NVIDIA Faces Downgrade as Analyst Forecasts Modest Price Increase

On November 22, 2024, Phillip Securities revised their outlook for NVIDIA (BIT:1NVDA) from Buy to Accumulate.

Analysts Predict Steady Growth Ahead

As of November 21, 2024, the average one-year price target for NVIDIA stands at €149.68 per share. Estimates vary, with a low of €70.40 and a high of €196.84. This forecast suggests a potential increase of 8.20% from its latest closing price of €138.34 per share.

For a comparison, take a look at our leaderboard of companies that offer the largest price target upside.

Revenue and Earnings Projections

NVIDIA’s projected annual revenue is €94,037 million, which represents a decrease of 16.98%. Additionally, the anticipated non-GAAP earnings per share (EPS) is €20.91.

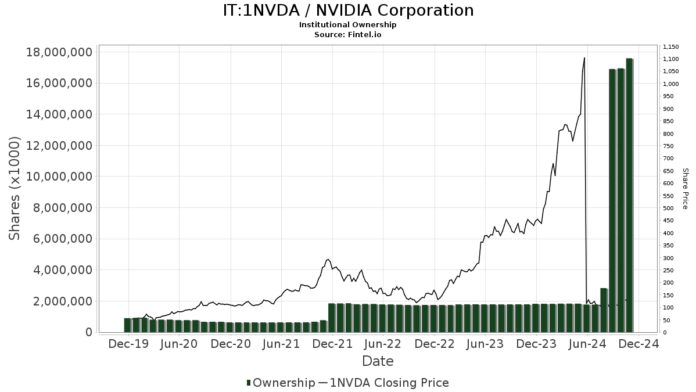

Institutional Interest in NVIDIA

Currently, 6,619 funds or institutions report holdings in NVIDIA, marking an increase of 148 funds, or 2.29%, over the last quarter. The average portfolio weight dedicated to 1NVDA stands at 3.15%, a rise of 0.66%. Institutions increased their total shares owned by 13.77% in the past three months, bringing the total to 17,756,746K shares.

Institutional Movements

BlackRock currently holds 1,851,627K shares, accounting for 7.56% of the company’s ownership. This is a slight increase from their previous holding of 1,839,270K shares, but the firm reduced its portfolio allocation in 1NVDA by 8.22% over the last quarter.

Meanwhile, VTSMX – Vanguard Total Stock Market Index Fund Investor Shares increased its holdings to 738,297K shares, now representing 3.01% ownership. This showcases an impressive increase of 89.89% from their last filing and reflects a 31.49% rise in portfolio allocation.

VFINX – Vanguard 500 Index Fund Investor Shares holds 631,333K shares, or 2.58% of the company. Their shares rose 90.14%, with an additional 31.27% allocation in 1NVDA.

Geode Capital Management owns 546,079K shares, which corresponds to 2.23% ownership. They have increased their holdings by 2.11%, but decreased their portfolio allocation by 7.41%. Conversely, Price T Rowe Associates holds 407,608K shares, representing 1.66% ownership, which is a drop from 444,582K shares previously, resulting in a 56.71% decrease in allocation.

Fintel serves as a leading investing research platform for individual investors, traders, financial advisors, and small hedge funds. Their data encompasses a variety of financial aspects, including fundamentals, analyst reports, ownership data, fund sentiment, and much more—all powered by advanced, backtested models for potential profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.