“`html

Three Promising Fintech Stocks for Savvy Investors

Money and technology are key to successful investments, especially in the fintech sector. Here are three promising fintech stocks you can consider buying with an investment of $1,000 or less.

Exploring Bill Holdings

While you may not be familiar with Bill Holdings (NYSE: BILL), many businesses are. Bill provides accounting software tailored for diverse enterprises.

The marketplace is busy, with competitors like QuickBooks, NetSuite, and ZipBooks. Nonetheless, Bill stands out. Its software specifically addresses the needs of accounts receivable and accounts payable teams and supervisors looking to monitor employee spending. The company generates revenue by charging subscription fees and processing fees for payments.

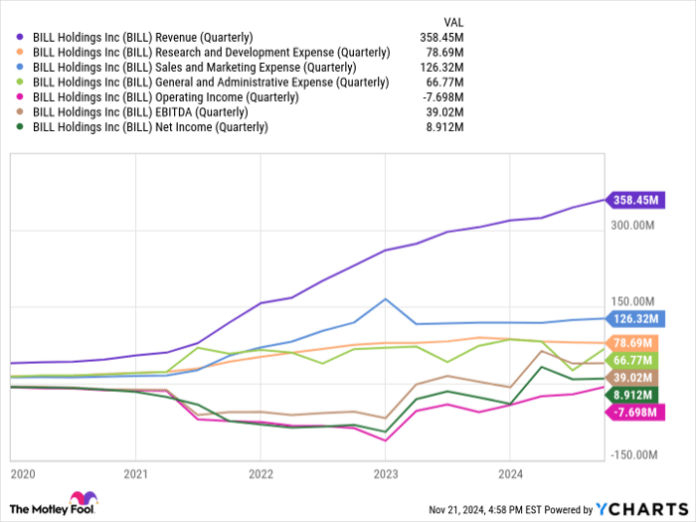

For the last quarter, Bill’s revenue grew by 18% year-over-year, continuing a trend of solid growth.

BILL Revenue (Quarterly) data by YCharts

However, Bill’s revenue growth is beginning to slow. Its revenue-retention rate has dropped to 92% by the end of fiscal 2024 from over 100% just two years ago. Some clients may be discontinuing service or using the platform less frequently. This deceleration may also stem from economic challenges that force small businesses to reduce expenses. Bill must address these issues correctly and keep shareholders informed of its progress.

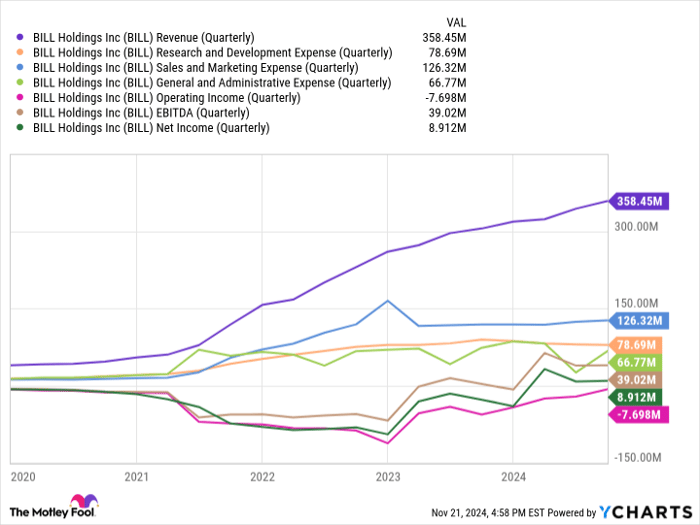

It’s important to see the bigger picture. The explosive growth Bill experienced in 2022 and 2023 was bound to stabilize. While the top-line revenue growth is slowing, profit margins are expanding more quickly due to sales increasing significantly faster than expenses. This shift offers Bill the financial flexibility needed to meet current challenges.

Data source: StockAnalysis.com. Chart by author.

Despite these positives, the stock remains relatively expensive and trades slightly above the consensus price target of approximately $82. While this might deter some investors, the current pricing reflects more on past performance than future potential. If the stock rebounds from its pandemic-related dip, the market may start to recognize its promising outlook. Many businesses are in need of Bill’s solutions right now.

Potential with SoFi Technologies

As online activity grows, it’s no surprise that many consumers are using online banking services. This trend has escalated faster than many expect.

According to the American Bankers Association, 48% of consumers now primarily use mobile banking apps, while online banking via browser comes in second at 23%. Physical bank visits and phone calls are becoming rare.

This shift indicates that many banking customers prefer to manage their finances independently.

