Amazon Surges Past Its 2021 High: What This Means for Investors

It took some time, but e-commerce leader Amazon (NASDAQ: AMZN) has finally surpassed its all-time high, marking a significant moment since its peak in 2021. While you may feel uneasy due to the broader market’s strong performance—reminiscent of a market bubble fueled by near-zero interest rates—it’s important to recognize that Amazon has transformed substantially over the last three years.

Most people are familiar with Amazon’s dominance in the e-commerce space, controlling approximately 40% of America’s online shopping market. However, recent Q3 earnings report offer some optimistic insights into Amazon’s future.

Strategic Growth in Key Areas

Amazon’s journey began in the late 1990s with online book sales. Since then, it has evolved into a powerhouse known for an extensive product selection, competitive pricing, and swift delivery. This unique combination has allowed it to dominate about 40% of the U.S. e-commerce market. A key to Amazon’s success is its ability to branch out from its core e-commerce operations into other profitable ventures.

To maintain competitive pressure, Amazon often sells products at minimal profit margins. Fortunately, it is thriving in areas that contribute more significantly to the company’s earnings.

Notably, the following segments are showing strong growth:

- The cloud computing segment, Amazon Web Services (AWS), experienced 19% year-over-year growth in Q3.

- Subscription services, including Prime memberships, saw an 11% year-over-year increase.

- Amazon’s advertising business, which includes ads for online shoppers and streamed video, also grew by 19% year-over-year.

While Amazon does not disclose operating income by segment, it categorizes its earnings into three areas: North America, International, and AWS. Impressively, AWS accounted for $10.4 billion of Amazon’s total operating profit of $17.4 billion in Q3, despite making up only 17% of sales. This highlights the importance of focusing on the higher-margin segments for future profitability.

Increasing Cash Flow Trends

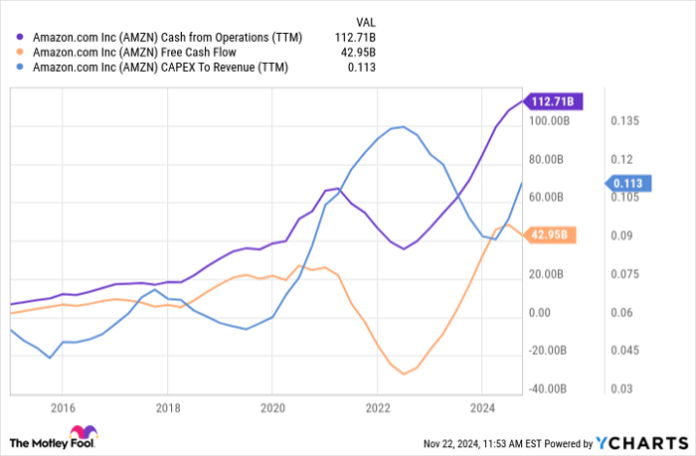

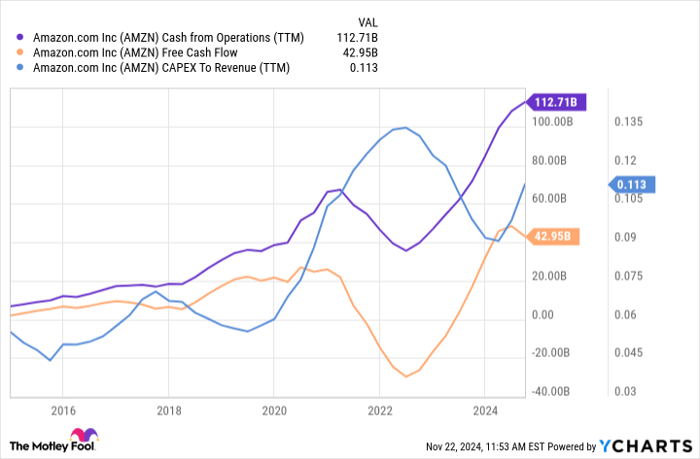

Indeed, Amazon’s numbers reflect a positive trend. The chart below illustrates significant growth in cash flow from operations (the cash generated from day-to-day activities).

AMZN Cash from Operations (TTM) data by YCharts

The surge in cash flow from operations over recent years has boosted Amazon’s free cash flow, even as the company invests more into its business. Significant investments have been made in logistics for its e-commerce operations and in AWS to expand its computing capabilities, particularly in emerging areas like artificial intelligence (AI).

If the high-margin segments were not experiencing growth, increasing Amazon’s capital expenditures from 4%-6% of sales to 11%-13% would likely slow earnings growth. However, earnings have continued to rise, with analysts projecting an average growth rate of 28% annually over the next three to five years.

Amazon’s Stock: Buy, Sell, or Hold?

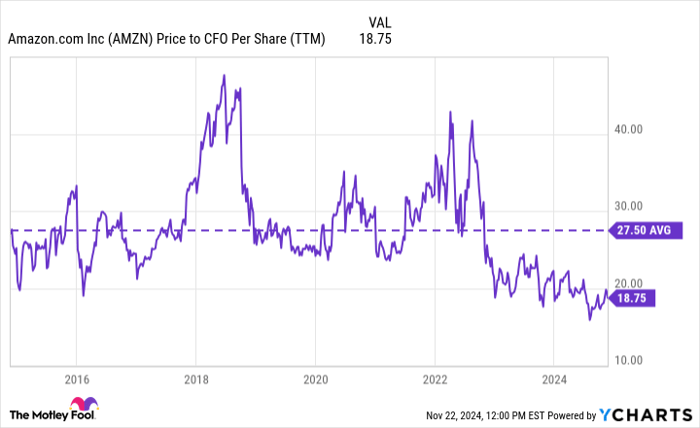

Given Amazon’s significant reinvestment back into the company, assessing the stock based solely on current earnings might be misleading. A better comparison would be to analyze the company’s cash flow from operations, which serves as a steadier performance indicator.

The chart indicates that Wall Street has not yet fully recognized the level of cash Amazon generates compared to three years ago. The strong cash flow has led to a valuation approximately 30% lower than its ten-year average, marking its lowest levels since 2016:

AMZN Price to CFO Per Share (TTM) data by YCharts

Looking ahead, the outlook for Amazon’s ad business and AWS appears promising. AWS is expected to gain from the ongoing developments in AI, which seems to still be in its early stages, while Amazon enhances its Prime Video platform by introducing more live sports broadcasts in 2025, including NBA games and NASCAR races.

For long-term investors, Amazon stock presents a strong buying opportunity.

Considering a $1,000 Investment in Amazon?

Before making an investment in Amazon, consider this:

The Motley Fool Stock Advisor analyst team has identified what they believe to be the 10 best stocks for investors currently… and Amazon is not on that list. The selected stocks could yield substantial returns in the coming years.

Take Nvidia, for instance. When it was recommended on April 15, 2005, a $1,000 investment would have grown to an impressive $869,885!

Stock Advisor provides an accessible strategy for successful investing, including guidance on portfolio building, regular analyst updates, and two new stock picks each month. Since 2002, Stock Advisor has more than quadrupled the return of the S&P 500.*

Explore the 10 stocks »

*Stock Advisor returns as of November 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.