XPeng Receives Rating Upgrade as Analyst Forecasts Significant Price Growth

On November 22, 2024, China Renaissance raised their outlook for XPeng (OTCPK:XPNGF) from Hold to Buy.

Analyst Price Target Indicates Potential for 76.54% Gain

The average one-year price target for XPeng as of November 21, 2024, is set at $7.17 per share. Predictions range from a low of $3.78 to a high of $15.71. This average target reflects a notable increase of 76.54% from XPeng’s last closing price of $4.06 per share.

Check out our leaderboard featuring companies with the highest price target potential.

XPeng’s Growth Projections Highlight Strong Revenue Expectations

XPeng’s projected annual revenue stands at 68,164 million, signifying an impressive growth increase of 80.27%. However, the projected annual non-GAAP EPS shows a loss of -3.59.

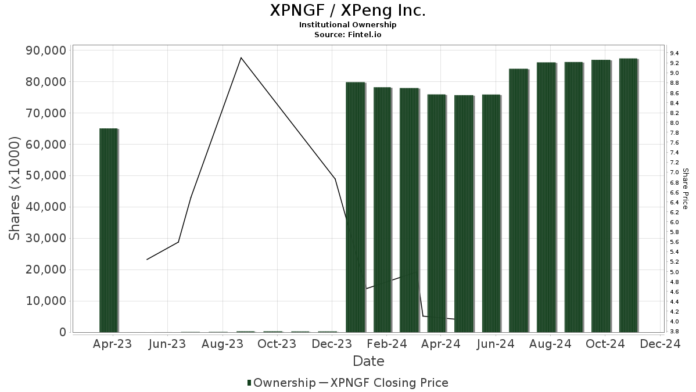

Changes in Fund Sentiment Toward XPeng

Currently, 108 funds or institutions have reported holdings in XPeng, which is a decrease of 9 owners, or 7.69%, in the past quarter. The average portfolio weight of all funds invested in XPNGF has risen by 22.58% to 0.25%. Institutional ownership has seen a slight uptick, with total shares owned increasing by 1.48% over the last three months to 87,364K shares.

VGTSX – Vanguard Total International Stock Index Fund Investor Shares holds 18,122K shares, accounting for 1.17% ownership of XPeng. Previously, the firm owned 17,953K shares, marking an increase of 0.93%. However, their allocation in XPNGF decreased by 5.12% over the last quarter.

VEIEX – Vanguard Emerging Markets Stock Index Fund Investor Shares reports holding 16,909K shares, representing 1.09% ownership. This reflects a decrease of 1.87% from the previous 17,225K shares, alongside a 5.51% drop in their portfolio allocation over the last quarter.

IEMG – iShares Core MSCI Emerging Markets ETF possesses 10,935K shares, equating to 0.71% ownership. This is an increase of 4.21% compared to their earlier holding of 10,474K shares, yet they reduced their portfolio allocation in XPNGF by 2.27% last quarter.

MCHI – iShares MSCI China ETF currently holds 2,884K shares, representing 0.19%. This is down 12.55% from their prior holding of 3,246K shares, although they raised their portfolio allocation in XPNGF by 11.99% in the last quarter.

EEM – iShares MSCI Emerging Markets ETF has 2,845K shares or 0.18% ownership. This shows a decrease of 3.55% from 2,946K shares owned previously, with their portfolio allocation in XPNGF also down by 1.70% over the last quarter.

Fintel offers an extensive investing research platform designed for individual investors, traders, financial advisors, and small hedge funds.

Our comprehensive data encompasses global fundamentals, analyst insights, ownership details, fund sentiment, insider trading statistics, options activity, and more. Our exclusive stock picks utilize advanced, backtested quantitative models aimed at enhancing profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.