SiriusXM (SIRI) is at a pivotal moment as it transitions to being a fully independent public company after its split from Liberty Media. The company has set ambitious goals, aiming for 50 million subscribers and $1.8 billion in free cash flow. However, current market conditions and valuation metrics suggest that investors should proceed with caution. Notably, SiriusXM’s trailing 12-month P/E ratio stands at 16.52X, which is significantly higher than the Zacks Broadcast Radio and Television industry average of -181.32X. This disparity leads to questions about the stock’s short-term potential.

SiriusXM’s Valuation: An Overvalued Stock?

Image Source: Zacks Investment Research

Recent Financial Results

In the third quarter of 2024, SiriusXM reported a loss of 84 cents per share, falling short of the Zacks Consensus Estimate of a 75-cent loss. This contrasts with earnings of 90 cents per share from the same period last year. Total revenues dropped 4.4% year-over-year to $2.17 billion, missing expectations by 0.91%. Additionally, advertising revenue decreased by 2%, coming in at $450 million. Although SiriusXM added 14,000 self-pay subscribers—a positive sign—the adjusted EBITDA fell 7% to $693 million. The company’s EBITDA margin remains stable at 32%, aided by ongoing cost-cutting initiatives aimed at achieving $200 million in savings for 2024.

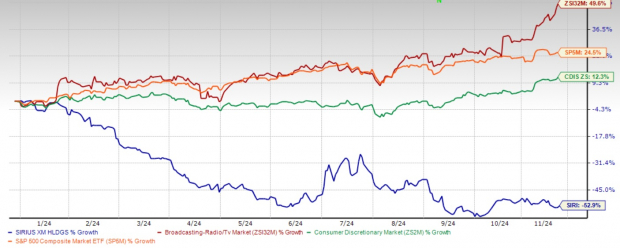

SiriusXM finds itself in a challenging position in 2024. The company’s stock has plummeted 52.9% this year, underperforming the broader Zacks Consumer Discretionary sector, which has returned 12.3%. This raises concerns about the company’s future growth prospects.

Stock Performance This Year

Image Source: Zacks Investment Research

Growth Strategies and Challenges Ahead

SiriusXM is actively working on various growth strategies, including launching a new pricing model starting at $9.99 for streaming and in-car services. The company is also forming important partnerships with brands like Walmart and ESPN+, as well as securing exclusive content deals, such as the Unwell podcast network. However, it is grappling with challenges in the advertising sector due to increased competition in Connected TV (CTV), changing advertiser preferences, and a shortened election cycle, which has led to a $75 million reduction in revenue guidance.

Debt and Investment Strategy

Currently, SiriusXM’s net debt to adjusted EBITDA ratio is at 3.8x. Management aims to lower this to the low to mid-3x range. The company’s capital expenditure plans indicate a strong focus on building technology infrastructure, with non-satellite capital expenditures expected to stay between $450-$500 million through 2025 before dropping below $400 million in 2026. Meanwhile, satellite expenditures are expected to fall gradually from $300 million in 2024 to nearly zero by 2028.

Intense Competition: The Rivals Challenge

SiriusXM faces escalating competition in an increasingly crowded audio entertainment market, calling into question its long-term survival in the industry.

The automotive sector, which has traditionally been a stronghold for SiriusXM, is undergoing significant changes. The emergence of electric vehicles and developments in autonomous driving have paved the way for tech companies and startups to challenge SiriusXM’s dominance in car entertainment. A prominent example is Tesla (TSLA), which is outfitting its vehicles with proprietary entertainment systems that bypass traditional satellite radio.

The streaming audio market, once seen as a complementary service to SiriusXM’s offerings, now poses serious competition. Services like Spotify (SPOT), Apple (AAPL) Music, and Amazon Music are rapidly growing, providing personalized playlists, exclusive content, and seamless integration across multiple devices. Moreover, even as SiriusXM invests in podcast content, it encounters fierce competition from dedicated podcast platforms such as Spotify and Apple Podcasts, as well as newer entrants like Substack and Patreon, which offer content creators more control and monetization options.

Investment Insights and Recommendations

Taking into account the current valuation metrics and market challenges, investors might consider delaying new purchases or waiting for a more advantageous entry point. The Zacks Consensus Estimate projects 2024 revenues at $8.68 billion, representing a 2.99% year-over-year decline. Additionally, the consensus estimate for 2024 earnings forecasts a loss of $6.03 per share.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

SiriusXM’s strategic initiatives and cost-saving measures appear promising, yet the high P/E ratio hints that the stock may be overvalued compared to industry peers. The transition phase, alongside advertising challenges and substantial capital requirements, could exert pressure on the stock price in the near term.

The company still maintains its dividend program, distributing $103 million to shareholders in the third quarter, although its focus on reducing debt might restrict aggressive capital returns for now. Investors should keep an eye on how well the new pricing strategies perform, trends in subscriber growth, and advertising revenue stabilization before making new investments. Existing shareholders may find it wise to hold their positions while monitoring the company’s execution of its strategic plans in the current market context.

Conclusion

The current premium valuation of SiriusXM would be more justifiable if the company could show consistent subscriber growth and successfully implement its strategic initiatives, especially in reversing sales declines in advertising. Until then, taking a wait-and-see approach seems prudent for prospective investors. Currently, SiriusXM holds a Zacks Rank #3 (Hold). You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each stock in this selection has been specifically chosen by a Zacks expert as a top pick for a potential gain of 100% or more in 2024. Historical recommendations have seen returns of +143.0%, +175.9%, +498.3%, and even +673.0%.

Most stocks included in this report are currently under the radar, presenting a prime opportunity for early investment.

Discover 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

Apple Inc. (AAPL): Free Stock Analysis Report

Sirius XM Holdings Inc. (SIRI): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Spotify Technology (SPOT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.