Why Investors Should Consider Buying the Dip in Applied Materials

Nvidia has been a market favorite for several years, recently regaining its title as the largest company in the world with a market cap exceeding $3.5 trillion. This surge has largely resulted from the booming artificial intelligence (AI) sector, leading many latecomers to feel they’ve missed out. However, for those looking to enter the AI stock market now, Applied Materials (NASDAQ: AMAT) presents an intriguing option. Despite recent struggles, savvy investors recognize that this is a temporary setback for a company with robust fundamentals. Here’s why this might be the perfect time to invest in Applied Materials.

Applied Materials: Powering Semiconductor Production

Most investors understand that Nvidia manufactures essential computer chips used in everyday technology — from data centers to smartphones. These chips drive modern life, and making them requires advanced machinery. That’s where Applied Materials comes into play. The company produces the equipment and software that semiconductor manufacturers rely on to package, etch, and construct their chips. The technology offered by Applied Materials enables the production of chips that deliver high performance while consuming less electricity, key traits prized within the industry.

Due to the critical role these machines play in chip manufacturing, Applied Materials can command high prices for both its equipment and the associated service contracts. Over the last four quarters, the company has amassed $27 billion in revenue from customers worldwide.

Strong Financials and Reduced Share Count

Applied Materials has consistently delivered impressive financial results over the long haul. Its free cash flow reached $7.5 billion in the last year, and the company has maintained positive cash flow for every year of the 21st century. Despite operating within a cyclical industry, its vital machinery ensures a steady stream of revenue.

This financial strength has allowed the company to repurchase significant amounts of its stock. Since 2003, Applied Materials has cut its outstanding shares by over 50%, positively impacting earnings per share (EPS) and free cash flow per share. These metrics are critical for long-term investors as they contribute to shareholder value. Free cash flow per share has increased by nearly 800% over the past decade.

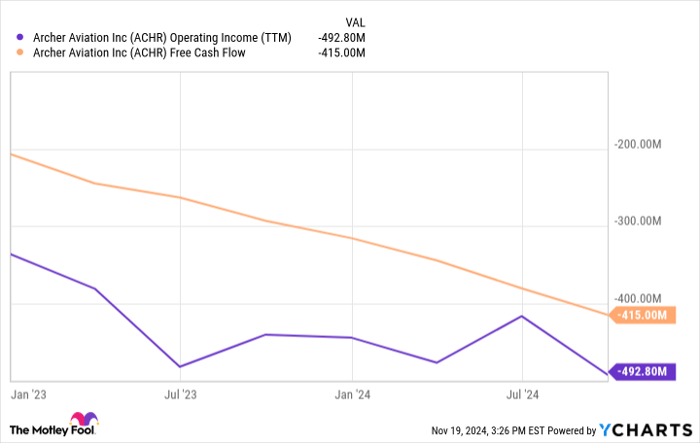

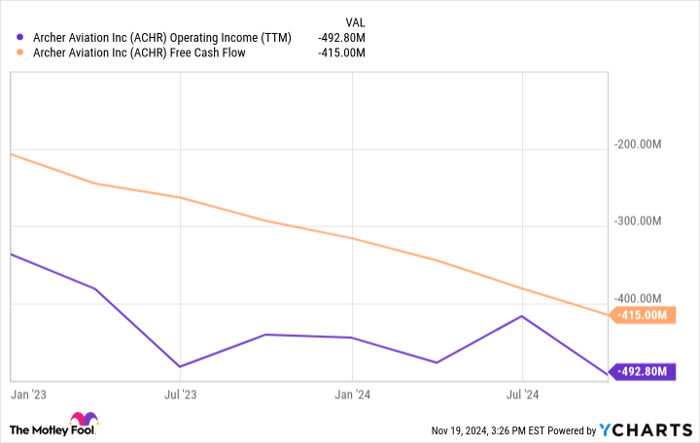

ACHR Operating Income (TTM) data by YCharts.

Why Now Is the Time to Invest in Applied Materials

Recent investor concerns have led to a decline in Applied Materials’ stock price, largely attributed to falling revenue from China. In its most recent fiscal quarter ending October 27, the company reported China revenue of $2.1 billion, down from $3 billion a year prior. This decline comes amid U.S. export restrictions, which pose challenges for semiconductor manufacturers in China. Notably, this region represents 30% of Applied Materials’ revenue from last quarter—an aspect that has unsettled investors.

While this presents a short-term challenge, the global demand for computer chips remains strong, independent of location. Should production in China be curtailed, manufacturing will simply shift to other countries. Applied Materials will continue to see demand for its highly sought-after machines.

Currently, Applied Materials’ stock is trading more than 33% below its peak. With a trailing price-to-earnings ratio (P/E) of 20 and a forward P/E of 17.7—well below the S&P 500 average of 30—it appears undervalued, especially for a company positioned to grow in the expanding semiconductor market. Thus, investing in Applied Materials stock during this dip may be a wise long-term strategy.

A Second Chance at a Promising Investment

Have you ever felt you missed an opportunity to invest in a high-performing stock? This could be your moment.

Our expert team has identified rare “Double Down” recommendations for companies poised for growth. If you’re concerned about missing the boat, now might be the ideal time to make your move. Consider the following past performance:

- Nvidia: A $1,000 investment when our team doubled down in 2009 is now worth $368,053!*

- Apple: Investing $1,000 when we doubled down in 2008 would have grown to $43,533!*

- Netflix: A $1,000 investment from 2004 has transformed into $484,170!*

At this moment, we are issuing “Double Down” alerts for three exceptional companies, and opportunities like this may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Applied Materials and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.