Is Apple Still a Smart Investment for Your Future?

Apple (NASDAQ: AAPL) has transformed into one of the largest companies globally over the last few decades, leaving a lasting impact on investors. For example, a mere $1,000 investment made in 2005 could have grown to over $117,000 today, showcasing the company’s lucrative history.

With over 2 billion users of iPhones and other iOS devices, Apple’s brand is world-renowned. Recently, the company unveiled Apple Intelligence, its biggest venture into artificial intelligence (AI) yet. Many investors are optimistic that AI will elevate Apple and its stock further. But is now a good time to buy and secure your financial future?

Here are three key points to consider.

1. Apple’s Size: A Double-Edged Sword

Apple has become a giant in the tech industry, currently valued at $3.4 trillion. Earlier this year, it announced a share repurchase program worth $110 billion, the largest in U.S. history. Such a vast customer base provides a strong foundation for selling new products and subscription services.

However, as companies grow, their sheer size can work against them. Last year, Apple reported $391 billion in sales, a 3.3% increase over three years. The launch of the Apple Intelligence-powered iPhone 16 is expected to drive growth, but management has forecasted only a modest revenue increase for the coming quarter, which coincides with the holiday season. Thus far, the anticipated surge in iPhone upgrades is looking unlikely.

There’s a point where aiming for lofty goals can make it hard to keep up. Currently, Apple’s heavy reliance on iPhone sales may be hitting its limits.

2. Stock Valuation Challenges

Despite being widely respected, Apple’s stock carries a premium valuation compared to peers. Recent trends indicate the market may revisit this valuation if growth does not keep pace.

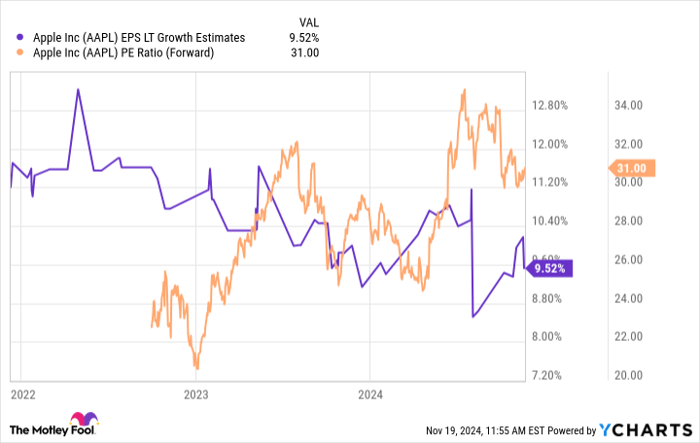

Currently, shares are trading at a forward price-to-earnings (P/E) ratio of 31. Analysts have also reduced long-term growth estimates to about 9.5%.

AAPL EPS long-term growth estimates, data by YCharts.

This paints a picture of a price-to-earnings-to-growth (PEG) ratio of 3.2, indicating that the stock is priced high when considering future growth. While a crash isn’t necessarily on the horizon, this could diminish future investment returns as the stock may lag until earnings align with current valuations.

3. Time for a New Growth Catalyst

Apple appears to be losing some of its momentum. As the business slows and valuations keep climbing, the burdens may become heavier. To revitalize growth, the company needs another defining moment, akin to the launch of the original iPhone in 2007.

But will Apple Intelligence provide this spark? Some consumer research suggests that AI features alone might not be enough to drive significant iPhone sales.

Management has taken steps in various directions, such as launching the Apple Vision Pro virtual reality headset; however, it has faced weak demand, prompting reduced production. Additionally, after years of development, Apple has reportedly shelved its autonomous vehicle project.

Should You Invest in Apple Stock?

Completely dismissing Apple would be unwise. The company has a track record of achieving success when it discovers the right innovation. With significant resources, Apple can continue exploring new avenues for growth. However, until such an innovation occurs, the stock may struggle to deliver the remarkable returns that investors once enjoyed. Therefore, if you’re aiming to transform your financial situation quickly, Apple may not be the solution for you at this time.

That said, Apple remains a remarkable stock investment.

Few companies possess such a strong consumer brand today. Its ability to pay dividends and execute substantial stock buybacks (achieving a 35% reduction in share count over the past decade) suggests potentially solid, if not extraordinary, long-term returns. It’s essential to adjust expectations to match Apple’s current situation.

Don’t Miss This Unique Investment Opportunity

Do you ever feel like you missed out on investing in the top stocks? Here’s your chance to act.

Our expert team occasionally issues a “Double Down” stock recommendation for companies they believe are on the brink of major success. If you’re worried you’ve missed your opportunity, now might be the perfect time to invest before it’s too late. The data supports this approach:

- Nvidia: if you invested $1,000 when it was recommended in 2009, you’d have $368,053!

- Apple: if you invested $1,000 when it was recommended in 2008, you’d have $43,533!

- Netflix: if you invested $1,000 when it was recommended in 2004, you’d have $484,170!

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this opportunity may not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.