Unlocking Potential: Comparing Vanguard’s S&P 500 ETF and Tech-Focused Alternatives

Why Vanguard’s ETFs Remain Popular Choices

From novice investors to seasoned professionals, the Vanguard S&P 500 ETF (NYSEMKT: VOO) is a solid addition to any portfolio. Offering broad diversification, remarkably low annual fees, and a 1.3% dividend-like yield, it provides an excellent entry point into the stock market. While it won’t outperform the market, as it closely tracks the S&P 500 (SNPINDEX: ^GSPC) index, it remains a low-risk option for benefiting from long-term market growth.

However, there are alternative strategies worth considering for potentially greater returns.

In today’s market, where technology fuels broader growth, the Vanguard Information Technology ETF (NYSEMKT: VGT) stands out as an appealing choice.

Strategies for Building Wealth Through Investment

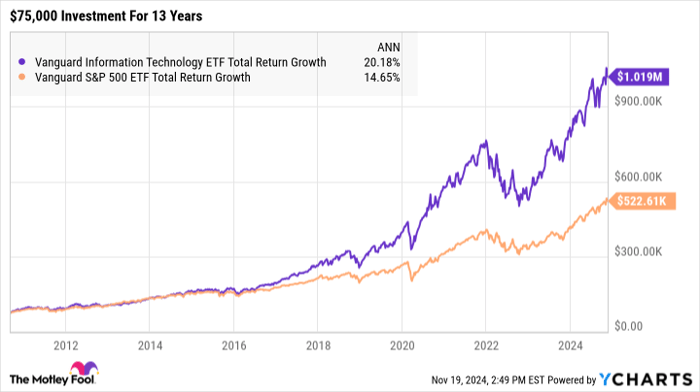

An S&P 500 ETF can lead to wealth accumulation over time, particularly for investors who start with a robust initial investment and maintain a long-term commitment. Let’s consider a hypothetical initial investment of $75,000, untouched for 13 years, with dividends reinvested. During this period, the Vanguard S&P 500 ETF would have appreciated to approximately $523,000. In contrast, the technology-focused ETF would have surpassed a million dollars:

VGT Total Return Level data by YCharts

The S&P 500 achieved an average annual return of 14.7% over this period, whereas the technology ETF led with an impressive average return of 20.2%.

Analyzing Risks and Returns in Technology ETFs

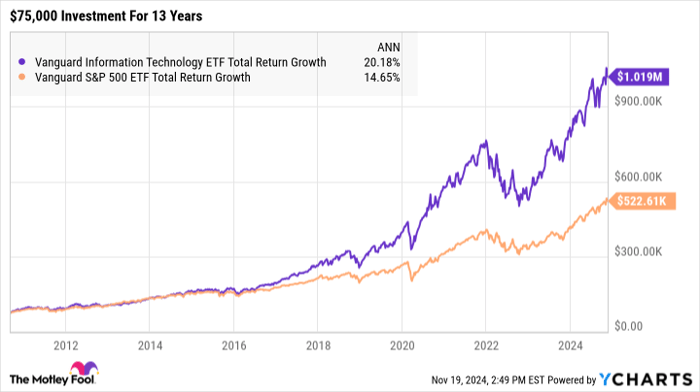

It’s important to remember that past performance is not necessarily an indicator of future results. The Vanguard Information Technology ETF does not guarantee market-beating returns every year. There have been times when the ETF has matched the S&P 500 or trailed it:

VGT Total Return Level data by YCharts

While this fund excels when the tech sector thrives, its performance has been notably strong in recent years—especially since the AI boom began in November 2022. The information technology ETF has surged 81% during this time, compared to the S&P 500’s 53% gain.

The Composition and Strategy of the Technology ETF

The Information Technology ETF maintains low fees and adopts a hands-off investment strategy based on an independently managed market index. It manages $90.5 billion in assets and enjoys significant trading activity. Although not as well-known as the S&P 500 fund, it still plays an important role in the investment landscape.

This ETF has significant holdings in semiconductors, software, and tech hardware. Notably, three stocks represent over 10% of its total value: Apple (NASDAQ: AAPL) is approximately 16%, followed by Nvidia (NASDAQ: NVDA) at 15%, and Microsoft (NASDAQ: MSFT) at 13%. These allocations shift as market dynamics evolve; for instance, Nvidia’s stake was just 4% two years ago.

If a growth-focused tech strategy aligns with your investment goals, the Vanguard Information Technology ETF might be worth considering. It has delivered strong results recently, and trends in AI may sustain its momentum, despite occasional dips in performance.

Should You Invest $1,000 in the Vanguard Information Technology ETF?

Before purchasing shares in the Vanguard Information Technology ETF, take a moment to reflect:

The Motley Fool Stock Advisor analyst team has recently highlighted what they consider the 10 best stocks for investors currently, and the Vanguard Information Technology ETF is not among them. The recommended stocks could yield significant gains.

For instance, if you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, you’d now have $900,893!

Stock Advisor offers an easy-to-follow investment strategy, featuring insights on portfolio building, continuous updates from analysts, and two fresh stock picks each month. Since 2002, it has remarkably outperformed the S&P 500 by more than four times.

See the 10 stocks »

*Stock Advisor returns as of November 18, 2024

Anders Bylund has positions in Nvidia, Vanguard S&P 500 ETF, and Vanguard Information Technology ETF. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool also recommends long January 2026 $395 calls and short January 2026 $405 calls on Microsoft. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.