CF Industries Reaches New Heights: A Look at Rising Stock and Key Growth Drivers

CF Industries Holdings, Inc.’s CF shares reached a new 52-week high of $91.06 yesterday, before settling at $90.64 by the end of the trading day.

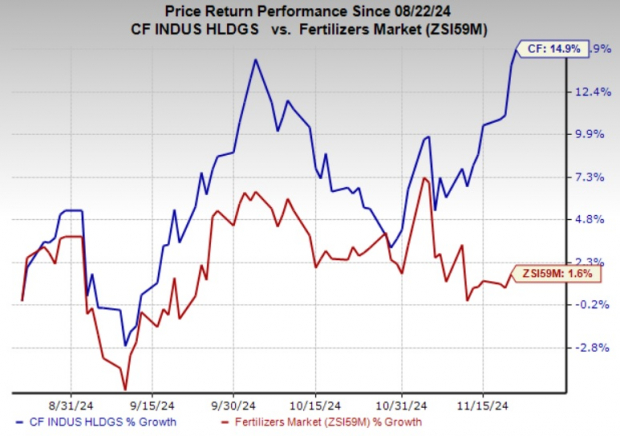

Over the last three months, CF stock has surged by 14.9%, significantly outpacing the Zacks Fertilizers industry, which saw only a 1.6% increase. Additionally, CF has outperformed the S&P 500, which rose around 5.7% in the same timeframe.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Why CF Stock Is Climbing: Key Factors Behind the Momentum

CF Industries is reaping benefits from the increasing global demand for nitrogen fertilizers, spurred by strong agricultural needs. Demand from industrial markets is also bouncing back following disruptions caused by the pandemic. Analysts predict that this robust demand will persist due to the recovering economy and favorable conditions for farmers.

In North America, high corn planting rates coupled with low nitrogen inventories are set to further increase nitrogen demand. Similarly, Brazil is expected to maintain strong urea demand, aided by an uptick in corn acreage. In India, promising weather conditions will likely support crop production, subsequently driving nitrogen needs.

In the third quarter of 2024, strong global nitrogen demand alongside limited supply helped bolster nitrogen prices. During its quarterly call, CF indicated optimism regarding the supply-demand balance, suggesting inventories are below average globally, while North America enjoys significant energy cost advantages over higher-cost production in Europe.

The decline in natural gas prices also benefits CF Industries. Average natural gas costs dropped to $2.10 per MMBtu in the third quarter, down from $2.54 per MMBtu in the same quarter last year. These reduced costs are expected to carry into the fourth quarter.

Moreover, earnings forecasts for CF have improved significantly over the past 60 days. The Zacks Consensus Estimate for 2024 has seen a 5.9% increase, and the estimate for the fourth quarter of 2024 has also risen by 1.9%. These positive revisions bolster investor confidence.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

CF Industries Holdings, Inc. Price and Estimate Analysis

CF Industries Holdings, Inc. price-consensus-chart | CF Industries Holdings, Inc. Quote

CF’s Zacks Rank & Top Stock Picks

Currently, CF holds a Zacks Rank #1 (Strong Buy).

Other notable stocks in the Basic Materials sector include IAMGOLD Corporation IAG, Axalta Coating Systems Ltd. AXTA, and Ingevity Corporation NGVT, all with a Zacks Rank #2 (Buy). You can view the complete list of Zacks #1 Rank stocks here.

In the past 60 days, the Zacks Consensus Estimate for IAMGOLD’s current-year earnings has jumped by 24.4%. IAG has successfully outperformed consensus estimates over the last four quarters, averaging a surprise of 203.4%. Its shares have soared approximately 136% over the past year.

For Axalta Coating, the current-year earnings estimate reflects a 36.9% increase from last year’s figures at $2.15. The stock has also seen a 29% rise in value over the last year, with estimates increasing by 3.9% in the last two months.

Ingevity has outperformed estimates in three of the last four quarters, averaging a 95.4% earnings surprise. Shares of NGVT have climbed approximately 23% over the previous year.

5 Stocks Poised for Massive Gains

These selections come from a Zacks expert, who identifies each as a top contender expected to rise by 100% or more in 2024. While past recommendations show impressive gains, not every pick is a guaranteed success.

Investors should note that many of these stocks are currently flying under Wall Street’s radar, presenting a unique opportunity for early investment.

Today, See These 5 Potential Home Runs >>

CF Industries Holdings, Inc. (CF): Free Stock Analysis Report

IAMGOLD Corporation (IAG): Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA): Free Stock Analysis Report

Ingevity Corporation (NGVT): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.