Market Momentum: A Strong Start to 2024

As 2024 progresses, Wall Street has seen one of its most successful presidential election year starts, with the S&P 500 Index climbing over 26% thus far. However, this surge has not been without its worries. Investors are monitoring geopolitical tensions in Europe and the Middle East, persistent high interest rates, and the sustainability of the artificial intelligence boom. Nevertheless, there are compelling reasons to remain optimistic about stocks as the year draws to a close:

Understanding Presidential Election Year Trends

Historical patterns provide valuable insights for investors. Although trading volumes often decline as Thanksgiving approaches, stocks typically see positive movement leading into late November. Ryan Detrick from Carson Research notes, “No month is more likely to be higher than December in an election year.” Analyzing data from 1950 onward reveals that December outperforms 83% of the time during these election years.

Diverse Market Participation

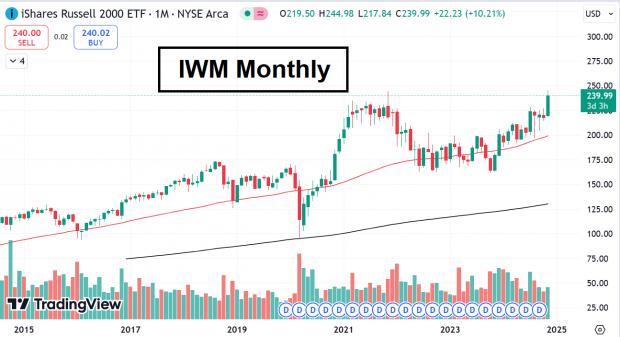

One common concern among Wall Street experts has been the limited participation in the market. However, this narrative has shifted recently. The Russell 2000 Index ETF (IWM) saw an increase of over 12% in November and is on its way to recapturing its all-time highs from 2021.

Image Source: TradingView

Continued Growth in AI Spending

Investment in artificial intelligence has skyrocketed by 500% this year, totaling $13.8 billion, as reported by Menlo Ventures. Looking ahead, the outlook remains promising. Analysts project that Nvidia’s (NVDA) earnings could soar with an expected year-over-year growth of 123.08%.

Image Source: Zacks Investment Research

Year-End Portfolio Adjustments

As the year comes to a close, institutional investors often look to showcase winning stocks in their portfolios, a practice known as “window dressing.” This could lead to a boost in the prices of notable stocks like Coinbase (COIN), Tesla (TSLA), and Astera Labs (ALAB).

Potential Nasdaq Breakout

The Nasdaq 100 ETF (QQQ) stands at the brink of breaking out from a three-month consolidation pattern.

Image Source: TradingView

Conclusion

Despite impressive gains in U.S. equities this year, various indicators suggest that it remains a favorable time to invest in stocks for a potential year-end rally.

5 Stocks Poised for Significant Growth

These stocks have been carefully selected by a Zacks expert as top picks likely to double in value in 2024. While not every choice will be a success, past recommendations have achieved gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks featured in this report are under the radar on Wall Street, presenting a unique opportunity to invest early.

Today, check out 5 potential high-reward stocks >>

Are you interested in recent selections from Zacks Investment Research? You can download the report on 5 Stocks Set to Double for free.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

iShares Russell 2000 ETF (IWM): ETF Research Reports

Coinbase Global, Inc. (COIN): Free Stock Analysis Report

Astera Labs, Inc. (ALAB): Free Stock Analysis Report

To access this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.