Investors Eye Undervalued Real Estate Stocks as RSI Levels Signal Potential Gains

As the real estate sector shows signs of vulnerability, certain stocks are emerging as potentially lucrative opportunities for investors who specialize in undervalued companies.

The Relative Strength Index (RSI) serves as a key momentum indicator, measuring a stock’s performance on days when prices rise versus days when they fall. Analysts consider a stock oversold when its RSI drops below 30, according to data from Benzinga Pro. This metric can provide investors insight into short-term price movements.

Below is a current list of major oversold players in the real estate sector, each with an RSI close to or below 30.

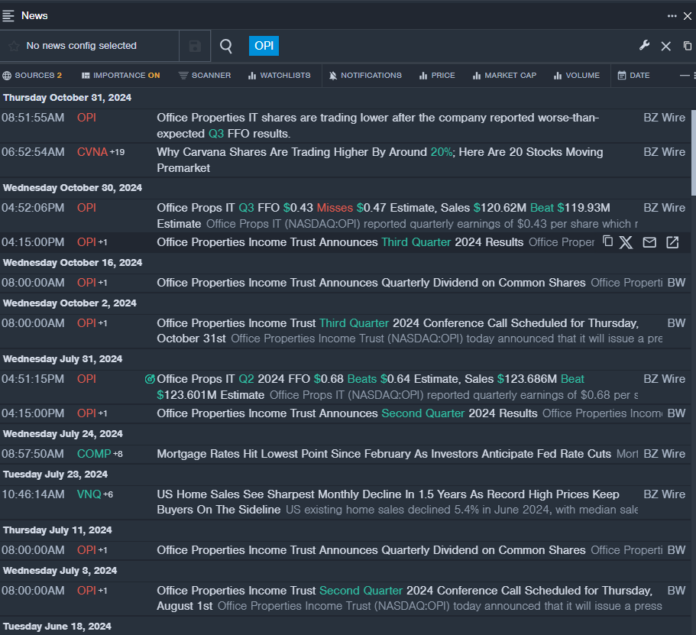

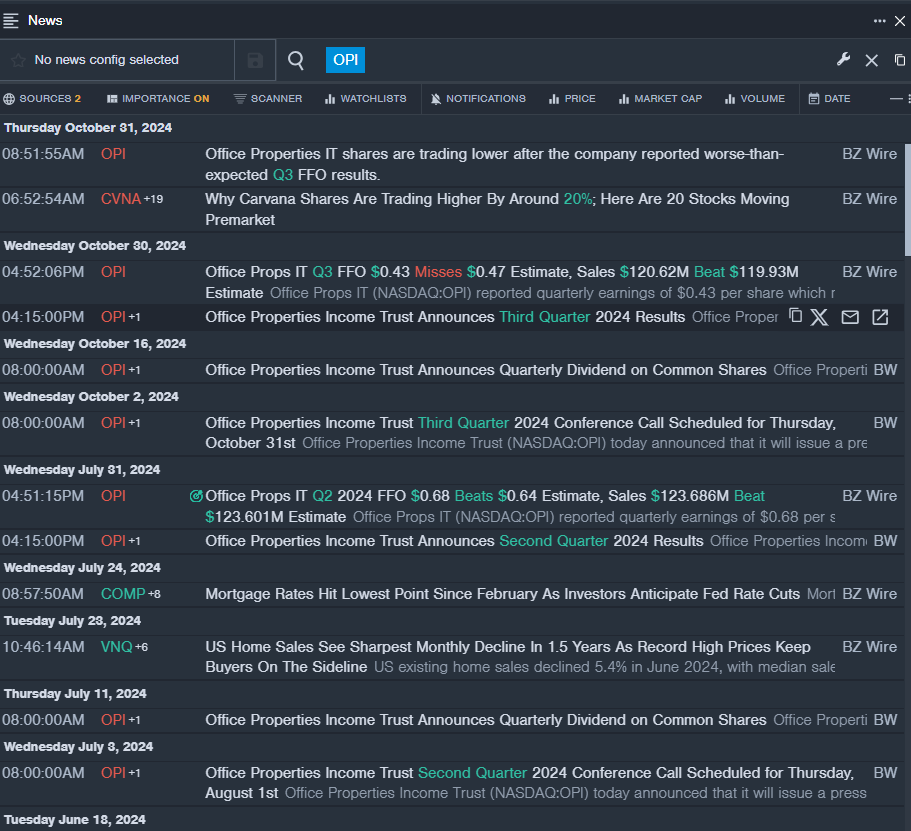

Office Properties Income Trust OPI

- On October 30, Office Properties Income Trust reported disappointing third-quarter funds from operations (FFO) results, leading to a staggering decrease in its stock value of about 40% over the past month, with a 52-week low of $1.06.

