Navigating the AI Boom: Why Alphabet Could Be a Smart Investment Choice

The current buzz around artificial intelligence (AI) might be getting a bit overblown. The stock market often reacts like an emotional rollercoaster, swinging wildly with any news, whether positive or negative. Take AI stocks like Nvidia, which have skyrocketed tenfold in recent years; they might soon face a correction as their prices already reflect high expectations.

Nevertheless, generative AI is still in its infancy, with analysts predicting that spending in this area could hit $356 billion by 2030. This represents an impressive 46% annual growth rate over the next six years, up from an estimated $36 billion this year. Companies like Nvidia are likely already priced for this anticipated growth.

Despite this crowded field, one AI stock stands out as a strong contender: Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG). Here’s why this tech titan may emerge as a significant player in the growing generative AI landscape through 2030.

Alphabet’s Rise in AI

Back in late 2022, the emergence of OpenAI and tools like ChatGPT caused concern among Alphabet investors. Fears that Alphabet, the parent company of Google Search, was lagging behind in the AI race led to its stock plummeting. By early 2023, Alphabet’s price-to-earnings ratio (P/E) had fallen to around 15, marking its lowest point in ten years.

However, over the past two years, Alphabet has dispelled these concerns. From early 2023 lows, the stock has rebounded dramatically, posting a total return of 90%. Through its various subsidiaries and research teams, Alphabet has innovated and even outperformed several of OpenAI’s offerings, unveiling new AI tools of its own.

Products like NotebookLM provide summarized documents in both audio and text formats. Additionally, Google Search now features AI-generated summaries, enhancing the user experience of the world’s most popular search engine. Moreover, the latest Google Lens feature allows users to conduct searches using images instead of text.

Alphabet’s success isn’t confined to generative AI. Its self-driving division, Waymo, has expanded its services to multiple U.S. cities, completing 100,000 rides weekly—a tenfold increase year over year. This division highlights Alphabet’s substantial lead in AI technology, contributing significantly to its overall business.

Cloud Services Fueling Growth

Over the last few years, Alphabet has established itself as a frontrunner in AI technology. The pressing question now is how the company will monetize its innovations effectively.

One major avenue is through Google Cloud, which is currently Alphabet’s most promising unit. This segment leverages Alphabet’s advances in AI, chip technology, and data infrastructure, offering these capabilities to external clients. In the last quarter, Google Cloud generated $11.4 billion in revenue, reflecting a year-over-year growth of 35%. Analysts anticipate that this growth will persist given the expected explosion in generative AI spending leading up to 2030.

If Google Cloud reaches $100 billion in annual revenue with profit margins of about 25%—a goal that appears achievable in the next few years—it could yield $25 billion in operating earnings. This would represent a significant portion of Alphabet’s $105 billion in trailing consolidated operating earnings.

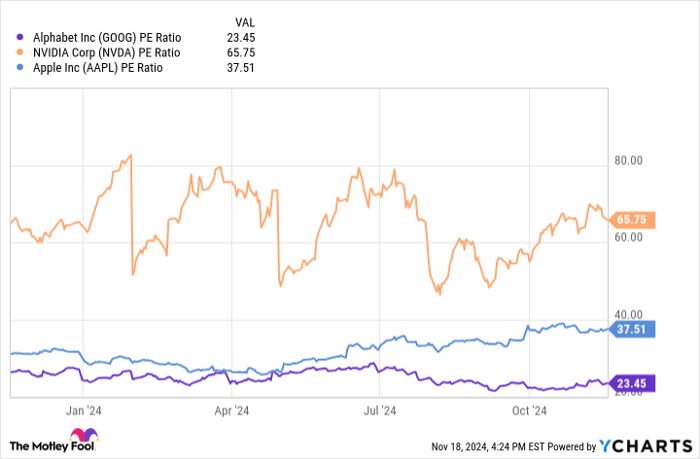

GOOG PE Ratio data by YCharts

Misjudged Potential in Alphabet’s Stock

Even though Alphabet has demonstrated its prowess in AI through innovative products and solid financial performance, its stock has not kept pace with other major tech stocks.

Currently, Alphabet’s P/E ratio is around 23, which is among the lower figures in the AI and technology sectors. In contrast, Nvidia boasts a P/E of 66, while Apple trades at a P/E of 37, despite its slower growth and limited success in AI products.

As generative AI revenues are projected to rise significantly this decade, Alphabet stands to capture a large share due to its diverse range of AI products and strategic monetization methods. Investors can acquire shares now at a P/E of 23, notably below the S&P 500 index average of 30—a promising opportunity for long-term portfolio growth.

Your Second Chance to Invest Wisely

Have you ever felt like you missed out on investing in top-performing stocks? If so, this is your chance.

Occasionally, our team of analysts recommends a “Double Down” stock—companies they believe are about to soar. If you’ve been worried about missing your window of opportunity, now could be the perfect time to invest before prices rise again. A few examples of past recommendations include:

- Nvidia: A $1,000 investment in 2009 would now be worth $368,053!*

- Apple: A $1,000 investment in 2008 has grown to $43,533!*

- Netflix: A $1,000 investment in 2004 is now valued at $484,170!*

We are currently issuing “Double Down” alerts for three outstanding companies, and opportunities like this may not come around again soon.

Explore 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Apple, and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.