Wall Street Ratings: What Analysts are Saying About Gladstone Commercial

For many investors, Wall Street analysts’ recommendations play a crucial role in deciding whether to buy, sell, or hold a stock. Changes in these ratings by brokerage firms can significantly impact stock prices. But how trustworthy are these recommendations?

To better understand the value of these analyst ratings, let’s examine what the experts currently think about Gladstone Commercial (GOOD).

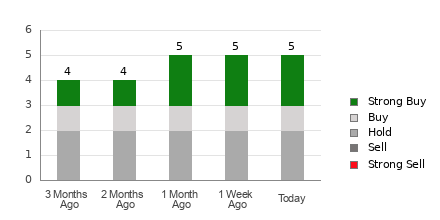

Gladstone Commercial has an average brokerage recommendation (ABR) of 2.00, on a scale ranging from 1 to 5 (with 1 being a Strong Buy and 5 a Strong Sell). This rating is based on insights from five brokerage firms and suggests a Buy rating for GOOD.

Among those firms, two analysts have rated it as Strong Buy and one as Buy, making up 40% and 20% of the total recommendations, respectively.

Analyzing Broker Recommendations for GOOD

Explore price targets & stock forecasts for Gladstone Commercial here>>>

While the ABR suggests that Gladstone Commercial is a strong buy, relying solely on this metric to make investment decisions may not be advisable. Research indicates that brokerage recommendations often do not effectively predict stocks that will see significant price gains.

Why is this so? Brokerage analysts may have inherent biases, often influenced by the interests of the firms they work for. Their recommendations tend to favor positive ratings; notably, for every “Strong Sell,” there are typically five “Strong Buy” ratings.

As a result, retail investors may find the recommendations misleading, as they might not accurately reflect the stock’s potential future performance. It’s wise to combine these insights with your own analysis or use reliable tools for stock price predictions.

The Zacks Rank model, which categorizes stocks into five ranks—from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell)—serves as an effective tool for predicting near-term stock performance. It would be beneficial for investors to use the ABR to confirm Zacks Rank assessments.

Understanding the Difference: ABR vs. Zacks Rank

Although both the ABR and Zacks Rank operate on a similar 1 to 5 scale, these ratings are calculated differently. The ABR comprises mostly broker recommendations, often seen in decimal form (such as 1.28), while the Zacks Rank, which focuses on earnings estimate revisions, is expressed in whole numbers.

Historically, brokerage analysts have been more optimistic in their ratings, often yielding more favorable assessments than what their analysis might justify. Consequently, this practice can lead to misleading recommendations for investors.

In contrast, the Zacks Rank’s basis on earnings estimate revisions has proven to correlate strongly with stock price movements over short periods.

Furthermore, Zacks Rank maintains a balanced distribution of grades across all stocks covered, unlike the ABR, which may not always be current. Brokers frequently update earnings estimates to reflect market shifts, which are quickly reflected in the Zacks Rank, enhancing its reliability for short-term predictions.

Is Gladstone Commercial a Smart Investment?

Recent earnings estimate data for Gladstone Commercial reveal a 1.1% increase in the Zacks Consensus Estimate for this year, now pegged at $1.42.

The optimistic outlook from analysts, illustrated by their consensus on raising the earnings estimate, could signal potential growth for the stock in the near term.

This recent consensus shift, combined with other factors related to earnings estimates, has earned Gladstone Commercial a Zacks Rank of #2 (Buy). Investors can check the full list of today’s Zacks Rank #1 (Strong Buy) stocks here>>>>.

Consequently, the ABR rating of Buy for Gladstone Commercial can offer investors valuable insight.

Top Stock Pick Declared by Research Chief

Five Zacks experts have selected their top stock picks from thousands of options, with one specifically chosen by Director of Research Sheraz Mian as the most likely to see explosive growth of 100% or more in the upcoming months.

This company attracts millennial and Gen Z consumers and has recently reported nearly $1 billion in revenue. A recent stock pullback presents a promising entry point for investors. While not every recommendation leads to success, this stock has the potential to outperform previous Zacks picks, like Nano-X Imaging, which rose by over 129.6% in just nine months.

Discover Our Top Stock and Their 4 Alternatives for Free

Free Stock Analysis Report for Gladstone Commercial Corporation (GOOD): Here

Read the article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.