Dropbox Stock Gains Momentum with Strong Earnings and Innovation Focus

With increased profitability and strong cash flow, Dropbox DBX is becoming a worthwhile option in the Zacks Internet-Services Industry, which ranks in the top 14% out of 250 Zacks industries.

The cloud-based collaboration platform continues to expand, making Dropbox shares attractive to both growth and value investors. The stock sports a Zacks Rank #1 (Strong Buy) after surpassing its Q3 expectations earlier this month.

Profitability on the Rise

Dropbox functions as a file hosting service, allowing users to create, access, and share digital content through its personal and enterprise software.

At the end of Q3 2024, Dropbox had 18.24 million paying users, up slightly from 18.17 million in the same period last year. Operating efficiency is evident with Q3 EPS rising to $0.60, surpassing the Zacks EPS Consensus of $0.52 a share.

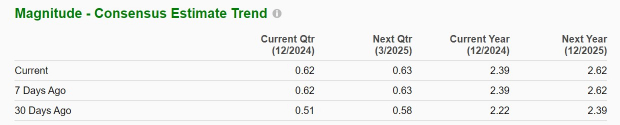

Total sales for the third quarter reached $638.8 million, an increase of 1% from the previous year, and exceeded estimates of $636.93 million. Notably, earnings estimates for fiscal 2024 and FY25 have risen by 7% and 9%, respectively, within the last month. Additionally, Dropbox’s projected annual earnings are expected to climb over 20% this year and increase another 9% in FY25 to $2.62 per share.

Image Source: Zacks Investment Research

Cash Flow Grows Stronger

In line with its operational gains, Dropbox achieved a free cash flow of $270.1 million in Q3, marking a 9% year-over-year increase and setting a new quarterly record.

Image Source: Zacks Investment Research

Focus on AI and Expansion

Using its free cash flow to fuel growth, Dropbox is expanding its platform with plans announced by Co-founder and CEO Drew Houston during the Q3 report. The focus is on leveraging its customer base, trusted brand, and infrastructure for further advancements.

Investors might be particularly interested in the company’s AI ventures, notably Dropbox Dash, an AI-powered tool designed for universal search, helping users locate, organize, and share content across different applications.

Attractive Valuation for Investors

As Dropbox prepares for its next growth phase, its current valuation may attract value investors. DBX is trading below $30, with a reasonable forward earnings multiple of 11.7X.

This figure stands in stark contrast to the S&P 500’s 25.1X and the Zacks Internet-Services average of 23.5X, with notable competitors like Shopify SHOP and Uber Technologies UBER.

Image Source: Zacks Investment Research

Final Thoughts

Recent positive revisions in earnings estimates enhance Dropbox’s promising P/E valuation and EPS growth. As the market conditions seem favorable, now appears to be an opportune moment to consider investing in Dropbox for long-term potential.

Research Chief Names “Single Best Pick to Double”

Amid thousands of stocks, five Zacks experts have selected their top pick each expected to soar over 100% in the coming months. From this group, Director of Research Sheraz Mian has identified one company likely to show the most significant growth.

Targeting millennial and Gen Z audiences, this company generated nearly $1 billion in revenue last quarter alone. A recent dip in stock value offers an ideal entry point. While not all selections guarantee success, this stock could significantly outperform earlier Zacks’ Stocks Set to Double, like Nano-X Imaging, which rose +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

For the latest insights from Zacks Investment Research, download 5 Stocks Set to Double. Click to obtain this free report.

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.