HSBC Lowers Outlook for Palo Alto Networks: What Investors Should Know

HSBC Adjusts Rating from Hold to Reduce

On November 22, 2024, HSBC announced a downgrade of their outlook for Palo Alto Networks (XTRA:5AP) from Hold to Reduce.

Forecast Indicates Minor Decline Ahead

As of October 22, 2024, the average one-year price target for Palo Alto Networks sits at 362.26 €/share. This target varies, with estimates ranging from a low of 257.13 € to a high of 431.97 €. Notably, this average suggests a decline of 1.49% from the latest reported closing price of 367.75 € / share.

Check out our leaderboard for companies with the highest price target upsides.

Strong Revenue Growth Projected

Palo Alto Networks is expected to report annual revenue of 10,060 million €, reflecting an impressive growth rate of 21.38%. Furthermore, the projected annual non-GAAP EPS stands at 5.47.

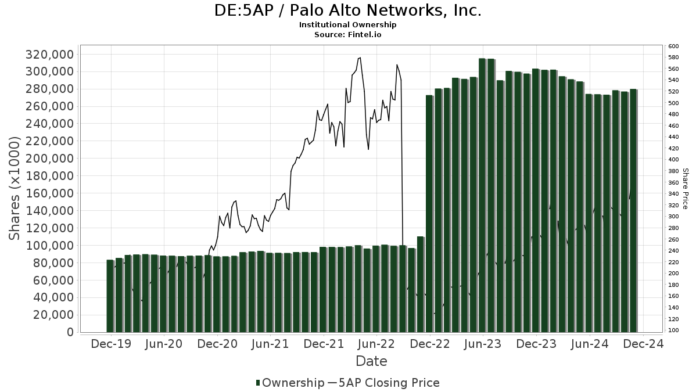

Understanding Fund Sentiment

Currently, 3,053 funds or institutions hold positions in Palo Alto Networks, marking an increase of 9 owners or 0.30% over the last quarter. The average portfolio weight dedicated to 5AP among these funds is 0.46%, which is a rise of 4.41%. Institutional shares rose by 1.09% over the past three months, reaching a total of 285,768K shares.

Activity Among Major Shareholders

BlackRock remains a significant player, holding 25,086K shares which amounts to 7.67% ownership of the company.

The Vanguard Total Stock Market Index Fund (VTSMX) controls 10,228K shares, equating to 3.13% ownership. In its last filing, it reported a small rise from 10,156K shares, resulting in a 0.70% increase and a 16.85% boost in its portfolio allocation for 5AP over the previous quarter.

The Vanguard 500 Index Fund (VFINX) holds 8,293K shares, also representing 2.53% ownership. Previously, it owned 7,946K shares, indicating a 4.19% increase. Its 5AP portfolio allocation rose by 17.88% in the last quarter.

Bank of America’s position has slightly changed; it holds 8,150K shares (2.49% ownership), down from 8,313K shares for a 2.00% decrease and a significant decrease of 76.67% in its portfolio allocation for 5AP during the past quarter.

Geode Capital Management has increased its stake to 7,657K shares, representing 2.34% ownership, an increase of 2.88% from the previous 7,436K shares, but their portfolio allocation for 5AP has dropped by 4.27% in the most recent quarter.

Fintel offers extensive research tools for individual investors, traders, financial advisors, and small hedge funds. Our platform includes data on fundamentals, analyst reports, ownership data, fund sentiment, insider trading, options flow, unusual options trades, and more. Additionally, advanced, backtested quantitative models power our exclusive stock picks for enhanced profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.