Target’s Disappointing Q3 Report: What It Means for Investors

Investors in Target (NYSE: TGT) faced a tough shock with the release of its third-quarter earnings for 2024. The stock plummeted by 22% in the following trading session due to disappointing results.

As a result, Target’s stock price has dropped to levels not seen in over a year. This leads to a critical question: is the market overreacting, or is it time to steer clear of Target stock? Let’s delve into the details.

Examining Target’s Q3 Earnings

Target’s recent financial results are unlikely to inspire investor confidence. In the third quarter of 2024, the company reported revenues exceeding $26 billion, reflecting a slight increase of less than 1% compared to last year. Comparable sales rose only 0.3%. Although digital sales soared 11%, this performance couldn’t compensate for the disappointing results from in-store shopping.

During the earnings call, CEO Brian C. Cornell attributed the modest revenue growth to cautious consumer spending. This disappointing sales environment resulted in a rising inventory, with current levels at $15 billion—an increase of over $3 billion from the previous year.

Moreover, operating expenses rose by more than 3%. Target cited factors such as a brief port strike, storms in the Southeast, and increased healthcare costs as contributors to these rising expenses. Consequently, the company’s net earnings dropped by 12% on a year-over-year basis to $854 million, equating to $1.85 per share.

Perhaps the most notable letdown came in the company’s full-year projections. Target has revised its estimate for 2024 adjusted earnings per share to $8.60, significantly lower than the previous forecast of $9.35 made just a quarter ago.

Investors may also wonder how Target plans to generate future growth. With more than 75% of Americans residing within 10 miles of a Target store and no clear intention to expand internationally, the company may face challenges in driving long-term growth.

Current Landscape of Target Stock

Such struggles have led Target stock to hit new 52-week lows. As a result, the company has managed to achieve only a minimal positive return over the past five years, raising concerns for investors.

Despite these challenges, the current state of Target stock might attract growth and income investors.

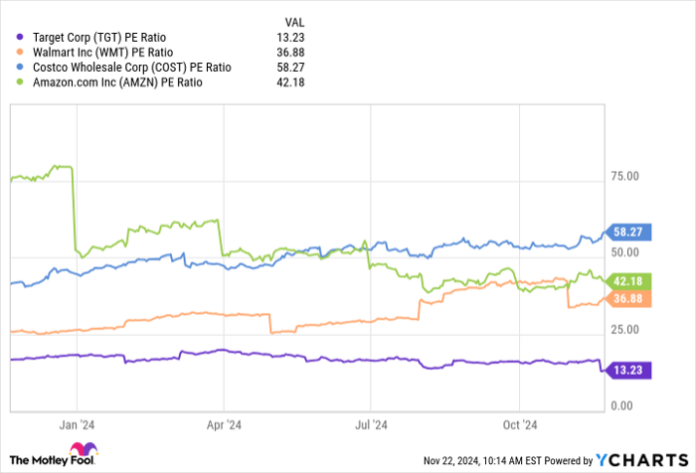

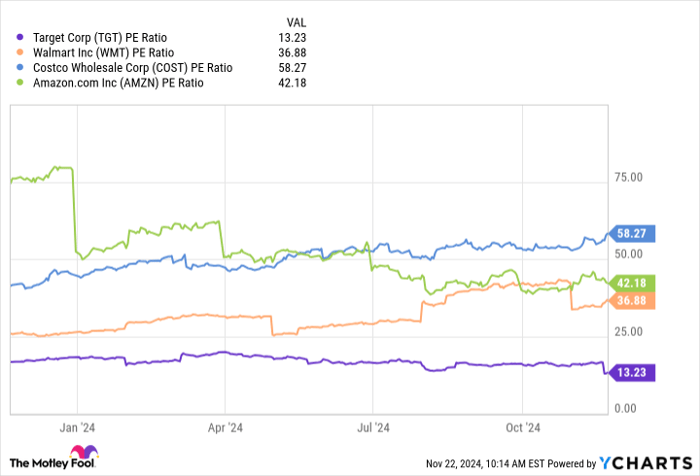

The high inventory levels and cautious consumer sentiment are likely cyclical issues that could improve with time. Furthermore, these challenges seem to be factored into Target’s stock price. Notably, its P/E ratio has dropped to about 13, close to five-year lows and significantly lower than its major competitors.

TGT PE Ratio data by YCharts

Additionally, Target offers an annual dividend of $4.48 per share, yielding 3.6%. This dividend yield is approximately three times that of the S&P 500, which is just over 1.2%.

Recognized as a Dividend King, Target has increased its dividend for 53 consecutive years. This long-term trend enhances confidence in the stock but also indicates that much of its value relies on consistent annual payouts. Target is expected to continue this pattern, which would solidify its steady income stream for investors.

Considering an Investment in Target

Although Target may appear to be in a rough patch at the moment, there are compelling reasons to consider investing in the company.

Sales are subdued, and challenges like high inventory and limited expansion options are concerning. However, it’s important to note that the company is still profitable, which is a critical factor.

The 13 P/E ratio suggests that the stock price may already reflect the company’s present difficulties. Furthermore, a 3.6% dividend yield combined with a 53-year history of payout increases is an attractive proposition for income-focused investors.

As market conditions improve, sales and earnings should rise again, enhancing not just Target’s stock price but also its ability to maintain its long-standing history of dividend increases.

A New Opportunity for Investors

Have you ever felt like you missed the chance to invest in successful stocks? Now could be your moment.

Our team of expert analysts occasionally issues a “Double Down” stock recommendation for companies they believe are poised for significant growth. If you’re concerned about having missed your opportunity, it may be the ideal time to invest.

- Nvidia: If you had invested $1,000 when we recommended it in 2009, you’d have $368,053!

- Apple: If you had invested $1,000 in 2008, you’d now have $43,533!

- Netflix: If you had invested $1,000 in 2004, you’d have $484,170!

Currently, we are issuing “Double Down” alerts for three outstanding companies, and you won’t want to miss this opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy holds no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Costco Wholesale, Target, and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.