Super Micro Computer: A Stock Roller Coaster with Potential Pitfalls Ahead

Super Micro Computer (NASDAQ: SMCI) has seen dramatic swings in its stock price throughout 2024. Starting at approximately $28 per share, it surged to nearly $120 by March, only to crash back down to the year’s starting point, dipping as low as $21 just a few days ago.

This type of volatility is not typical for investors, but the sharp rise and fall of Supermicro, as it’s commonly known, can be explained. With the stock currently down roughly 75% from its highest point, questions arise: Is it poised for a comeback in 2025?

Booming Business Amid AI Demand

Supermicro specializes in data center components and complete server systems. Notably, the company produces liquid-cooled servers, which offer energy efficiency and reduced space requirements compared to traditional servers.

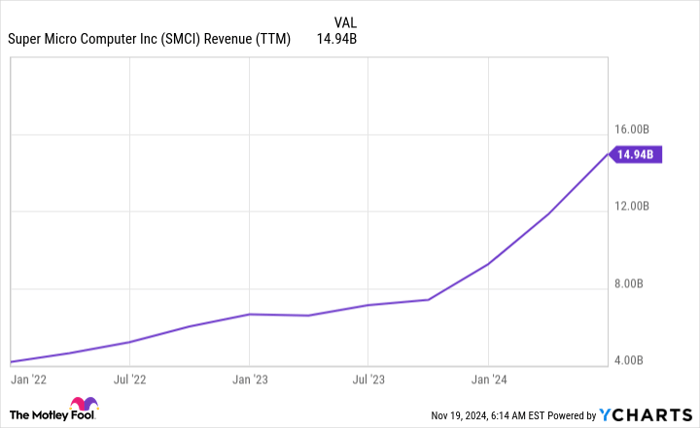

These advantages fueled soaring demand for Supermicro’s products in 2024, as businesses scrambled to expand computing capabilities to meet the growing appetite for artificial intelligence (AI). Consequently, revenue experienced consistent growth, with some quarters surpassing 100% increases.

SMCI revenue (TTM) data by YCharts; TTM = trailing 12 months.

However, questions linger about the credibility of these numbers. Supermicro’s decline can be partly attributed to over-exuberance, but significant concerns arose from allegations of accounting fraud.

Loyalty to Management in Question

The trouble began when prominent short-seller Hindenburg Research published a report accusing Supermicro of accounting malpractice, which was not a new issue; the company had faced fines from the Securities and Exchange Commission in 2020 related to previous accounting discrepancies from 2018.

In response to Hindenburg’s claims, Supermicro announced the delay of its end-of-year form 10-K to evaluate its financial reporting controls. These developments led to a rapid fall in stock prices. To make matters worse, a report from the Wall Street Journal revealed that the Department of Justice was investigating the company, further impacting the stock.

While many details remain speculative, Supermicro’s auditor, EY (formerly Ernst & Young), resigned, stating it no longer wished to be connected with the company’s reported figures. The departure of an auditor indicates serious underlying concerns and prompted further drops in stock value.

Given the stock’s significant decline, investors may see potential for recovery, especially as the company still benefits from trends surrounding AI. Yet, skepticism regarding management’s reliability complicates this view.

A lack of trust among institutional investors often leads to avoidance of stocks, making it challenging for prices to regain traction without major financial backing. Trust between a company and its investors is essential, and currently, Supermicro struggles in this area.

While a new management team might improve confidence, the founder, CEO, and chairman Charles Liang’s established presence makes this unlikely.

On a potentially positive note, Supermicro has appointed BDO, a respected auditing firm, as its new auditor, vowing to navigate its financial submissions efficiently. Following this announcement, the stock price surged by approximately 30%. This uptick could be the beginning of a resurgence if investor confidence returns. However, switching auditors does not instantly resolve existing financial issues, and reporting problems may still exist.

While Super Micro Computer could turn into a comeback story in 2025, considerable uncertainty remains. For now, cautious investors might find better opportunities elsewhere, as significant risks persist for Supermicro.

Possible Second Chance for Investors

Ever wish you had invested in top-performing stocks sooner? If so, you won’t want to miss this opportunity.

Occasionally, our expert analysts spot a company ripe for investment—a concept we call a “Double Down” stock. Act quickly before it’s too late, as the following performances demonstrate:

- Nvidia: An investment of $1,000 when we doubled down in 2009 would now be worth $368,053!*

- Apple: A $1,000 investment when we doubled down in 2008 would have grown to $43,533!*

- Netflix: Investing $1,000 when we doubled down in 2004 would be worth $484,170!*

Right now, we have “Double Down” alerts for three exceptional companies. This may be your best chance to invest before opportunities disappear.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.