Supermicro’s Stock Surges 31.2%: Is It Time to Invest?

Super Micro Computer, Inc. (SMCI), commonly known as Supermicro, has recently experienced a rollercoaster of stock performance due to a mix of external excitement around artificial intelligence and internal challenges. While share prices saw a significant drop, the stock rebounded sharply, making it the top performer on the S&P 500 on Tuesday with a remarkable 31.2% increase. This raises the question for investors: is now the right time to consider investing in SMCI stock? Let’s explore.

Challenges Facing SMCI Stock

Supermicro has encountered numerous setbacks that negatively impacted its stock price. In August, Hindenburg Research alleged accounting irregularities, leading to a sharp decline in SMCI shares. The situation became more dire when the company announced a delay in filing its annual 10-K report with the SEC, which raised further concerns.

Subsequently, the Department of Justice began investigating the company for accounting violations, while Nasdaq issued a non-compliance letter threatening delisting. This potential delisting could force SMCI to trade over the counter, decreasing trading volume substantially. Compounding these issues, Ernst & Young, Supermicro’s auditor, resigned over disagreements regarding financial reporting standards.

Lastly, Supermicro announced it would not be submitting its recent quarterly report, increasing investor anxiety and resulting in a sell-off of SMCI shares. Despite these challenges, investors began purchasing the stock again following Tuesday’s trading session.

Reasons for SMCI Stock’s Recent Rebound

Recently, optimism returned for Supermicro investors when the company appointed BDO, the fifth-largest public accounting firm, as its new auditor. This appointment is a promising sign, indicating that Supermicro may be able to file its annual 10-K report on time, thus reassuring the market.

Timely filing could significantly reduce the chances of delisting from Nasdaq, as Supermicro has previously resolved similar compliance issues successfully with the SEC. For instance, the company settled penalties concerning accounting discrepancies from fiscal years 2014 to 2017.

Moreover, BDO’s involvement suggests that Supermicro’s finances may be in better shape than initially thought, reflecting trust in management’s integrity at a critical time. A parallel can be drawn to Marvell Technology, Inc. (MRVL), which weathered a governance crisis in 2015 by hiring Deloitte and restored investor confidence.

Additional Factors Favoring Super Micro Computer

Supermicro’s business model is notably scalable, particularly in relation to the semiconductor powerhouse, NVIDIA Corporation (NVDA). Supermicro’s AI servers are essential for mounting AI chips, and with only a 10% share of the AI server market, there’s significant growth potential available.

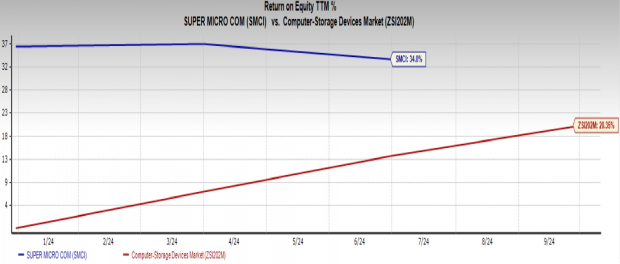

Financially, Supermicro boasts a commendable 34% return on equity (ROE), surpassing the Computer-Storage Devices industry average of 20.4%. Such performance underscores its profitability, positioning the company favorably as any ROE above 20% is viewed as a strong indicator of success.

Image Source: Zacks Investment Research

Why SMCI is a Smart Investment Choice

Given the reduced risk of delisting as Supermicro introduces a new auditor and maintains a robust presence in the AI server market, now appears to be an opportune moment for investors. Current SMCI shares are relatively attractive, trading at a price/earnings ratio of 8.4X forward earnings, with the industry average at 14.5X.

Image Source: Zacks Investment Research

SMCI currently holds a Zacks Rank of #2 (Buy), with many analysts projecting that the stock will rise significantly. In fact, brokers have raised their average short-term price target for SMCI by 157.2% to $55.39, based on its last closing price of $21.54. Some estimates even place the highest target at $130, indicating a potential upside of 503.5%.

Image Source: Zacks Investment Research

Expert Opinion on High-Potential Stocks

Our team of analysts has identified five stocks with strong potential for significant gains in the near future. Among these, Director of Research Sheraz Mian has spotlighted one stock likely to achieve the highest growth, characterized by innovation, a rapidly expanding customer base exceeding 50 million, and a variety of advanced solutions. While not all recommended stocks perform well, this selection may outperform past stocks highlighted by Zacks, such as Nano-X Imaging, which soared by +129.6% within just nine months.

For those interested in top stock recommendations, download the free report on “5 Stocks Set to Double” for insights on promising opportunities.

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.