Elections and Their Impact: Tilray Brands Faces Challenges Ahead

The results of U.S. elections play a crucial role in shaping future policies. Following Donald Trump’s election as the 47th president and the Republican Party reclaiming control over both the Senate and House of Representatives, some sectors may see benefits. However, this political shift could negatively impact the cannabis industry, particularly for one key player: Tilray Brands (NASDAQ: TLRY).

Tilray’s Hopes Rest on Cannabis Legalization

Since Canada legalized recreational marijuana in 2018, the cannabis industry has grappled with intense competition and strict regulations. As a result, many companies in this sector, including Tilray, have struggled to maintain stable revenue and earnings.

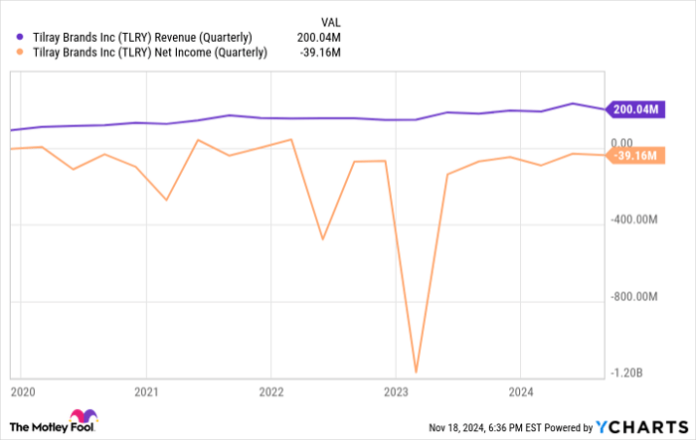

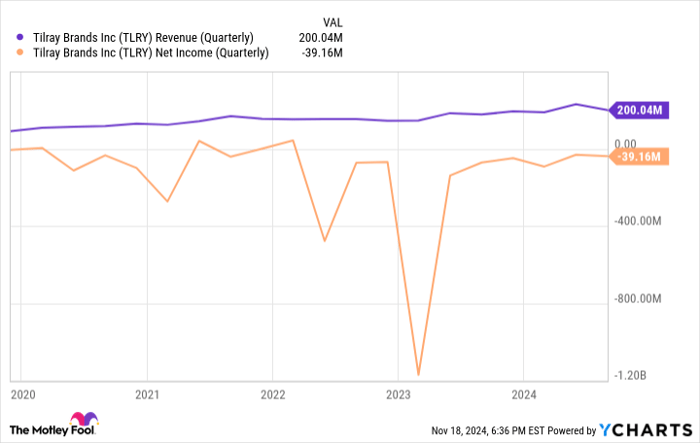

TLRY Revenue (Quarterly) data by YCharts.

Tilray has experienced growth in certain quarters, primarily through acquisitions rather than organic revenue. To mitigate risks, the company has ventured beyond the Canadian cannabis market, notably establishing a presence in the beverage industry. Impressively, Tilray is now recognized as the fifth-largest craft brewer in the U.S.

The company’s strategy is to integrate these two markets if cannabis is legalized federally in the U.S. CEO Irwin Simon stated, “Upon legalization [in the U.S.] one day, we will infuse these drinks with THC, with CBD, but we’ll have the distribution, and we’ll have the brands when and if legalization does happen.” While this presents a potential revenue stream, it may be a long time coming.

Voter Decisions Turn Against Legalization Efforts

On election night, three states—Florida, North Dakota, and South Dakota—had the chance to approve adult recreational marijuana use but ultimately rejected these measures. Nebraska did vote in favor of legalizing medical marijuana, yet this is of little comfort to Tilray and other cannabis companies. Even if federal legalization occurs, setbacks at the state level remain disheartening.

Recent election outcomes suggest federal legalization may be further off, especially with Florida, North Dakota, and South Dakota leaning Republican during the election. Generally, Republicans show less support for legalization; a Gallup poll from last year indicated that 55% support the measure compared to a national average of 70%. Among Democrats, support jumps to 87%.

Although President-elect Trump, a Florida resident, has expressed some support for legalization in his state, he maintains that legalization should be a local issue. This stance may complicate the push for federal legalization.

Tilray Brands Faces an Uphill Battle

Tilray’s ambitions are not solely tied to the U.S. market. The company has made advancements in Germany, yet the U.S. remains the most lucrative market. Recent election results leave Tilray in a more precarious position than before, with overall conditions already challenging. Prospects for a recovery seem bleak as the company continues to face significant hurdles in recent years.

Consequently, Tilray’s financial outlook appears grim, suggesting unimpressive results ahead. Consequently, stock performance is likely to follow suit, making Tilray less appealing as an investment opportunity. Caution is advised for those considering entering the market.

Opportunity Awaits for Savvy Investors

Have you ever thought you missed the chance to invest in successful stocks? If so, this might be your moment.

Every so often, our team of analysts identifies a “Double Down” stock recommendation for companies poised to make significant gains. If you fear you’ve already missed out, now could be the ideal time to invest, as opportunities like this don’t last forever. Consider the numbers:

- Nvidia: an investment of $1,000 back in 2009 would now be worth $368,053!*

- Apple: $1,000 invested in 2008 would have grown to $43,533!*

- Netflix: if you invested $1,000 in 2004, you’d have $484,170!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies—don’t miss your chance to get in on these opportunities.

Discover 3 “Double Down” stocks now »

*Stock Advisor returns as of November 18, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool recommends Tilray Brands. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.