Navigating the Retail Struggles: Target vs. Dollar General

Certain retail stocks have encountered challenges in the current economic landscape. While the overall economy enjoys strength and a near full employment rate, persistent inflation and rising interest rates have placed pressure on consumer spending.

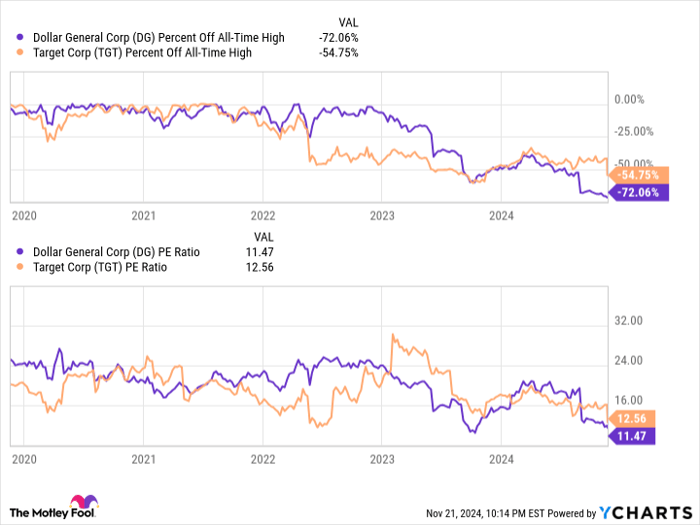

Target (NYSE: TGT) and Dollar General (NYSE: DG) have particularly suffered, trading significantly below their peak values. The question arises: Which stock presents a better value today?

Reality Check on Prices

The performance charts highlight the steep declines both companies have experienced. Target’s sales dropped in late 2021, coinciding with a broader downturn for retailers tied to home goods. Dollar General’s downturn began in early 2022, leading to even sharper declines. Previously, both stocks enjoyed mid-20s price-to-earnings (P/E) multiples, but their valuations have similarly dwindled alongside their earnings.

Data displayed shows DG Percent Off All-Time High as sourced from YCharts. PE Ratio refers to price-to-earnings ratio.

If the economy begins to show signs of improvement, both companies could potentially rebound. Yet, each is grappling with unique challenges that raise questions about their recoveries.

Customer Struggles Amid Rising Costs

Though their target demographics slightly differ, both Target and Dollar General are seeing a downturn in customer spending as inflation strains budgets.

In August, Dollar General CEO Todd Vasos shared that 60% of their sales originate from households earning $35,000 or less annually. He noted that sales weakens during the last weeks of each month, indicating that customers face budgetary pressures as they deplete their funds.

Coupled with this financial strain, Dollar General has seen theft, or shrink, become a major factor, with a significant negative impact on its gross margins. The company reported elevated theft levels compared to last year despite its ongoing problems.

Similarly, Target’s most recent earnings report revealed comparable pressures. Although its customer base leans more towards the middle class, CEO Brian Cornell explained that shoppers are being more selective and capitalizing on promotional offers, only splurging for essential seasonal items.

On the operational side, Cornell mentioned incurring added costs by redirecting inventory to West Coast ports during potential labor strikes at East Coast facilities. This logistical issue further impacted earnings.

A silver lining for Target is that its shrink issue has improved, in contrast to Dollar General’s ongoing struggles. Nonetheless, disappointing results might hint at increased competition. For instance, competitor Walmart (NYSE: WMT) experienced robust quarterly results, potentially luring customers away from Target due to its generally lower prices.

Image source: Getty Images.

Identifying the Stronger Contender

Despite Dollar General’s steeper decline and lower P/E ratio, Target appears to be the less risky option at this time.

Dollar General, which had previously shown resilience in tough economic climates, now faces challenges from inflation that may be more damaging to its core customer base than a recession would be. Escalating food and housing costs have broadly impacted lower-income households in the U.S.

Conversely, Target’s customers—while seeking out bargains—seem more stable and less inclined to resort to theft. This persistent shrink issue plagues Dollar General, whereas Target appears to be turning a corner.

Even though Target recently posted weak quarterly results, it has seen some positive trends in the last year. The logistical challenges seem to be an isolated incident, and Target has successfully reduced its debt load, with its debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio improving relative to Dollar General.

DG Financial Debt to EBITDA (TTM) data sourced from YCharts. EBITDA = earnings before interest, taxes, depreciation, and amortization; TTM = trailing 12 months.

While a favorable shift in market conditions or improvements at Dollar General could theoretically present a chance for growth, Target seems to offer a more secure investment space at present. Following its recent stock decline, Target merits a closer look.

Seize This Opportunity

Ever had the feeling of missing out on well-performing stocks? If so, you’re not alone.

Occasionally, our expert analysts identify a “Double Down” stock recommendation for companies poised for significant growth. If you’re concerned about missing your chance to invest, now might be the ideal moment to act before it’s too late. The statistics demonstrate the potential:

- Nvidia: If you had invested $1,000 when we doubled down in 2009, it would be worth $368,053!*

- Apple: If you had invested $1,000 when we doubled down in 2008, it would be worth $43,533!*

- Netflix: If you had invested $1,000 when we doubled down in 2004, it would be worth $484,170!*

At present, we are issuing “Double Down” alerts for three outstanding companies, and this might be a fleeting chance.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Billy Duberstein and/or his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Target and Walmart. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.