Ken Griffin Makes Bold Tesla Bet Amid Political Shifts

Billionaire investor Ken Griffin has made headlines with his unusual purchases over the years.

In 2021, Griffin purchased a first-edition copy of the U.S. Constitution for $43 million, outbidding a group of cryptocurrency advocates known as a decentralized autonomous organization (DAO). Most recently, he acquired a stegosaurus fossil for $45 million. It’s clear that Griffin’s collection surpasses anything most of us could imagine.

Griffin has built his wealth through his role as the CEO of Citadel Advisors, one of Wall Street’s top hedge funds. Analyzing Citadel’s latest regulatory filings, I found that Griffin’s firm bought 1.2 million shares of electric vehicle (EV) manufacturer Tesla (NASDAQ: TSLA) in the third quarter, raising their stake by an impressive 395%.

Political Contributions: A Look at Griffin’s Influence

Griffin’s political activity is notable as well. He ranked as the fifth-highest contributor among disclosed individual donors during the 2024 election cycle, reportedly spending $100 million to support various Republican initiatives.

Interestingly, Elon Musk, Tesla’s CEO, is among the top donors to the GOP too. While it’s difficult to determine Griffin’s exact motivation for increasing Citadel’s Tesla stake, the timing suggests a strategic alignment with his political interests as the election neared.

Image source: Getty Images.

Wall Street’s Optimism: The Trump Administration’s Effects on Tesla

This year, Musk has taken a more prominent role in political discussions, particularly as Trump prepares for a potential presidency. Through social media platform X, Musk has shown support for Trump’s campaign, hinting at a possible alignment between the two.

As the election unfolded, analysts on Wall Street began to express optimism about Tesla’s future under a Trump administration. Dan Ives from Wedbush Securities believes the next administration could be a “game changer” for Tesla with anticipated regulatory changes favoring autonomous vehicle development.

BREAKING: The Trump administration is reportedly planning to ease regulations for autonomous vehicles in the US

— unusual_whales (@unusual_whales) Nov. 17, 2024

This context suggests that Griffin and Citadel may share Ives’ mindset, with their Tesla investment riding on the notion of potential policy benefits tied to a close relationship between Musk and Trump.

Is Now a Good Time to Buy Tesla Stock?

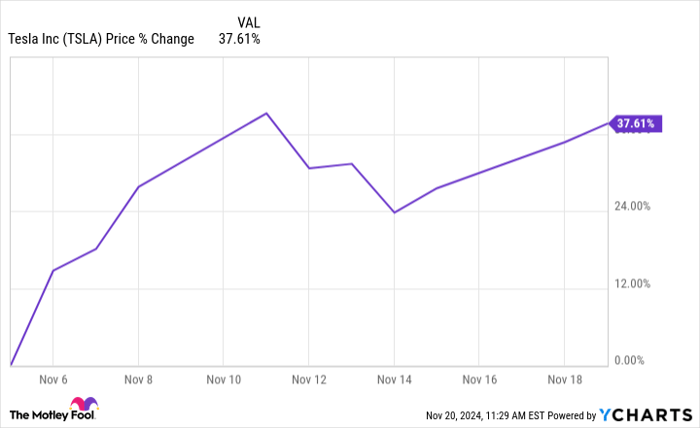

Following Election Day on November 5, Tesla’s shares have surged. Typically, significant stock gains of over 30% in a short period stem from major news or announcements, rather than mere speculation.

Data by YCharts.

While Tesla’s future appears promising, it’s essential to note that no concrete changes have occurred yet at the company level. Current stock price movements are fueled by excitement rather than solid results.

Citadel might be enjoying large gains from its recent Tesla shares, but the firm’s investment strategy is not strictly about long-term holding. They often realize profits quickly, indicating that investors should approach Tesla’s soaring stock with caution.

In conclusion, it may not be wise to jump into Tesla stock right now. Instead, it’s prudent to observe how the company adapts to potential new government influences before making any investment decisions.

A Potential Second Chance for Smart Investments

Many investors worry they’ve missed opportunities to buy successful stocks. However, there are moments when our team recommends specific stocks they believe could see significant gains. If you feel you’ve missed your chance, this might just be the right moment to consider these investments:

- Nvidia: If you invested $1,000 when we recommended it in 2009, you’d have $381,173!

- Apple: A $1,000 investment from our 2008 recommendation would now be worth $43,232!

- Netflix: A $1,000 investment following our 2004 advice would have grown to $469,895!

This could be a unique opportunity, so don’t miss out on these stocks.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Adam Spatacco has positions in Tesla. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.