Increased Demand for Data Centers Fuels Dell Technologies Growth Potential

As our reliance on data storage and processing continues to grow, investments in data centers have surged. This boom is driven, in part, by the immense demands of artificial intelligence (AI) applications. While these facilities can vary in size, some hyperscale data centers exceed 100,000 square feet, with some spanning millions. Leading tech companies such as Microsoft, Amazon, Alphabet, and Meta are primarily behind these large-scale constructions.

For example, in 2025, Meta plans to launch an $800 million, 715,000-square-foot campus in South Carolina, and Microsoft will initiate a $1 billion data center project in La Porte, Indiana.

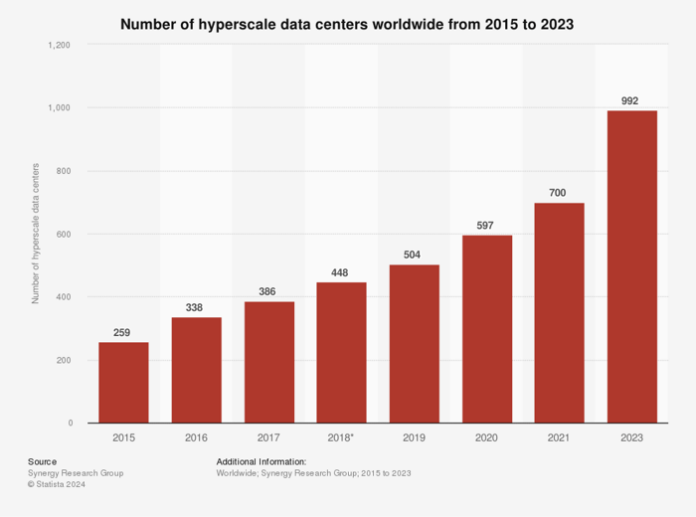

Below, you can see the recent increase in hyperscale data centers.

Statista.

In 2024, the total number of these data centers surpassed 1,000, and it is projected to increase by 120 to 130 each year. The infrastructure needed for these centers, such as servers, storage, and racking systems, presents significant opportunities for investors.

Dell Technologies (NYSE: DELL) is a key supplier in this sector, alongside Super Micro Computer. Current challenges faced by Supermicro may create advantages for Dell. Here’s what you need to know.

Supermicro’s Struggles and Opportunities for Dell

The difficulties Supermicro is encountering are well established. Here’s a brief overview:

- August: Hindenburg Research published a critical report, leading to a delay in the company’s annual 10-K filing.

- September: Nasdaq notified Supermicro about a possible delisting due to the delayed filing.

- October: Ernst & Young, the company’s auditing firm, resigned.

- November: Supermicro further postponed its quarterly 10-Q filing.

Currently, Supermicro’s stock is down 84% from its peak in 2024. These issues do not individually serve as a cause for alarm, but together they raise significant concerns.

Given these difficulties, data center operators may prefer Dell for their infrastructure requirements rather than Supermicro. Supermicro reported $5.3 billion in sales for its fourth quarter of fiscal year 2024, with $15 billion for the entire fiscal year, 64% of which came from large data centers. Dell’s Infrastructure Solutions Group achieved record revenues of $11.6 billion in the last quarter, indicating a potential for significant revenue gains as clients shift to Dell.

Dell Technologies Stock: A Good Investment?

Dell’s recent quarterly performance shows promise, but analysts are particularly excited about the company’s future. In the second quarter of fiscal 2025, revenue increased by 9% to $25 billion, while diluted earnings per share (EPS) surged 86% to $1.17. The Infrastructure Solutions Group, which caters to data centers, also set a record with $11.6 billion in sales, reflecting a remarkable 38% year-over-year growth.

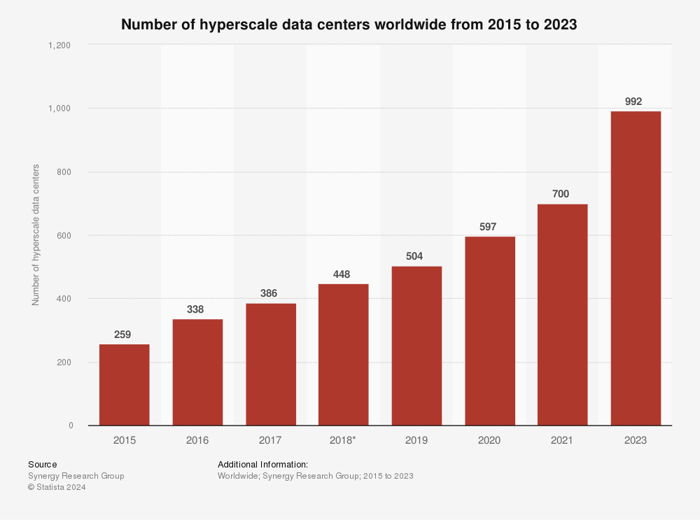

Looking ahead, analysts project an EPS of $7.87 for this fiscal year, with further increases expected:

DELL annual EPS estimates; data by YCharts.

This optimism is reflected in the recommendations of analysts, with 20 out of 25 rating the stock as a buy or strong buy, with an average price target of $145 per share. This target is about 10% higher than the current stock price, and there remains potential for additional growth as Dell may capture market share from Supermicro.

Dell is also appealing for its commitment to returning capital to shareholders through dividends and stock repurchases. The company plans to return 80% of its adjusted free cash flow to investors and has aimed for a 10% annual increase in its dividend, which currently yields 1.3%. In fiscal 2024, Dell’s adjusted free cash flow totaled $5.6 billion, with $3.7 billion already reported in the first half of fiscal 2025. This cash flow is likely to grow substantially alongside earnings.

As data center infrastructure needs expand rapidly, Dell appears to be optimally positioned to benefit in the coming years. Investors in the tech sector may want to consider a long-term investment in Dell stock.

Should You Invest $1,000 in Dell Technologies Now?

Before deciding to invest in Dell Technologies, consider this point:

The Motley Fool Stock Advisor analyst team has recently highlighted their view on the 10 best stocks for investors right now, and Dell Technologies did not make the list. The stocks chosen could yield substantial returns in the upcoming years.

In hindsight, consider when Nvidia appeared on this list on April 15, 2005… If you had invested $1,000 at the time, you’d have $869,885!*

Stock Advisor offers investors a straightforward strategy for success with guidance on portfolio building, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of November 18, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook, and sister to Meta Platforms CEO Mark Zuckerberg, is also a member of The Motley Fool’s board. Suzanne Frey, an executive at Alphabet, and Bradley Guichard, with investments in Amazon and Dell Technologies, are also part of the board. The Motley Fool has investments in and recommends Alphabet, Amazon, Meta Platforms, and Microsoft. The Motley Fool endorses the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. A disclosure policy is available from The Motley Fool.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.