MicroStrategy’s Bitcoin Strategy Faces New Challenges

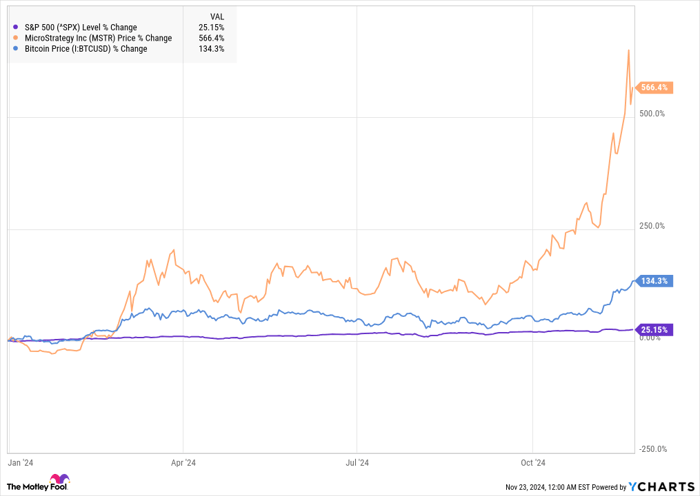

MicroStrategy (NASDAQ: MSTR) has established itself as a leading stock on the Nasdaq by following a straightforward plan: investing heavily in Bitcoin (CRYPTO: BTC). This year, as Bitcoin prices surged, so did MicroStrategy’s stock, driven by the overall bull market, excitement around spot Bitcoin exchange-traded funds (ETFs), and expectations of favorable crypto policies from a potential new Trump administration.

^SPX data by YCharts.

MicroStrategy operates uniquely in the market, resembling a leveraged Bitcoin ETF. CEO Michael Saylor, a prominent supporter of Bitcoin, initiated purchases for the company in 2020, with the company now holding 252,220 bitcoins as of the third quarter.

Nonetheless, a renowned short-seller is questioning the company’s valuation. Andrew Left of Citron Research announced his shift on platform X, noting that while he once endorsed MicroStrategy as a way to gain Bitcoin exposure, he has now changed his stance.

Citron believes MicroStrategy’s stock value has diverged significantly from Bitcoin’s actual performance. Although it remains bullish on Bitcoin itself, Citron is now hedging against MicroStrategy with a short position.

Following Citron’s report, MicroStrategy’s stock experienced a 16% decline last Thursday.

Criticism of MicroStrategy’s Valuation

Left accurately observes that MicroStrategy’s fundamentals seem disconnected from Bitcoin’s current value. While the company possesses a minor software business, it is nearly irrelevant when considering its market cap, which stood at $94.8 billion on November 22. The firm brands itself primarily as a Bitcoin treasury company.

However, even its Bitcoin holdings do not fully justify this market cap. At present, the company is valued at $375,864 per Bitcoin token, substantially exceeding Bitcoin’s market price of $98,807 at the time of this report. MicroStrategy’s Bitcoin assets are valued at approximately $22.4 billion.

Currently, the company enjoys an average gain of $49,441 per Bitcoin, having purchased them at an average price of $39,266, totaling a profit of $12.5 billion from its Bitcoin investments.

In addition, MicroStrategy holds $4.2 billion in long-term debt, continuing to borrow and issue stock to expand its Bitcoin portfolio.

Image source: Getty Images.

The Volatility Factor

MicroStrategy’s stock behaves like a leveraged Bitcoin ETF due to its considerable investment in the cryptocurrency, making it an amplified bet on Bitcoin’s price increase. Buying Bitcoin directly or through a traditional ETF does not provide this level of exposure.

The valuation of its Bitcoin holdings may serve as a de facto price target for Bitcoin. For MicroStrategy’s stock price to be justified, Bitcoin would need to appreciate to meet this value.

Saylor’s strategy also involves borrowing money and diluting shares to acquire more Bitcoin, which increases risk. A drastic drop in Bitcoin’s price could threaten MicroStrategy’s financial stability if such a decline occurs.

If Bitcoin were to crash, confidence in MicroStrategy could evaporate, leading investors to sell off their shares.

Is It Time to Sell MicroStrategy Stock?

Left raises valid concerns about MicroStrategy, yet these alone may not lead to a significant decline in stock value. A marked decrease would likely require Bitcoin to fall as well, which remains unpredictable.

Recently, Bitcoin gained ground due to a supposed embrace from the potential Trump administration. However, there is a possibility that the coming election events could result in a “buy on the rumor, sell on the news” scenario, potentially causing the cryptocurrency to retreat.

Bitcoin operates as a high-risk asset, often driven by market sentiment rather than fundamentals. This characteristic can lead to speculation, causing its value to fluctuate dramatically without clear justification.

Deciding whether to sell MicroStrategy shares hinges on Bitcoin’s performance. Those optimistic about Bitcoin’s future may find MicroStrategy a worthwhile investment since it could outperform Bitcoin should the currency’s price continue to rise.

Conversely, if Bitcoin’s value starts to decline, MicroStrategy shareholders should brace for a possible stock drop.

Should You Invest $1,000 in MicroStrategy Now?

Before purchasing MicroStrategy stock, it’s essential to weigh your options:

The Motley Fool Stock Advisor team recently identified what they consider the 10 best stocks to buy at this moment… and MicroStrategy was not included among them. These 10 stocks could yield significant returns in the coming years.

For instance, consider Nvidia, which made the list back on April 15, 2005… had you invested $1,000 at that time, it would now be worth $869,885!*

Stock Advisor offers a straightforward plan for investors, featuring advice on portfolio building, ongoing updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the S&P 500’s return since 2002*.

View the 10 stellar stocks »

*Stock Advisor returns as of November 25, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin and Coinbase Global. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.