Bio-Techne Corporation: Finding Stability Amid Market Challenges

Based in Minneapolis, Minnesota, Bio-Techne Corporation (TECH) specializes in life science reagents, instruments, and services tailored for research, diagnostics, and bioprocessing. With a market capitalization of $10.9 billion, the company operates in two primary segments: Protein Sciences and Diagnostics & Spatial Biology.

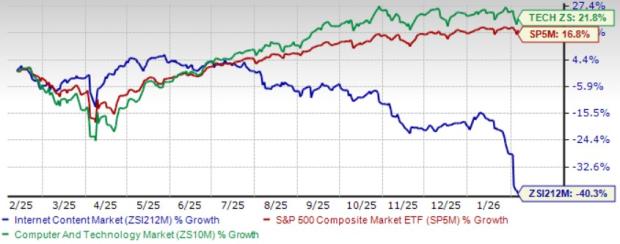

Stock Performance: A Year of Struggles

Over the last year, Bio-Techne has struggled to keep pace with the broader market. In 2024, the company’s stock price fell by 10.9% but experienced a modest 8.1% increase over the past 52 weeks. In comparison, the S&P 500 Index ($SPX) surged by 24.1% year-to-date and 30.1% over the same 52-week period.

Narrowing the view further, Bio-Techne also lagged behind the iShares Biotechnology ETF’s (IBB) slight dip in 2024 and its impressive 13.4% growth over the past year.

Recent Earnings Release Sparks Investor Optimism

On October 30, following a better-than-expected Q1 2025 earnings release, Bio-Techne’s stock soared by 7.5%. The company reported a year-over-year net sales growth of 4.5%, bringing total sales to $289.5 million, which exceeded Wall Street’s expectations by 3.1%. This growth was significantly driven by advancements in the Diagnostics & Spatial Biology segment, which saw a remarkable 14.3% rise in revenue, totaling $83.2 million. Additionally, Bio-Techne’s adjusted earnings per share (EPS) of $0.42 surpassed analyst expectations, boosting investor confidence.

Market Context: Factors Behind Underperformance

In 2024, Bio-Techne’s setbacks can be attributed to a steep sell-off in biotech and pharmaceutical stocks. Notably, this was triggered by former President Trump’s nomination of Robert F. Kennedy Jr. for the U.S. Department of Health and Human Services, resulting in a nearly 12% decline in Bio-Techne’s stock from November 14 to November 19.

Looking Ahead: Analyst Predictions and Ratings

For the fiscal year ending in June, analysts predict a 7% increase in adjusted EPS to $1.68. Bio-Techne has had a mixed track record regarding earnings surprises, having exceeded EPS estimates in three of its last four quarters but failing to do so on one occasion.

Currently, Bio-Techne holds a consensus “Strong Buy” rating among analysts. Out of the 13 analysts monitoring the stock, 10 recommend a “Strong Buy” while three suggest a “Hold” rating.

These ratings have remained steady over recent months. On October 31, Scotiabank analyst Sung Ji Nam upgraded the price target to $88, indicating a potential upside of 28.1% from current levels. The average price target of $85 represents a 23.7% premium to the current price, while the highest target of $95 implies a substantial potential upside of 38.2%.

On the date of publication, Aditya Sarawgi did not hold positions in any of the securities mentioned. All information is provided for informational purposes. Please view the Barchart Disclosure Policy for further details.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.