That’s where SoFi Technologies (NASDAQ: SOFI) comes in. Founded in 2011 to help customers manage student loans, SoFi has expanded its offerings significantly, now including checking accounts, loans, credit cards, insurance, and investments, all available online.

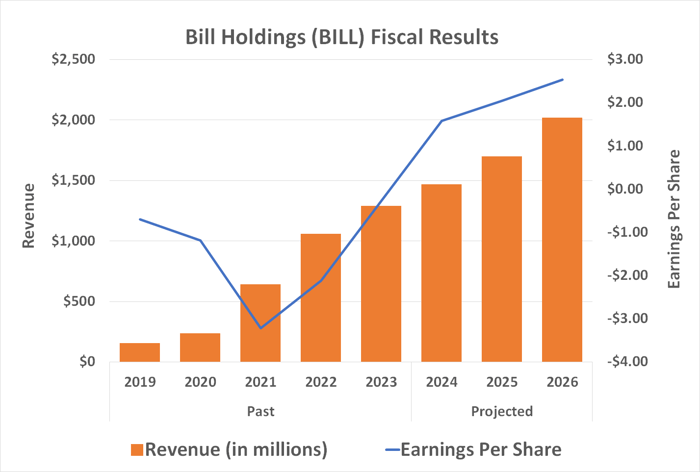

The response from consumers has been overwhelmingly positive. By September, SoFi had reached 9.4 million customers, up from just 1.5 million in the same quarter of 2020. Both revenue and EBITDA have also risen sharply as customers continue to explore additional services. The company turned a profit early this year, with expectations of further profit growth ahead.

SOFI Revenue (Quarterly) data by YCharts

There’s plenty of room for SoFi to keep growing, too. Despite the significant strides in online banking, YouGov reports that only 30% of U.S. consumers have accounts with online-only banks, leaving a vast majority still available. Straits Research anticipates the global online banking sector will grow by nearly 14% annually until 2030, with North America leading the way.

Investing in American Express

Finally, consider American Express (NYSE: AXP) as another solid fintech stock to buy with your extra $1,000.

Unlike Bill Holdings or SoFi Technologies, American Express is a household name. Its payment network handled almost $1.7 trillion in transactions last year, generating $13.5 billion in revenue. Currently, around 140 million American Express cards are in circulation.

Unlike other well-known credit card companies such as Mastercard and Visa, American Express combines the roles of being both a credit card provider and a payment network. This unique setup creates a lucrative ecosystem for its credit cards.

While many credit cards offer rewards, few rival the perks available through American Express. Cardholders can enjoy hotel credits, cash back on groceries, discounts on streaming services, and airport lounge access. These benefits can persuade users to pay up to $695 annually for an American Express card, while merchants also pay fees every time a card is used at their location.

Moreover, American Express tends to attract higher-income consumers, enhancing its revenue potential.

“`

American Express Thrives with 14 Straight Quarters of Revenue Growth

American Express is experiencing strong growth, aided by affluent consumers who seem less affected by economic challenges compared to others. This trend has contributed to a remarkable 14 consecutive quarters of revenue increases, signaling a robust recovery from the pandemic downturn.

Millennials and Gen Z Drive Future Growth

Looking ahead, the future appears promising for American Express, particularly as Millennials and Gen Z show substantial interest. Together, these younger generations account for roughly one-third of the payment volume and the majority of new cardholders last quarter. This demographic is used to membership models seen in platforms like Amazon Prime and Costco, which has likely helped drive their loyalty to American Express.

As these consumers mature and Generation Alpha enters adulthood, it is expected that even more customers will appreciate the enhanced benefits offered by Amex.

Seize the Opportunity: Consider Our “Double Down” Stocks

If you’ve ever felt you missed out on top-performing stocks, there may be good news for you now. Our expert analysts have identified unique opportunities in which they recommend a “Double Down” position on companies poised for significant growth.

For those concerned about missed investments, this is an optimal time to act. The past performance of these stocks is compelling:

- Nvidia: If you had invested $1,000 when we issued a double down in 2009, you would now have $368,053!*

- Apple: A $1,000 investment from 2008 would have grown to $43,533!*

- Netflix: An investment of $1,000 in 2004 would be worth $484,170!*

Currently, we are highlighting “Double Down” alerts for three exceptional companies. There may not be another chance to invest like this in the near future.

Discover 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board. American Express is an advertising partner of Motley Fool Money. James Brumley does not hold any interest in the mentioned stocks. The Motley Fool endorses positions in and recommends Amazon, Bill Holdings, Costco Wholesale, Mastercard, and Visa. The Motley Fool also suggests options on Mastercard for January 2025. Please refer to The Motley Fool’s disclosure policy for more details.

The views expressed in this article are those of the author and do not necessarily represent the opinions of Nasdaq, Inc.