- RSI Value: 20.67

- OPI Price Action: The stock closed at $1.14 on Friday.

- Benzinga Pro provided real-time updates on the latest developments regarding OPI.

Wheeler Real Estate Investment Trust Inc WHLR

- On November 15, Wheeler Real Estate Investment Trust announced a 1-for-2 reverse stock split that will take effect on November 18. The stock has experienced a decline of approximately 32% over the last five days, hitting a 52-week low of $5.79.

- RSI Value: 26.03

- WHLR Price Action: The shares fell 2.2% to $8.50 by the end of trading on Friday.

- Benzinga Pro’s charting tool helped track the recent trends in WHLR stock.

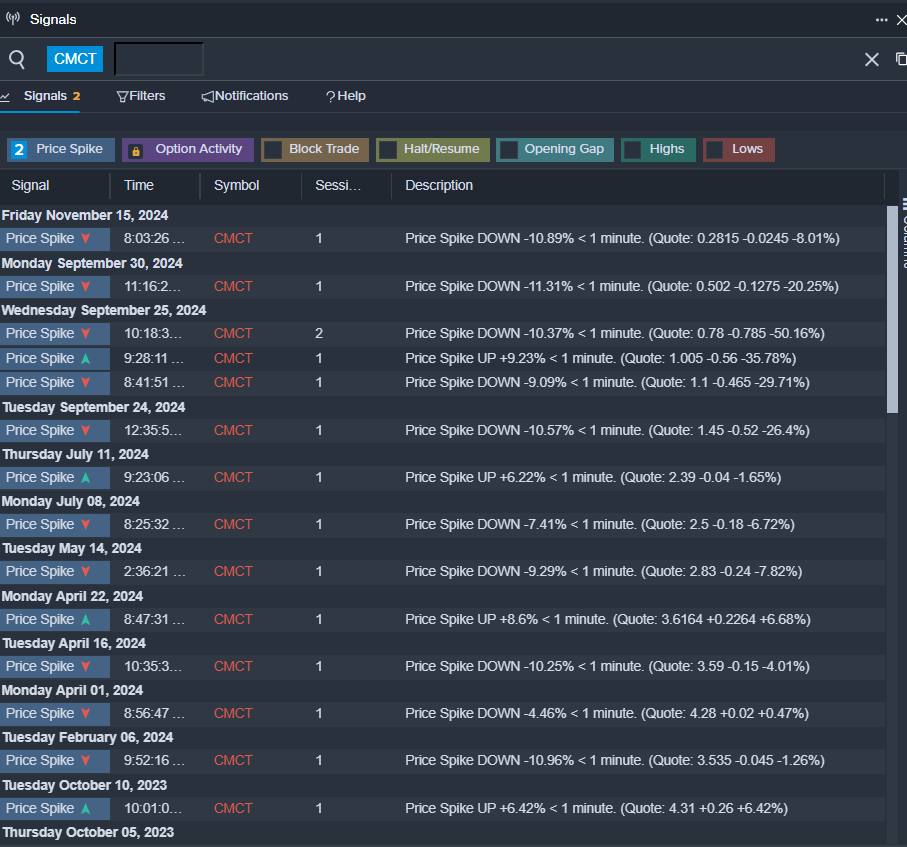

Creative Media & Community Trust Corp CMCT

- On November 8, Creative Media reported a quarterly loss of $1.22 per share, significantly missing the analyst consensus of a loss of $0.64 per share. CEO David Thompson stated, “We continue to make progress on our previously announced actions to accelerate our focus towards premier multifamily assets, strengthen our balance sheet, and improve our liquidity.” The company has seen its stock fall about 25% over the last five days, with a 52-week low of $0.21.

- RSI Value: 21.55

- CMCT Price Action: Shares closed at $0.22 on Friday, marking a decline of 9.1%.

- Benzinga Pro’s signals feature alerted investors to a potential breakout in CMCT shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs