Jefferies Begins Coverage of Canadian Solar: A Positive Outlook for Investors

On November 22, 2024, Jefferies initiated coverage of Canadian Solar (LSE:0XGH) with a strong Buy recommendation.

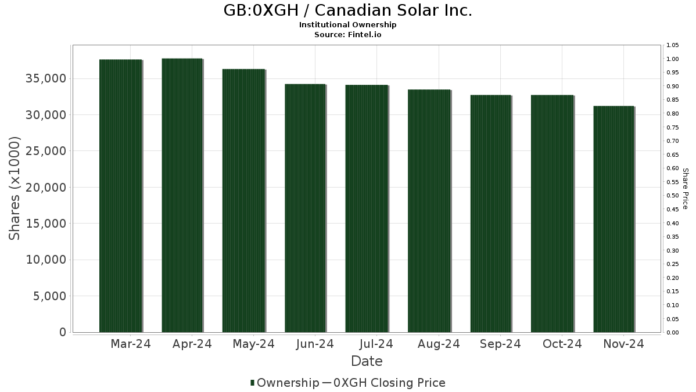

Fund Sentiment: A Shift in Ownership

Currently, 192 funds and institutions hold positions in Canadian Solar, marking a decrease of 24 owners, or 11.11%, from the previous quarter. The average portfolio weight for these funds in 0XGH has risen slightly to 0.17%, increasing by 2.26%. Additionally, total shares owned by institutions grew by 2.75% over the past three months, amounting to 34,160K shares.

Among the notable shareholders, BlackRock holds 5,228K shares, which accounts for 7.90% of the company’s ownership. Mackenzie Financial has increased its stake to 5,166K shares (7.81% ownership), up by 0.97% compared to its previous filing and reflecting a 7.45% increase in portfolio allocation this quarter.

Invesco, on the other hand, now owns 2,049K shares (3.10% ownership), having seen a significant increase of 9.63% from 1,852K shares last quarter. Notably, Invesco reduced its total allocation in 0XGH by 90.13% during the same period.

Legal & General Group’s ownership saw a small rise as well, with 1,590K shares (2.40% ownership), an increase of 0.39% from 1,584K shares previously. The firm has, however, decreased its allocation in 0XGH by 46.38%.

Furthermore, the TAN – Invesco Solar ETF now holds 1,364K shares (2.06% ownership), which is an increase of 17.39% from last filing’s 1,127K shares. Yet, it, too, reduced its portfolio allocation in 0XGH by 9.33%.

Fintel stands out as a comprehensive investment research platform tailored for individual investors, traders, financial advisors, and smaller hedge funds.

Our extensive data encompasses global fundamentals, analyst insights, ownership metrics, fund sentiment, options activity, insider trading, and more. We also provide unique stock picks derived from advanced, backtested quantitative models aimed at optimizing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.