“`html

NVIDIA’s Impressive Q3 Earnings Showcase Robust Growth in Gaming and Data Center Sectors

NVIDIA Corporation NVDA has reported earnings of 81 cents per share for the third quarter of fiscal 2025, surpassing the Zacks Consensus Estimate by 8%. This figure represents a remarkable increase of 103% compared to last year and 19% from the previous quarter, fueled by rising revenues.

Notably, NVDA has exceeded the Zacks Consensus Estimate in all four of the preceding quarters, achieving an average earnings surprise of 12.7%.

Check out the latest earnings estimates and surprises on Zacks Earnings Calendar.

For the fiscal third quarter, NVDA’s revenues exceeded consensus estimates by 5.6%, climbing to $35.08 billion—a 94% year-over-year increase and a 17% sequential rise. This strong revenue growth was primarily driven by record sales in the Data Center market and increased sales across Gaming, Professional Visualization, and Automotive sectors.

Given its strong performance in the third quarter, NVIDIA has issued optimistic guidance for the fourth quarter and raised its outlook for the full fiscal year. This solid quarterly performance could further propel the company’s stock price. Nvidia has seen its stock price surge 192.6% year to date, significantly outperforming the Zacks Semiconductor – General industry, which has returned 140.1%.

NVIDIA’s Revenue Segments Explained

NVIDIA separates its revenues into two main segments: Graphics and Compute & Networking.

The Graphics segment includes GeForce graphics processing units (GPUs) for gaming and personal computers, the GeForce NOW game-streaming service, and related infrastructure. It also offers gaming platform solutions, Quadro GPUs for enterprise design, GRID software for cloud-based applications, and automotive infotainment systems.

This segment accounted for 11.5% of the total fiscal third-quarter revenues, which rose 16% year over year and 13% sequentially to $4.05 billion. Our estimate for the segment’s revenues was $4.16 billion.

The Compute & Networking segment represented 88.5% of the fiscal third-quarter revenues. It includes Data Center platforms and systems for artificial intelligence, high-performance computing, and accelerated computing, along with the DRIVE platform for autonomous vehicles, Jetson for robotics, and other embedded solutions.

Revenues from Compute & Networking surged 112% year over year and 17% sequentially to reach $31.04 billion, exceeding our estimate of $28.4 billion.

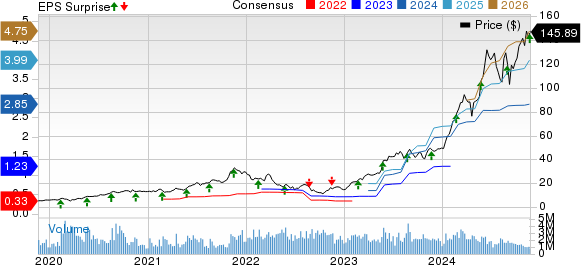

NVIDIA Corporation Price, Consensus and EPS Surprise

NVIDIA Corporation price-consensus-eps-surprise-chart | NVIDIA Corporation Quote

NVIDIA’s Market Platform Revenue Breakdown

Within its market platform, Data Center revenue, accounting for 87.7% of total revenues, rose 112% year over year and 17% sequentially to $30.77 billion. This growth was supported by increased shipments of the Hopper GPU computing platform, used for large language models and generative AI applications. Our prediction for this sector’s revenues was $28.5 billion.

NVIDIA has seen strong demand from all customers for its Data Center chips, with large cloud providers comprising half of Data Center revenues and the remainder coming from consumer Internet and enterprise companies.

Revenues from Gaming grew 15% year over year and 14% sequentially, totaling $3.28 billion, making up 9.3% of total revenues. This increase was attributed to higher sales of the GeForce RTX 40 series of GPUs and gaming console chipsets. Our estimated third-quarter revenues for Gaming stood at $3.11 billion.

Professional Visualization segment revenues (1.4% of total revenues) increased 17% year over year and 6% sequentially to $454 million, driven by an increase in RTX GPU workstation sales based on the Ada architecture. We estimated revenues for this segment at $475.7 million.

Automotive sales in the quarter amounted to $346 million, marking a 37% rise year over year and a 7% increase sequentially. The growth was largely due to advancements in self-driving technologies using NVIDIA Orin. Additionally, NVDA has seen increased demand from Volvo, which is launching a fully electric SUV powered by NVIDIA Orin and DriveOS. OEM and Other revenues rose 33% year over year and 10% sequentially to $97 million. Our estimates for Automotive and OEM revenues were $340.3 million and $86.8 million, respectively.

