with ZBH’s G7 Acetabular System, providing surgeons with a comprehensive and efficient solution for hip surgeries.

ZBH’s Stock Performance Overview

Over the past year, ZBH stock has declined by 1.8%, while the overall industry has seen a growth of 21.2%.

ZBH’s Zacks Rank and Key Competitors

Currently, ZBH has a Zacks Rank of #3 (Hold).

Within the broader medical sector, several stocks are performing better, including Haemonetics HAE, Globus Medical GMED, and ResMed RMD. While ResMed is rated #1 (Strong Buy), both Haemonetics and Globus Medical hold a #2 (Buy) rating. You can view the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics boasts an earnings yield of 5.02%, compared to the industry’s 1.18%. The company has exceeded the Zacks Consensus Estimate for earnings in each of the past four quarters, averaging a surprise of 19.39%, with its stock price growing 1.8% in contrast to the industry’s 23.1% increase over the last year. Its earnings estimates for 2025 have risen 0.4% to $4.59 in the past month.

Globus Medical has maintained its 2024 EPS estimates at $2.84 over the past month, with its stock soaring by 60.6% over the last year, significantly outpacing the industry’s growth of 32.7%. It has also surpassed earnings estimates consistently, with an average surprise of 12.1%. Recently, it reported a 10.3% earnings surprise for the last quarter.

Similarly, ResMed has seen its fiscal 2025 EPS estimates rise by 2.7%. The company’s shares have jumped by 86.3% over the past year against an industry growth of 32.1%. ResMed has also exceeded earnings estimates consistently, with a 6.4% average surprise in the previous quarters.

Zacks’ Research Chief Reveals “Stock Most Likely to Double”

According to our team of experts, five stocks have the highest potential to gain +100% or more soon. Among these, Director of Research Sheraz Mian has highlighted one stock that is anticipated to see substantial growth.

This top recommendation comes from an innovative financial firm with a rapidly expanding customer base exceeding 50 million and a diverse range of advanced solutions. While not every suggested stock is guaranteed to soar, this one could surpass previous Zacks stocks that demonstrated significant growth, such as Nano-X Imaging, which surged 129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

ResMed Inc. (RMD) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Globus Medical, Inc. (GMED) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.