Consumer Products Lead the Market Amid Positive Trading Day

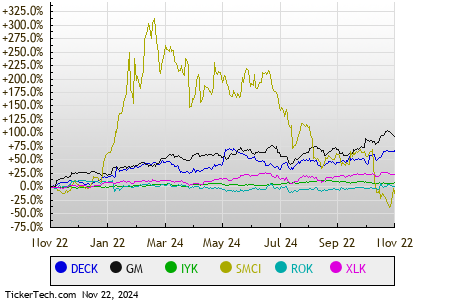

The Consumer Products sector is the top performer at midday on Friday, climbing by 1.2%. Key players in this sector include Deckers Outdoor Corp. (Symbol: DECK) and General Motors Co (Symbol: GM), which are gaining 5.8% and 5.0%, respectively. Among exchange-traded funds (ETFs) that track this sector, the iShares U.S. Consumer Goods ETF (Symbol: IYK) is up 0.6% today and has seen an 11.12% rise year-to-date. Notably, Deckers Outdoor Corp. boasts a 72.75% increase so far this year, while General Motors Co has risen by 63.81% during the same period.

Trailing behind in performance is the Technology & Communications sector, which has increased by 1.0%. Leading tech stocks include Super Micro Computer Inc (Symbol: SMCI) and Rockwell Automation, Inc. (Symbol: ROK), which have risen by 12.0% and 5.6%, respectively. The Technology Select Sector SPDR ETF (XLK), which focuses on this sector, dipped slightly by 0.1% during midday trading but is up 21.81% year-to-date. Super Micro Computer Inc is currently up 16.99% this year, while Rockwell Automation, Inc. shows a decrease of 3.69% year-to-date. Notably, SMCI represents about 0.2% of XLK’s total holdings.

To provide a clearer perspective, below is a chart depicting the relative stock price performance of these stocks and ETFs over the trailing twelve months. Each stock symbol is color-coded for easy identification in the legend below:

This Friday afternoon, a closer look at S&P 500 components reveals that eight sectors are showing positive performance, while one sector is declining.

| Sector | % Change |

|---|---|

| Consumer Products | +1.2% |

| Technology & Communications | +1.0% |

| Industrial | +1.0% |

| Services | +0.9% |

| Financial | +0.9% |

| Materials | +0.6% |

| Healthcare | +0.4% |

| Energy | +0.4% |

| Utilities | -0.1% |

![]() 25 Dividend Giants Widely Held By ETFs »

25 Dividend Giants Widely Held By ETFs »

Additional Insights:

• ADBE Historical Stock Prices

• Zimmer Biomet Holdings YTD Return

• FMK Historical Stock Prices

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.