NVIDIA’s Operating Performance

NVIDIA maintained a non-GAAP gross margin of 75% year over year; however, it saw a decline of 70 basis points sequentially, attributed to a shift in product mix toward higher-end H100 data center systems.

Non-GAAP operating expenses increased by 50% year over year and 9% sequentially to $3.05 billion, largely due to higher development costs associated with new product introductions. Nevertheless, these expenses accounted for 8.7% of total revenues, a decrease from 11.2% in the same quarter last year and 9.3% in the previous quarter.

Non-GAAP operating income soared 101% year over year and increased 17% sequentially to $23.27 billion, driven by strong revenue.” Non-GAAP operating margin improved by 250 basis points to 66.3% from 63.8% in the year-ago quarter. However, sequentially the margin contracted 10 basis points due to the decline in gross margin.

The non-GAAP net income margin for NVIDIA was 57% in the third quarter, up 170 basis points year-over-year and 60 basis points sequentially.

Balance Sheet and Cash Flow Overview

As of October 27, 2024, NVDA’s cash, cash equivalents, and marketable securities stood at $38.4 billion, an increase from $34.8 billion on July 28. The total long-term debt as of September 27 was $8.46 billion, unchanged from the previous quarter.

NVIDIA generated $17.63 billion in operating cash flow during the third quarter, up from $7.3 billion a year ago and $14.5 billion in the previous quarter. In the first three quarters of fiscal 2025, NVIDIA’s operating cash flow totaled $47.5 billion. The company achieved a free cash flow of $16.78 billion in the third quarter and $45.2 billion in the first three quarters of fiscal 2025.

In this quarter, NVIDIA returned $245 million to shareholders through dividends and share buybacks.

“`

NVIDIA’s Financial Moves and Future Outlook for Q4 Fiscal 2025

With significant actions taken in recent months, NVIDIA (NVDA) is making waves in the financial markets. In the first three quarters of fiscal 2025, the company returned $589 million to shareholders through dividends and engaged in share buybacks amounting to $25.9 billion.

On August 26, 2024, NVIDIA’s board approved a substantial $50 billion share repurchase plan. This moves the total authorization to $57.5 billion without an expiration date. As of October 27, 2024, NVIDIA still has approximately $46.5 billion available from this authorization.

Insights into Q4 Projections

Looking ahead to the fourth quarter of fiscal 2025, NVIDIA expects its revenues to reach around $37.5 billion, with a variance of +/-2%. This figure is in contrast to the Zacks Consensus Estimate of $36.84 billion.

Furthermore, the company anticipates a non-GAAP gross margin of 73.5% (with a potential variation of +/-50 basis points). Operating expenses, calculated on a non-GAAP basis, are expected to be approximately $3.4 billion.

Current Rankings and Alternative Investment Options

At present, NVDA holds a Zacks Rank #1 (Strong Buy), positioning it well among investors. Other stocks worth considering within the broader Zacks Computer & Technology sector include BlackBerry (BB), Amphenol (APH), and Celestica (CLS). All three companies also enjoy a Zacks Rank #1.

In recent updates, BlackBerry’s earnings consensus for 2025 reflects a 3-cent upward revision to a projected loss of 2 cents per share, signaling a significant year-over-year decline of 140%. This has led to a 34.8% drop in BB’s shares year to date.

Conversely, Amphenol’s 2024 earnings consensus increased by 2 cents, now estimated at $1.17 per share, which suggests a robust 58% year-over-year growth. The stock has appreciated by 43% this year.

Celestica, too, has seen positive adjustments, with its 2024 earnings consensus going up by 20 cents to $3.85 per share, indicating a strong 58.4% increase compared to the previous year. This stock has surged an impressive 197.1% year to date.

Expert Picks to Consider

In a competitive market, Zacks experts have identified standout stocks with the potential to double in value. Director of Research Sheraz Mian has spotlighted one particular stock believed to offer substantial upside going forward.

This particular company, focusing on millennial and Gen Z markets, generated nearly $1 billion in revenue last quarter. Following a recent pullback in its stock price, analysts suggest that now might be an ideal time to invest. While not every recommendation will achieve positive results—unfortunately, some may falter—this stock shows promise exceeding past Zacks’ notable performers, such as Nano-X Imaging, which experienced a remarkable +129.6% rise within just nine months.

Free: See Our Top Stock and Four Runners-Up

If you are interested in the latest investment recommendations by Zacks Investment Research, you can download the report, “5 Stocks Set to Double.” This report includes insights on multiple promising stocks.

For further analysis, you can access free stock reports on Amphenol Corporation (APH), NVIDIA Corporation (NVDA), Celestica, Inc. (CLS), and BlackBerry Limited (BB).

To read the full article on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.