Intuitive Machines Soars: A New Era for Lunar Infrastructure

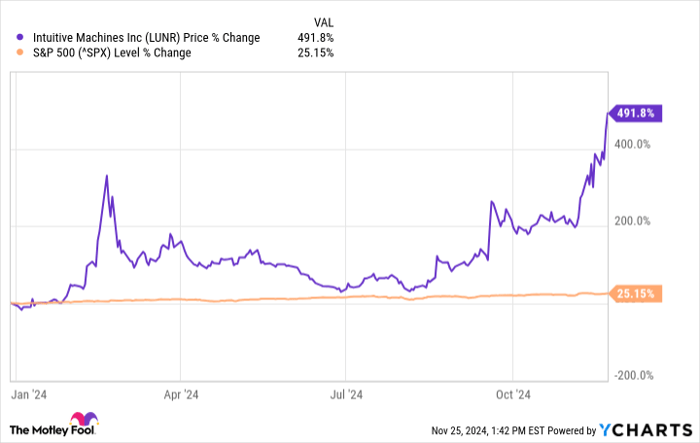

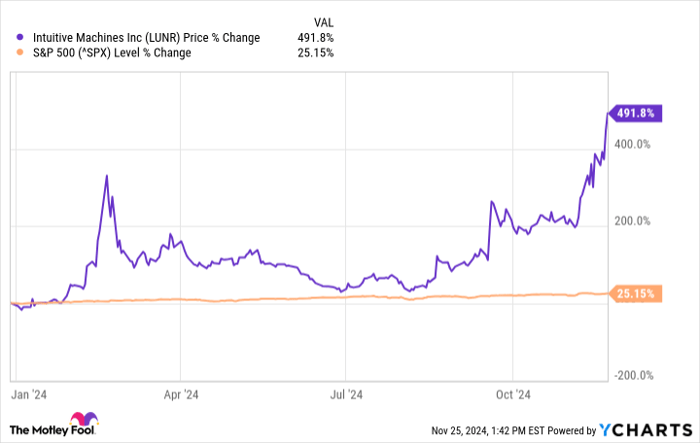

Intuitive Machines (NASDAQ: LUNR) has experienced an extraordinary 491% increase in share price year to date, surpassing the S&P 500‘s 25% growth. A recent modest investment in my Roth IRA has yielded a remarkable 76.8% gain in just a few weeks.

LUNR data by YCharts.

While investors often cash in on substantial gains, several key developments indicate that Intuitive Machines’ remarkable journey has only just begun. Here’s why this space stock is worth noting.

Image source: Getty Images.

Establishing Lunar Infrastructure

In the quarter ending on September 30, 2024, Intuitive Machines reported impressive results. Revenue increased by 359% year over year, reaching $58.5 million. This brings the year-to-date revenue to $173.3 million, already double the total revenue for 2023. The company also posted positive gross margins of $4.1 million and closed the quarter with a record $89.6 million in cash.

Intuitive Machines stands out due to its leadership role in NASA’s Commercial Lunar Payload Services (CLPS) program. Earlier this year, the company won its fourth CLPS contract, valued at $116.9 million, more than any other contractor.

This position in lunar delivery establishes a solid foundation for its overall infrastructure ambitions, supported by a three-pillar strategy focused on delivery, data transmission, and autonomous operations. Together, these elements could reshape space exploration and commerce.

Significant NASA Partnership

The pivotal moment for the company came on September 17, 2024, when NASA awarded Intuitive Machines a Near Space Network contract potentially worth up to $4.82 billion. Starting October 1, 2024, this five-year agreement (with a possible five-year extension) allows the company to offer vital communication and navigation services from Earth to beyond the Moon via a planned satellite network.

This contract introduces a pioneering pay-by-the-minute service, allowing for recurring subscription-like revenue. Additionally, a new partnership with Johns Hopkins Applied Physics Laboratory strengthens the company’s technology in lunar commercialization.

This collaboration aims to enhance safe and reliable communication infrastructure within cislunar space—the area between Earth and the Moon’s surface. Such advancements are crucial for sustainable lunar operations.

Why I’m Staying Invested

Even with a nearly 500% increase this year, I consider Intuitive Machines a strong long-term investment for my retirement account. The company’s mission extends beyond typical space ventures; it is constructing the essential infrastructure for future lunar missions.

With a market cap of $1.21 billion, the company appears undervalued, given its leadership in lunar payload delivery and the potential of the $4.82 billion contract with NASA. The space economy is expected to grow from $630 billion today to $1.8 trillion by 2035, amplifying the importance of lunar infrastructure.

Furthermore, the company’s record backlog of $316.2 million reflects increasing demand for its services. Notably, this figure does not encompass the initial $150 million of task orders related to the Near Space Network, illuminating further backlog growth potential.

My Roth IRA is optimized for such asymmetric opportunities—investing in firms with sizable addressable markets and distinct competitive advantages. Intuitive Machines embodies this profile, supported by strong execution, growing demand, and transformative partnerships.

Intuitive Machines aims to be a cornerstone of lunar infrastructure, leveraging its three-pillar strategy to develop various revenue sources and competitive edges that can thrive for decades. Maintaining a position after such impressive gains may not suit all investors, but the company’s unique stance in the lunar marketplace aligns well with my long-term investment strategy. Sometimes, the most challenging aspect of investing is to allow successful stocks to continue their journey, especially when they are just scratching the surface of their potential.

Is Now the Time to Invest?

Before investing in Intuitive Machines, think about this:

The Motley Fool Stock Advisor team recently identified what they believe to be the 10 best stocks for investors right now—and Intuitive Machines was not among them. The stocks on their list have tremendous growth potential in the coming years.

For example, when Nvidia appeared on this list on April 15, 2005, if you invested $1,000 at that time, your investment would now be worth $833,545!*

Stock Advisor offers investors a straightforward approach to success, providing portfolio-building advice, regular updates from analysts, and two new stock recommendations each month. Since its inception in 2002, Stock Advisor has outperformed the S&P 500 by more than four times.

See the 10 stocks »

*Stock Advisor returns as of November 25, 2024

George Budwell has positions in Intuitive Machines. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.