NVIDIA Faces Downgrade Amid Mixed Outlook from Analysts

New Price Target Indicates Limited Growth Potential

Fintel has reported that on November 22, 2024, Phillip Securities revised their outlook for NVIDIA (XTRA:NVD), moving from a Buy recommendation to an Accumulate rating.

The average price target for NVIDIA shares stands at 139,79 €/share as of October 22, 2024. Predictions vary, with a low estimate of 70,03 € and a high of 195,80 €. This average suggests a modest increase of 2.48% from NVIDIA’s last closing price of 136,40 € per share.

Annual Revenue Projections Signal Potential Concerns

NVIDIA’s projected annual revenue is estimated at 37,402 million €, representing a significant drop of 66.98%. Furthermore, analysts anticipate the company’s annual non-GAAP earnings per share (EPS) to be 5.98.

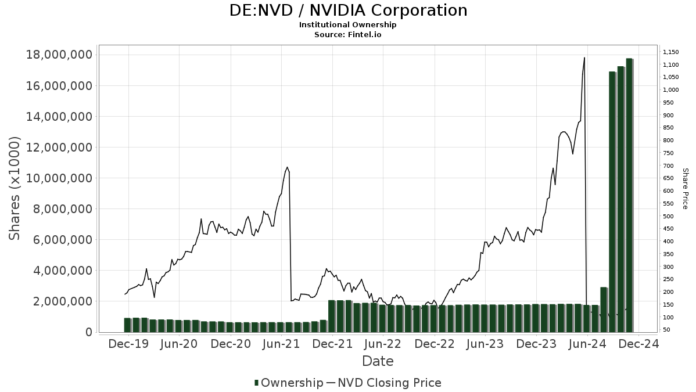

Institutional Interest Grows Among Fund Managers

Currently, 6,619 funds or institutions have reported holdings in NVIDIA, marking an increase of 2.29% or 148 new shareholders in the last quarter. The average portfolio weight for all funds has risen by 0.66% to 3.15%. Institutional ownership increased by 13.77% over the past three months, totaling 17,756,746K shares.

Key Shareholders Update Their Positions

BlackRock controls 1,851,627K shares, accounting for 7.56% ownership in NVIDIA. In its most recent filing, BlackRock indicated an increase of 0.67% from its previous total of 1,839,270K shares but reduced its portfolio allocation by 8.22% in the last quarter.

Vanguard Total Stock Market Index Fund Investor Shares has increased its holdings significantly, now owning 738,297K shares or 3.01% of the company. This reflects an 89.89% rise from 74,656K shares reported before. Their portfolio allocation to NVIDIA also grew by 31.49% recently.

Vanguard 500 Index Fund Investor Shares holds 631,333K shares, representing 2.58% ownership, and has similarly raised its holdings by 90.14%. Their allocation increased by 31.27% over the last quarter.

Geode Capital Management’s share count stands at 546,079K, with a slight 2.11% increase from their previous holding of 534,554K shares. However, they reduced their portfolio allocation by 7.41% during the same period.

Conversely, Price T Rowe Associates decreased their holdings by 9.07% to 407,608K shares, representing 1.66% ownership. Their portfolio allocation declined significantly by 56.71% in the last quarter.

Fintel provides comprehensive investing research to individual investors, traders, financial advisors, and smaller hedge funds, covering a wide range of financial data and insights.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.