Harnessing AI: A Closer Look at Broadcom and Nvidia’s Market Gains

As artificial intelligence (AI) becomes increasingly mainstream, technology giants Broadcom (NASDAQ: AVGO) and Nvidia (NASDAQ: NVDA) have seen significant sales growth. Companies are racing to invest in the hardware and software required to implement AI, leading to impressive figures for both firms.

Stock Performance Soars

Broadcom’s stock reached a new 52-week high of $186.42 in October, a remarkable jump from a low of $90.31 last December. Nvidia’s performance mirrored this trend, climbing from a low of $45.01 a year ago to a high of $152.89 as of November 21.

AI Market Expansion

Both companies are poised to benefit from ongoing demand for AI solutions, which is projected to grow dramatically. Estimates suggest the AI market will expand from approximately $184 billion in 2023 to over $826 billion by 2030.

Broadcom and Its AI Strategy

Broadcom’s extensive array of semiconductor products positions it well to capitalize on AI trends. The company reported $13.1 billion in revenue for its fiscal third quarter ending August 4, marking a substantial 47% year-over-year increase.

AI-driven demand significantly boosted its networking hardware sales, with a rise of 43% year-over-year to $4 billion. However, due to weaker sales in other areas, overall revenue growth for the division was limited to 5%, totaling $7.3 billion.

On the software side, Broadcom experienced a remarkable 200% year-over-year growth in its IT management software, reaching $5.8 billion, largely due to the acquisition of VMware last November. The VMware Cloud Foundation (VCF) allows clients to create private AI systems, safeguarding their data usage.

Nvidia’s Continued Dominance

Nvidia has emerged as a leading player in the AI revolution due to its focus on accelerated computing—a technology designed for handling data-heavy tasks separate from CPU operations. Nvidia pioneered this approach with its graphics processing unit (GPU) back in 1999, and now commands an impressive 80% share of the GPU market.

In its fiscal third quarter ending October 27, Nvidia’s revenue soared to a record $35.1 billion, a 94% increase from the previous year. The company anticipates further growth with estimated fourth-quarter revenue reaching about $37.5 billion, which would represent a 70% year-over-year increase from $22.1 billion.

CEO Jensen Huang emphasized the transformative power of AI, noting its application in building supercomputers in countries like Denmark and Japan.

Evaluating Investment Options: Broadcom vs. Nvidia

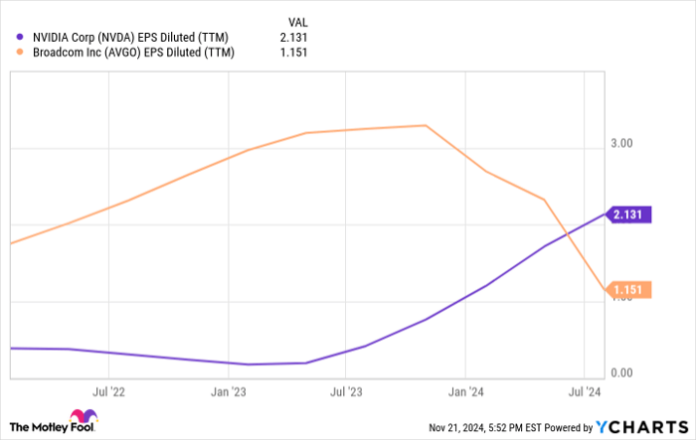

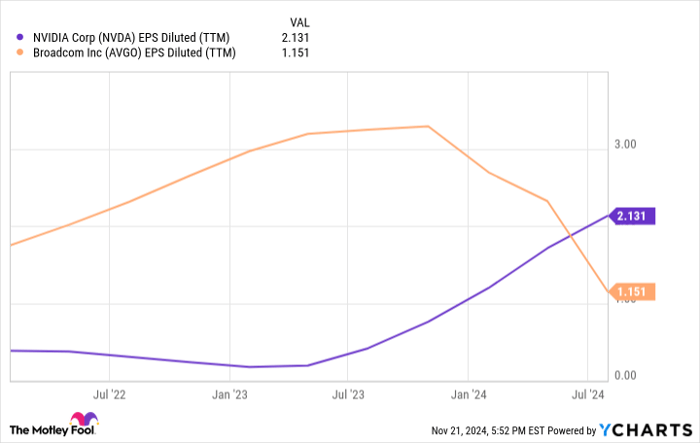

Choosing between Broadcom and Nvidia as an investment requires careful analysis, particularly of diluted earnings per share (EPS). Recent trends show Nvidia’s EPS spiked with the rise of AI, while Broadcom’s dipped due to higher expenses following its VMware acquisition. Over the last three fiscal quarters, Broadcom’s net income fell from $10.6 billion to $1.6 billion.

Data by YCharts.

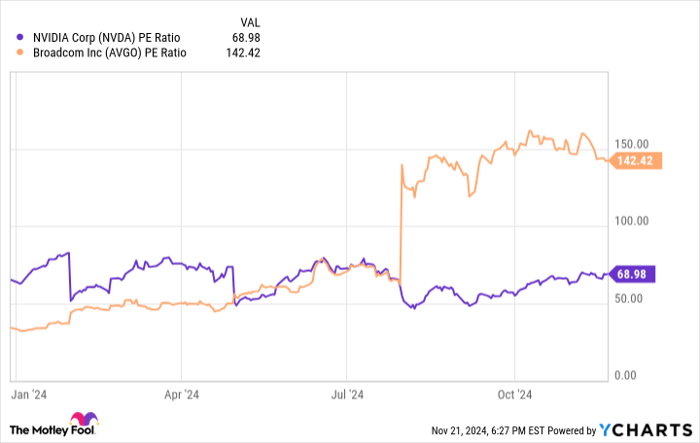

Another important metric is the price-to-earnings ratio (P/E ratio), which indicates how much investors are willing to pay for each dollar of earnings. Currently, Broadcom’s P/E ratio is higher than Nvidia’s, suggesting Nvidia may provide better value at this time.

Data by YCharts.

When considering long-term potential, Nvidia’s lower P/E multiple, higher EPS, and its established leadership in accelerated computing make it a more attractive stock compared to Broadcom.

Pursuing New Opportunities

Investors often wonder if they’ve missed the chance to buy into winning stocks. Recently, analysts from our team have issued a “Double Down” stock recommendation for prospective companies that appear to be on the verge of significant growth.

- Nvidia: An investment of $1,000 made when we doubled down in 2009 would now be worth $368,053!*

- Apple: A similar investment made in 2008 would yield $43,533!*

- Netflix: An investment in 2004 would have grown to $484,170!*

Our team has identified three companies currently garnering “Double Down” alerts, indicating this could be the moment for timely investment.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 25, 2024

Robert Izquierdo has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the opinions of the author and do not necessarily reflect those of Nasdaq, Inc.